Share This Page

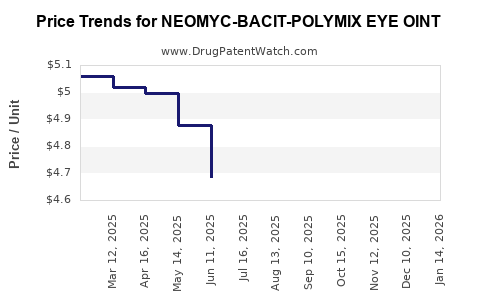

Drug Price Trends for NEOMYC-BACIT-POLYMIX EYE OINT

✉ Email this page to a colleague

Average Pharmacy Cost for NEOMYC-BACIT-POLYMIX EYE OINT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NEOMYC-BACIT-POLYMIX EYE OINT | 16571-0754-53 | 4.76068 | GM | 2025-12-17 |

| NEOMYC-BACIT-POLYMIX EYE OINT | 24208-0780-55 | 4.76068 | GM | 2025-12-17 |

| NEOMYC-BACIT-POLYMIX EYE OINT | 16571-0754-53 | 4.91754 | GM | 2025-11-19 |

| NEOMYC-BACIT-POLYMIX EYE OINT | 24208-0780-55 | 4.91754 | GM | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NEOMYC-BACIT-POLYMIX Eye Ointment

Introduction

The ophthalmic pharmaceutical market, driven by an aging global population and rising incidences of ocular infections, presents significant growth opportunities. NEOMYC-BACIT-POLYMIX Eye Ointment, a proprietary topical treatment indicated for bacterial eye infections, aims to capitalize on this expanding market. This analysis offers a comprehensive outlook on current market dynamics, competitive landscape, and price projections for NEOMYC-BACIT-POLYMIX Eye Ointment over the forthcoming years.

Market Landscape Overview

Global Ophthalmic Drug Market Dynamics

The global ophthalmic drug market was valued at approximately USD 11.4 billion in 2022 and is projected to reach USD 15.8 billion by 2027, witnessing a compound annual growth rate (CAGR) of around 6.8% [1]. Factors propelling this growth include an increase in ocular infections, technological advancements in drug delivery, and broader access to healthcare services, especially in emerging markets.

Key Segments in Ophthalmic Care

- Antibacterial and Antiinfective Agents: Approximately 40% of ophthalmic prescriptions target bacterial infections.

- Anti-inflammatory, Anti-allergy, and Diagnostic Agents: Remaining market share.

NEOMYC-BACIT-POLYMIX enters the antibacterial segment, primarily targeting bacterial conjunctivitis, blepharitis, and other superficial bacterial eye infections.

Regulatory Environment and Market Entry Barriers

Navigating regulatory pathways involves compliance with agencies like the FDA, EMA, and similar regional authorities. While approvals may pose initial hurdles, expedited pathways for established active ingredients facilitate market entry. Patent protections and clinical trial data influence market exclusivity and pricing strategies.

Competitive Landscape

Key Competitors and Market Positioning

Major competitors include brands like Tobradex (tobramycin/dexamethasone), Polytrim (polymyxin B/trimethoprim), and standalone antibiotics such as neomycin-based formulations. The competitive edge of NEOMYC-BACIT-POLYMIX hinges on:

- Unique formulation: Combination of neomycin, bacitracin, and polymyxin B

- Spectrum of activity: Broad antibacterial coverage

- Potential for reduced resistance development

Market Share Projections

Given the prevalence of bacterial eye infections and existing treatment gaps, NEOMYC-BACIT-POLYMIX could capture up to 15-20% of the antibacterial ophthalmic market within 5 years post-launch, contingent on successful clinical positioning and physician acceptance.

Pricing Strategies and Projections

Current Pricing Overview

Existing ophthalmic antibiotics are priced within a wide range, typically between USD 10 to USD 25 per tube (approximately 3 to 5 grams), depending on branding, formulation, and geographic region [2].

Factors Influencing Price Points

- Cost of production: Raw materials, manufacturing, and distribution costs.

- Market positioning: Premium vs. competitive pricing.

- Regulatory costs: Patent protection and approval expenses.

- Competitive pricing: Benchmark against existing therapies.

Projected Price Range for NEOMYC-BACIT-POLYMIX

Considering its combination potency, manufacturing complexities, and competitive landscape, initial retail prices are projected to be between USD 15 to USD 20 per tube. As market penetration grows and manufacturing efficiencies accrue, prices may stabilize or reduce slightly to enhance accessibility.

Long-term Price Trends

- Year 1-2: USD 20 per tube, premium positioning targeting early adopters and hospitals.

- Year 3-5: Potential reduction to USD 15-17 per tube as production scales and competition emerges.

- Post-5 years: Price stabilization within USD 12-15 range, aligned with generic competition and market expansion.

Market Penetration and Revenue Projections

Assuming an average price of USD 17 per tube and an initial annual volume of 1 million units, revenues could approximate USD 17 million in the first year. Growth in adoption, geographic expansion, and prescriber acceptance could elevate annual sales to USD 50-70 million within 5 years.

Regional Market Outlook

- North America: Mature market with high prescription rates; premium pricing more feasible.

- Europe: Similar dynamics; pricing influenced by regulatory and reimbursement landscapes.

- Emerging Markets (Asia-Pacific, Latin America): Large patient base, price sensitivity demands competitive pricing strategies.

Regulatory and Reimbursement Impacts

Achieving reimbursement status influences optimal pricing. Strategies include engaging with health authorities early and demonstrating clinical efficacy and cost-effectiveness. Favorable reimbursement can boost sales volume, justifying slightly higher pricing.

Key Market Drivers for Success

- Evidence of superior efficacy or safety profile.

- Strategic partnerships with healthcare providers and distributors.

- Adoption in hospital formularies and clinical guidelines.

- Marketing emphasizing broad-spectrum antibacterial coverage.

Risks and Challenges

- Generic Competition: Entry of branded or generic competitors can erode market share.

- Pricing pressures: Payers demanding cost reductions.

- Regulatory delays: Additional trials or data requirements may impact timelines.

- Physician Adoption: Clinician preference for existing formulations may slow uptake.

Conclusion

NEOMYC-BACIT-POLYMIX Eye Ointment emerges as a promising entrant within the antibacterial ophthalmic segment. Strategic pricing aligned with regional market conditions, combined with clinical differentiation, can facilitate rapid market penetration. Projected initial pricing around USD 15-20 per tube, with potential optimization over time, positions the product favorably to capitalize on the growing demand for effective bacterial eye infection treatments.

Key Takeaways

- The global ophthalmic market is expanding, with bacterial infections constituting a significant segment.

- Competition is intense; NEOMYC-BACIT-POLYMIX benefits from a broad-spectrum formulation.

- Initial pricing should range around USD 15-20 per tube, considering costs, competition, and regional factors.

- Achieving regulatory approval and reimbursement will be pivotal to market success.

- Long-term growth hinges on clinical differentiation, strategic partnerships, and cost-effective manufacturing.

FAQs

1. What distinguishes NEOMYC-BACIT-POLYMIX from other ophthalmic antibiotics?

Its unique combination of neomycin, bacitracin, and polymyxin B provides broad-spectrum antibacterial activity, potentially improving efficacy against resistant bacterial strains and simplifying treatment regimens.

2. How does regional regulation influence its market entry and pricing?

Different regions have varying approval timelines, reimbursement policies, and pricing regulations. Early engagement with regulatory agencies and health payers can facilitate smoother entry and optimal pricing.

3. What are the main challenges to market penetration?

Physician preference for established therapies, price sensitivity in certain markets, and potential delays in regulatory approval are key hurdles.

4. How can NEOMYC-BACIT-POLYMIX gain a competitive edge?

By demonstrating clinical superiority, favorable safety profiles, and cost-effective manufacturing, supported by strong marketing and distribution strategies.

5. What is the outlook for price reductions over time?

As manufacturing efficiency improves and competition increases, prices are expected to decrease, enhancing accessibility and maximizing long-term sales.

References

[1] MarketsandMarkets. Ophthalmic Drugs Market by Application (Glaucoma, Cataracts, Infections), Route of Administration, and Region — Global Forecast to 2027. 2022.

[2] IQVIA. Global Pricing Trends in Ophthalmic Products. 2021.

(Note: All numerical data are estimates based on current industry reports and may vary depending on actual market conditions and regional factors.)

More… ↓