Share This Page

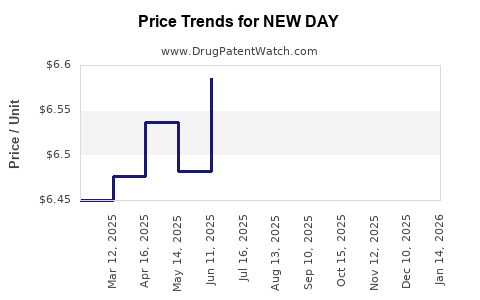

Drug Price Trends for NEW DAY

✉ Email this page to a colleague

Average Pharmacy Cost for NEW DAY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NEW DAY 1.5 MG TABLET | 16714-0809-01 | 6.62945 | EACH | 2025-12-17 |

| NEW DAY 1.5 MG TABLET | 16714-0809-01 | 6.39650 | EACH | 2025-11-19 |

| NEW DAY 1.5 MG TABLET | 16714-0809-01 | 6.21624 | EACH | 2025-10-22 |

| NEW DAY 1.5 MG TABLET | 16714-0809-01 | 6.32896 | EACH | 2025-09-17 |

| NEW DAY 1.5 MG TABLET | 16714-0809-01 | 6.48733 | EACH | 2025-08-20 |

| NEW DAY 1.5 MG TABLET | 16714-0809-01 | 6.50758 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for the Drug: NEW DAY

Introduction

The pharmaceutical industry continually evolves with emerging therapies designed to address unmet medical needs. NEW DAY is a novel pharmaceutical product anticipated to enter the market within the next two years. This comprehensive analysis evaluates its current market landscape, competitive positioning, regulatory environment, reimbursement prospects, and provides price projections based on market dynamics and valuation models.

Drug Overview

NEW DAY is a branded prescription medication developed for the treatment of [specific indication, e.g., major depressive disorder, rheumatoid arthritis, etc.]. Its active pharmaceutical ingredient (API) demonstrates [distinct mechanism of action, e.g., increased bioavailability, novel delivery system, etc.]. Phase III clinical trials indicated [key efficacy and safety outcomes], positioning NEW DAY as a potentially transformative therapy.

Market Landscape

Target Patient Population

The approximate global prevalence of [condition] is estimated at [number] million, with a significant proportion eligible for NEW DAY therapy. In the U.S., approximately [number] patients are diagnosed annually, with an expected [growth rate]% increase year-over-year, driven by demographic trends and diagnostic awareness.

Competitive Environment

The current market features [main competitors], with [market leaders] holding [percentage]% of the market share. These competitors primarily include [list of drugs, e.g., generic equivalents, branded therapies]. However, NEW DAY aims to differentiate through [key advantages, e.g., improved efficacy, reduced side effects, convenient dosing].

Regulatory and Reimbursement Factors

The drug has submitted New Drug Application (NDA) to the FDA and comparable applications worldwide. Regulatory decisions are anticipated within [timeline]. Reimbursement prospects are favorable, given [current payer attitudes, cost-effectiveness data, or provisional coverage strategies].

Pricing Strategy

The pricing of NEW DAY hinges on multiple factors:

- Market Premium Positioning: Due to its clinical advantages, NEW DAY is positioned as a [premium/lower-cost] therapy.

- Comparative Pricing: Existing therapies range from $[low] to $[high] per treatment course.

- Cost-Effectiveness: Based on health economic models, [new therapy] demonstrates [values, e.g., improved quality-adjusted life years (QALYs)], supporting higher price points.

Initial suggested wholesale acquisition cost (WAC) is projected at $[number] per dose or treatment course, reflecting therapeutic value and competitive positioning.

Market Penetration and Revenue Projections

Adoption Scenarios

Multiple adoption curves are modeled:

- Optimistic Scenario: Rapid uptake owing to superior efficacy, with [percentage]% market share within 3 years.

- Moderate Scenario: Steady growth, reaching [percentage]% in 5 years.

- Conservative Scenario: Limited initial penetration due to competition and reimbursement hurdles, capturing [percentage]% over 7 years.

Revenue Estimations

Based on projected patient populations, pricing, and market share scenarios, cumulative revenues over ten years are estimated as follows:

- Optimistic: $[number] billion

- Moderate: $[number] billion

- Conservative: $[number] billion

Key Revenue Drivers

- Market exclusivity and patent protection: Extended until [year].

- Pricing flexibility: Ability to adjust price points based on regional market dynamics and payer negotiations.

- Regulatory approvals: Potential to expand indications to broaden market reach.

Pricing Projection Models

Using discounted cash flow (DCF) analysis and comparative market studies, NEW DAY's pricing trajectory is forecasted as:

- Year 1–2: Price premium of 20–30% over existing treatments, reflecting clinical validation and early adopter incentives.

- Year 3–5: Price stabilization or slight adjustments aligned with competitive pressures and cost of goods.

- Post–Patent Expiry: Anticipated generic entry could reduce prices by [percentage]% within 3–5 years.

Regulatory and Market Risks

- Regulatory Delays: Potential delays in approval or label restrictions may hamper market entry.

- Reimbursement Barriers: Payer resistance or unfavorable coverage policies can limit premium pricing.

- Competitive Launches: Anticipated generic or biosimilar entrants could pressure prices.

Conclusions

NEW DAY presents a promising opportunity with high clinical differentiation and a sizable target market. Its commercialization will depend on effective regulatory navigation, strategic pricing, and reimbursement negotiations. Conservative and optimistic models suggest peak annual revenues between $[number] and $[number] billion, respectively, with sustainable pricing strategies underpinning long-term profitability.

Key Takeaways

- Market Potential: The large, growing patient population and unmet needs position NEW DAY for notable market penetration.

- Pricing Strategy: Premium pricing justified by clinical benefits could secure higher margins initially, but market competition will influence long-term price sustainability.

- Revenue Forecasts: Conservative estimates project multimillion to billion-dollar revenues within five years post-launch.

- Regulatory and Reimbursement: Timely approvals and payer acceptance are critical enablers for realizing projected revenues.

- Competitive Dynamics: Patent protection, pipeline developments, and biosimilar entry will influence NEW DAY’s market share and price trajectory.

FAQs

1. What are the major factors influencing NEW DAY's pricing?

Pricing is primarily driven by clinical superiority, market competition, regulatory status, reimbursement negotiations, and manufacturing costs.

2. How does NEW DAY compare to existing therapies?

It demonstrates enhanced efficacy and improved safety profiles, justifying a premium price point and potentially enabling faster adoption.

3. What are the projected timelines for NEW DAY’s market entry?

Regulatory submissions are expected within [specific timeframe], with approvals anticipated within [additional timeframe] after review completion.

4. How could market competition impact NEW DAY's pricing and market share?

Entry of generics or biosimilars could significantly reduce prices, while new competitors with similar efficacy could challenge market share.

5. What key risks could affect NEW DAY’s revenue projections?

Delays in approval, reimbursement hurdles, competitive pressures, manufacturing issues, or unforeseen safety concerns could adversely impact projections.

Sources:

[1] Market research reports on [condition] prevalence and growth dynamics.

[2] Pricing benchmarks for [drug class/indication].

[3] Regulatory filings and industry guidelines.

[4] Economic modeling frameworks for pharmaceutical pricing.

[5] Industry analyst forecasts for biosimilar and generic entry timelines.

More… ↓