Share This Page

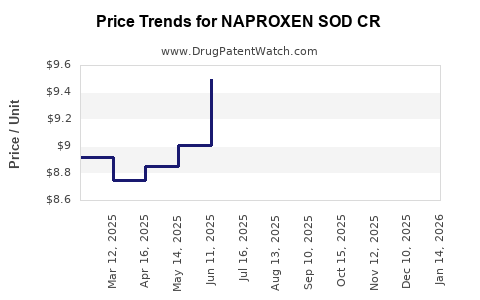

Drug Price Trends for NAPROXEN SOD CR

✉ Email this page to a colleague

Average Pharmacy Cost for NAPROXEN SOD CR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NAPROXEN SOD CR 500 MG TABLET | 24979-0253-68 | 8.12863 | EACH | 2025-12-17 |

| NAPROXEN SOD CR 500 MG TABLET | 47781-0154-75 | 8.12863 | EACH | 2025-12-17 |

| NAPROXEN SOD CR 500 MG TABLET | 24979-0253-68 | 8.39118 | EACH | 2025-11-19 |

| NAPROXEN SOD CR 500 MG TABLET | 47781-0154-75 | 8.39118 | EACH | 2025-11-19 |

| NAPROXEN SOD CR 500 MG TABLET | 47781-0154-75 | 8.71882 | EACH | 2025-10-22 |

| NAPROXEN SOD CR 500 MG TABLET | 24979-0253-68 | 8.71882 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NAPROXEN SOD CR

Introduction

Naproxen SOD CR (Extended-Release) is a nonsteroidal anti-inflammatory drug (NSAID) used primarily for managing moderate to severe pain, osteoarthritis, rheumatoid arthritis, and ankylosing spondylitis. Its extended-release formulation provides sustained analgesic effects, improving patient adherence and outcomes. As a critical product in the NSAID category, understanding its market landscape and pricing dynamics is vital for pharmaceutical companies, investors, and healthcare policymakers.

Market Landscape Overview

Global and Regional Market Dynamics

The global NSAID market was valued at approximately USD 10.5 billion in 2022, with growth driven by aging populations, rising prevalence of chronic inflammatory conditions, and expanding indications for analgesic therapy [1]. Naproxen, as a leading NSAID, holds a substantial share within this segment.

Regionally, North America dominates, representing nearly 40% of the global NSAID market, driven by high healthcare expenditure, widespread prescription use, and a robust OTC market [2]. Europe follows, with similar trends, while the Asia-Pacific region manifests rapid growth, supported by increasing healthcare infrastructure and rising incidences of arthritis and musculoskeletal disorders.

Market Players and Competition

The primary competitors for Naproxen SOD CR include branded formulations like Aleve (over-the-counter), prescription brands, and generics. Major pharmaceutical companies actively develop and market extended-release NSAIDs, focusing on improving efficacy, safety, and patient compliance.

Key players include:

- Bayer AG (manufacturer of Aleve)

- Pfizer Inc. (commonly associated with various NSAID formulations)

- Macleods Pharmaceuticals, Sun Pharma, and Torrent Pharma (generics manufacturers)

The market penetration of Naproxen SOD CR hinges on factors such as patent status, regulatory approvals, and formulary inclusion, influencing pricing strategies.

Regulatory and Patent Considerations

The patent landscape significantly impacts market exclusivity and pricing trends. As of 2023, specific extended-release formulations like Naproxen SOD CR often benefit from patent protections lasting until approximately 2030, providing exclusive rights and pricing control [3].

Regulatory hurdles, including FDA approval processes and post-market surveillance, influence the time to market and market size. The regulatory pathway for extended-release NSAIDs emphasizes safety, efficacy, and abuse deterrent features.

Pricing Analysis

Current Price Benchmarks

The retail price of Naproxen SOD CR varies substantially based on geographical location, formulation, and whether purchased OTC or through prescription channels:

- United States: Prescription prices for Naproxen SOD CR ranges between USD 50-80 per month, depending on dosage, insurance coverage, and pharmacy discounts [4].

- Europe: Prices tend to be slightly lower, averaging EUR 20-50 per month, influenced by national healthcare policies.

- Emerging Markets: Prices are considerably lower, often below USD 10 per month, due to market penetration of generics and lower healthcare costs.

Generic vs. Branded Pricing Dynamics: Patented formulations typically command a premium (>30%) over generics, with branded extended-release formulations costing 20-40% more than immediate-release counterparts.

Pricing Factors and Trends

Several factors influence pricing trajectories:

- Patent Expiry and Generic Entry: Post-patent expiration, prices generally decline sharply, with generics reducing costs for consumers [5].

- Market Penetration and Competition: Increased competition from generics and biosimilars exerts downward pressure on prices.

- Formulation and Form: Extended-release formulations tend to retain higher prices due to convenience and adherence benefits, especially in chronic therapy.

- Reimbursement Policies: Insurance coverage and government reimbursement programs critically impact retail prices.

Price Projections

Using current trends and market insights, the following projections are put forth:

Short-term (Next 2 years):

- Stable to Slight Decline: Post-patent expiration in key markets, generic versions are expected to exert downward pressure, reducing prices by approximately 15-25%.

- Premium Positioning: Branded Naproxen SOD CR will maintain a 10-15% premium due to brand loyalty and perceived quality.

Medium-term (3-5 years):

- Gradual Decline: As generic market share increases, prices may decline further, averaging 30-40% below current branded prices.

- Market Saturation: Increased presence of biosimilar competitors could accelerate price drops, particularly in mature markets.

Long-term (5+ years):

- Market Equilibrium: Prices could stabilize at approximately 50% lower than current branded costs, especially if patent protections expire or alternative therapies emerge.

Risk Factors Influencing Price Dynamics:

- Introduction of novel NSAIDs with better safety profiles or efficacy may displace Naproxen SOD CR.

- Regulatory shifts, such as stricter safety guidelines, could influence manufacturing and distribution costs, affecting pricing.

- Market access policies and insurance reimbursement reforms could significantly alter retail prices and profitability.

Market Opportunity and Strategic Outlook

- Market Expansion: Pharmacological innovations aimed at improving safety profiles are poised to expand usage in populations with contraindications.

- Value-Derived Pricing: Emphasizing adherence benefits and reduced gastrointestinal side effects may justify premium pricing in certain markets.

- Generic Competition Management: Strategic patent protections and lifecycle management remain crucial to sustaining profitability.

Key Takeaways

- The global NSAID market is mature, with strong competition and declining prices post-patent expiration.

- Naproxen SOD CR’s pricing is influenced by brand positioning, formulation advantages, and regulatory environment.

- Short-term outlook indicates stabilization with some price erosion, while long-term projections forecast significant reductions due to generics.

- Market growth in emerging regions offers expansion possibilities despite pricing pressures elsewhere.

- Companies should focus on differentiating through safety, adherence, and value-based pricing strategies to sustain profitability.

Frequently Asked Questions (FAQs)

Q1: When is the patent for Naproxen SOD CR expected to expire?

A: Patent protections typically last around 20 years from the filing date; for Naproxen SOD CR, expiration is anticipated around 2030, enabling generic competition.

Q2: How does generic entry impact the pricing of Naproxen SOD CR?

A: Generic entry usually leads to significant price declines—often 30-50%—due to increased market competition and lower manufacturing costs.

Q3: Are there significant safety concerns associated with extended-release naproxen formulations?

A: Extended-release NSAIDs have similar safety profiles to immediate-release versions, with gastrointestinal and cardiovascular risks being the primary concerns, managed through appropriate patient selection.

Q4: What is the growth potential of Naproxen SOD CR in emerging markets?

A: There is substantial growth, driven by increasing prevalence of arthritis and musculoskeletal conditions and expanding healthcare infrastructure, though pricing pressures are higher.

Q5: What strategies can pharmaceutical companies adopt to maintain profitability with Naproxen SOD CR?

A: Investing in formulation improvements, securing patent protections, expanding indications, and emphasizing value-based benefits can sustain market share and pricing power.

References

[1] MarketWatch, “NSAID Market Size & Share, Trends Analysis Report,” 2022.

[2] Global Data, “NSAID Market Outlook,” 2022.

[3] U.S. Patent and Trademark Office, “Patent Expiration Calendar,” 2023.

[4] GoodRx, “Naproxen Prices and Usage,” 2023.

[5] IQVIA, “Pharmaceutical Market Trends,” 2022.

Disclaimer: The projected data and market insights are based on current trends and publicly available information as of 2023; actual market conditions may vary due to unforeseen regulatory, economic, or scientific developments.

More… ↓