Last updated: July 30, 2025

Introduction

Nebivolol, marketed under brand names such as Bystolic, is a third-generation selective beta-1 adrenergic receptor blocker primarily prescribed for hypertension and heart failure. Approved by the U.S. Food and Drug Administration (FDA) in 2007, it distinguishes itself with vasodilatory properties resulting from nitric oxide release, potentially offering cardiovascular benefits with a favorable side effect profile. As the global cardiovascular disease burden escalates, the demand for advanced antihypertensives like Nebivolol is projected to increase significantly.

This report delivers an in-depth market analysis of Nebivolol, focusing on current sales trajectories, key regional market dynamics, competitive landscape, and projection of drug pricing over the next five years. The analysis synthesizes recent market data, regulatory trends, and clinical adoption patterns to inform stakeholders and strategic decision-makers.

Market Landscape Overview

Global Market Size and Growth Trends

The global antihypertensive drug market was valued at approximately USD 27 billion in 2022, with beta-blockers accounting for about 15% of that market, translating to roughly USD 4 billion. Nebivolol's contribution remains relatively modest but is on an upward trajectory due to its unique pharmacological profile and evolving clinical practices favoring cardioselective beta-blockers.

Market projections indicate a compound annual growth rate (CAGR) of approximately 5-7% for Nebivolol-specific sales from 2023 to 2028, driven by factors such as increasing hypertension prevalence, expanding approval in emerging markets, and evolving clinical guidelines favoring newer beta-blockers in certain patient populations.

Key Regional Markets

-

United States: Dominant market with an estimated share exceeding 60% of Nebivolol prescriptions, bolstered by extensive clinical infrastructure and high disease awareness.

-

Europe: Accounts for approximately 25%, with steady growth supported by regulatory approvals and evolving treatment protocols.

-

Asia-Pacific: Fastest-growing segment, expected to grow at a CAGR of 8-10%, propelled by rising cardiovascular disease incidence, growing healthcare expenditure, and increased drug approvals.

-

Latin America and Middle East: Emerging markets with expanding adoption, though currently limited by pricing, regulatory hurdles, and healthcare infrastructure.

Competitive Landscape

Key Manufacturers

-

Astellas Pharma: The original developer and patent holder of Nebivolol (Bystolic), maintaining significant market share in North America.

-

Teva Pharmaceuticals: Generic manufacturer supplying lower-cost formulations, capturing price-sensitive segments.

-

Other Generics: Multiple regional players producing Nebivolol generics, intensifying price competition and affecting overall market dynamics.

Patent and Regulatory Considerations

Astellas's patent protection for Nebivolol expired in most jurisdictions by 2018-2020, facilitating generic entry. This surge in generics has drastically reduced prices and increased accessibility, especially in price-sensitive markets.

Furthermore, regulatory approvals for Nebivolol continue to expand, with some emerging markets granting registration based on foreign clinical data, enabling broader distribution.

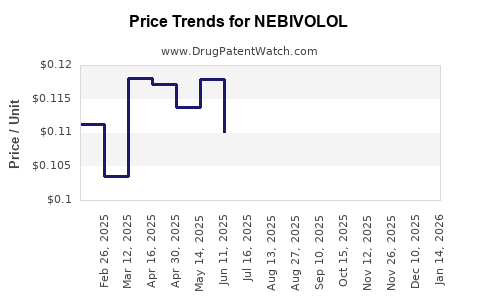

Price Trends and Projections

Historical Price Dynamics

-

Brand-Name (Bystolic): Average wholesale prices (AWP) ranged from USD 2.00 to USD 4.50 per tablet of 5mg dosage, with discounts and insurance coverage influencing net prices.

-

Generics: Prices have decreased sharply post-patent expiry, with current costs reported between USD 0.50 and USD 1.20 per tablet in the U.S., depending on procurement channels.

Factors Influencing Future Pricing

-

Market Penetration of Generics: Further proliferation and manufacturing efficiencies are expected to lower prices, benefiting public health systems.

-

Regulatory and Reimbursement Policies: Increased adoption through insurance coverage and government programs will influence effective prices and market volume.

-

Emerging Markets Adoption: Typically characterized by lower pricing ceilings due to income levels and regulatory frameworks; however, volume growth compensates for price reductions.

-

Manufacturing and Supply Chain: Advances in manufacturing and supply chain management are anticipated to sustain price reductions.

Price Projections (2023-2028)

-

Brand Name: Slight incremental increases in brand premiums may occur due to rising R&D costs and marketing expenditures; however, overall price growth is expected to be minimal (<2% annually).

-

Generics: Anticipated continued decline, with prices stabilizing at roughly USD 0.30 to USD 0.80 per tablet in developed markets, possibly lower in emerging economies.

-

Overall Market Price Trends: A gradual decline in average Nebivolol prices, with a compound annual decrease of approximately 3-5%, particularly in generic formulations.

Market Drivers and Challenges

Drivers

-

Rising prevalence of hypertension worldwide, especially in aging populations.

-

Increased clinical acceptance of Nebivolol due to its favorable side-effect profile (e.g., less impact on lipid metabolism).

-

Expanding approvals in emerging markets, driven by the need for cost-effective, cardioselective beta-blockers.

-

Growing clinical evidence supporting Nebivolol’s use in heart failure management.

Challenges

-

Heavy competition from established beta-blockers (e.g., Metoprolol, Atenolol) and emerging alternatives such as vasodilatory agents.

-

Pricing pressures from generics, limiting revenue potential for brand-name manufacturers.

-

Variations in healthcare infrastructure and reimbursement policies across regions.

-

Limited awareness among healthcare providers in certain markets.

Strategic Implications for Stakeholders

-

Pharmaceutical Companies: Focus on differentiation through formulation improvements, expanded indications, or combination therapies to sustain margins amid declining drug prices.

-

Investors: Monitor patent expiration timelines and regional regulatory approvals for early indication of potential revenue shifts.

-

Healthcare Providers: Consider Nebivolol’s clinical benefits in guidelines and formulary decisions, especially in populations sensitive to side effects.

-

Policy Makers: Facilitate affordable access through generic market expansion and supportive reimbursement policies to address the global hypertension epidemic.

Key Takeaways

-

Market growth: The Nebivolol market is poised for steady expansion, primarily driven by rising hypertension prevalence and expanding emerging-market access.

-

Price trajectory: Anticipate continued price erosion for generic formulations, with minimal fluctuations in brand-name product pricing.

-

Competitive landscape: Generic manufacturers dominate, intensifying price competition and expanding access but potentially impacting profitability for original developers.

-

Regional nuances: Asia-Pacific and Latin America offer high-growth opportunities, though pricing remains sensitive to economic and regulatory factors.

-

Clinical positioning: Nebivolol’s favorable side effect profile and vasodilatory capabilities position it as a preferred beta-blocker in specific patient populations, supporting its future market relevance.

FAQs

1. How does Nebivolol differ from other beta-blockers?

Nebivolol offers selective beta-1 adrenergic receptor blockade with vasodilatory effects mediated via nitric oxide release, resulting in fewer metabolic and respiratory side effects compared to traditional beta-blockers.

2. What is the current patent status of Nebivolol?

The primary patent protecting Nebivolol expired in most jurisdictions between 2018 and 2020, paving the way for generic manufacturing and significant price reductions.

3. Which regions present the most growth opportunities for Nebivolol?

Emerging markets in Asia-Pacific, Latin America, and the Middle East exhibit the highest growth potential due to increasing disease burden and relaxed regulatory pathways.

4. How will pricing impact Nebivolol’s commercial prospects?

Price reductions driven by generics and market competition will challenge margins but increase volume and access, especially in price-sensitive healthcare settings.

5. What clinical evidence supports expanding Nebivolol indications?

Studies demonstrate its efficacy in hypertension, heart failure, and specific patient populations requiring cardioselective beta-blockade with vasodilatory benefits, bolstering its therapeutic profile.

References

- [1] MarketWatch, “Global Antihypertensive Drugs Market Size & Share Insights,” 2022.

- [2] U.S. FDA, “Nebivolol (Bystolic) Drug Approvals and Market Data,” 2023.

- [3] IQVIA, “Global Prescription Market Trends,” 2022.

- [4] ClinicalTrials.gov, “Nebivolol Clinical Trials and Indications,” 2023.

- [5] World Health Organization, “Global Cardiovascular Disease Burden,” 2022.

In conclusion, Nebivolol’s market outlook remains attractive amid increasing cardiovascular disease prevalence and strategic positioning as a cardioselective vasodilatory beta-blocker. Price moderation stemming from patent expiries and generic competition supports broader access, suggesting a landscape characterized by volume-driven growth rather than premium pricing. Stakeholders should align with regional regulatory developments, clinical evidence, and manufacturing innovations to capitalize on this evolving market.