Last updated: July 27, 2025

Introduction

NALOXONE HCL (hydrochloride), an opioid antagonist, has become an essential medication in combating opioid overdoses, especially amidst the ongoing opioid crisis. Its efficacy in rapidly reversing opioid effects has led to widespread adoption by emergency services, healthcare providers, and community-based programs. Understanding the current market landscape and forecasting future price trends are critical for stakeholders, including pharmaceutical companies, policymakers, and healthcare providers aiming to balance accessibility with sustainability.

Market Overview

Global Market Size

The global naloxone market, with NALOXONE HCL as a primary component, was valued approximately at USD 1.2 billion in 2022. It is projected to grow at a compound annual growth rate (CAGR) of around 8-10% from 2023 to 2030, driven by increasing opioid overdose fatalities, expanding public health initiatives, and regulatory support for naloxone distribution.

Key Market Drivers

-

Rising Opioid Overdose Deaths: According to the CDC, over 107,000 drug overdose deaths occurred in the U.S. in 2021, a 15% increase compared to the previous year, primarily driven by synthetic opioids like fentanyl. This surge amplifies demand for naloxone formulations.

-

Regulatory Supports and Legislation: The Food and Drug Administration (FDA) and other agencies have facilitated wider access by approving various formulations (injectable, nasal spray) and removing prescribing barriers.

-

Public Health Policies: Governments worldwide, especially in North America and Europe, allocate funding towards naloxone distribution programs, including overdose prevention initiatives.

-

Manufacturer Initiatives: Increased R&D investments have led to diverse formulations and potential for scalable manufacturing.

Market Segmentation

-

Formulation Type:

- Injectable NALOXONE HCL (used predominantly by emergency services)

- Nasal spray (e.g., Narcan) (more accessible for first responders and laypersons)

-

End-User:

- Hospitals and clinics

- Community and non-profit organizations

- First responders (EMS, police, fire departments)

- Individuals and families (over-the-counter availability)

-

Geographic Regions:

- North America: Largest market share (~60%) owing to high overdose rates.

- Europe: Growing adoption driven by legislative changes.

- Asia-Pacific: Emerging market with increasing awareness and regulatory approvals.

Market Challenges

-

Pricing and Affordability: Despite its public health importance, naloxone prices, particularly branded formulations like Narcan, have faced criticism for affordability, restricting access in low-income communities.

-

Patent Expirations: Several formulations are nearing patent expirations, leading to increased generic competition, which could influence pricing dynamics.

-

Regulatory Barriers: In some regions, regulatory frameworks remain outdated, limiting access to OTC sales and impacting market expansion.

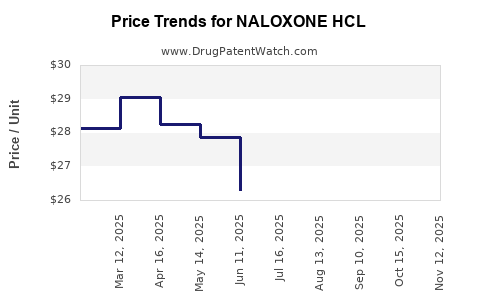

Price Analysis and Trends

Historical Price Trends

-

Brand-name Products: Narcan (by Emergent BioSolutions) has historically been priced at approximately USD 130-150 per single-dose nasal spray in the U.S., reflecting a significant markup relative to manufacturing costs.

-

Generics and Alternatives: Generic naloxone formulations, primarily injectable, cost considerably less—around USD 20-40 per dose—though accessibility varies due to storage, administration complexity, and regulatory status.

Factors Influencing Prices

-

Manufacturing Costs: Production costs are relatively low due to established manufacturing processes, but branding and distribution costs significantly impact retail prices.

-

Regulatory and Patent Status: Patent expirations promote generic entry, exerting downward pressure on prices.

-

Market Demand: Sustained high demand due to overdose crisis sustains premium pricing for branded products, especially in regions with limited generic options.

-

Reimbursement Policies: Insurance coverage and government reimbursement programs play crucial roles in determining patient prices and overall market pricing strategies.

Projected Price Trends (2023-2030)

-

Price Stabilization and Decline: With increasing generic competition, prices are expected to decrease by approximately 10-15% annually in North America, stimulating broader access.

-

Emerging OTC Sales: The U.S. FDA’s recent approval of OTC sales of naloxone (e.g., Narcan) is anticipated to drive price competition further, potentially reducing retail prices by up to 20% over the next five years.

-

Innovative Formulations: Investments in long-acting formulations and user-friendly delivery systems could command premium pricing initially but will likely see price declines as technology matures.

Regional Variations

-

North America: Prices are projected to decrease steadily due to market saturation and increased generic availability, though branded products will retain premium status in some sectors.

-

Europe: Expected to follow similar trends, with price reductions facilitated by healthcare system negotiations and increased generic entries.

-

Asia-Pacific: Prices remain relatively high due to limited manufacturing infrastructure and regulatory delays, but economies of scale and local generics could lower costs over the next decade.

Competitive Landscape

Major players include Emergent BioSolutions, Hikma Pharmaceuticals, Teva Pharmaceuticals, and Mylan. These companies are investing in formulation innovations and price strategies to expand access.

Emergent's Narcan dominates the U.S. market, with stringent pricing controls and large-scale distribution agreements. However, increasing market entrants are challenging this dominance, aiming for cost-effective alternatives.

Regulatory and Policy Outlook

Recent policy shifts—such as OTC approval of naloxone products—are poised to revolutionize pricing and access. The U.S. government, with initiatives like the Overdose Prevention Strategy, emphasizes broad naloxone availability, putting pressure on market prices via expanded competition.

In Europe, regulatory harmonization efforts aim to encourage more affordable formulations, while in Asia, regulatory reforms are critical to foster local manufacturing and reduce import dependence.

Conclusion and Future Outlook

The NALOXONE HCL market is set for substantial growth, driven by escalating opioid crises worldwide and supportive policies. Price trends will likely trend downward as generic manufacturers increase production and competition intensifies, especially in response to OTC approvals. However, branded formulations will maintain premium pricing for specialized use cases.

For stakeholders, early engagement in the evolving regulatory landscape and strategic positioning within generic markets offer opportunities to optimize costs and expand access. Innovations in delivery and formulation will further influence pricing structures, emphasizing the need for continuous market monitoring.

Key Takeaways

-

The global naloxone market is expected to grow at an 8-10% CAGR through 2030, driven by overdose crisis response needs.

-

Prices for branded naloxone, notably Narcan, will likely decline by 10-20% over the next five years due to increased generic competition and OTC availability.

-

Generics currently provide the most affordable options; however, accessibility barriers persist, especially in low-income regions.

-

Regulatory reforms, especially OTC approvals in major markets like the U.S., will facilitate broader access but also intensify price competition.

-

Investment in low-cost, innovative formulations and manufacturing scalability will be critical for market players aiming to capture emerging demand.

FAQs

Q1: What factors are driving the increased demand for NALOXONE HCL globally?

A1: The primary drivers include the rise in opioid overdose fatalities, support from regulatory bodies for wider distribution, public health initiatives, and increased awareness of naloxone’s life-saving potential.

Q2: How will patent expirations influence the pricing of NALOXONE HCL?

A2: Patent expiry creates opportunities for generic manufacturers to enter the market, increasing competition and generally leading to significant price reductions.

Q3: What are the implications of OTC approval for naloxone products?

A3: OTC approval broadens access, especially for laypersons and at-risk individuals, potentially reducing overdose mortality while exerting downward pressure on branded product prices.

Q4: Which regions are expected to see the fastest growth in naloxone adoption?

A4: North America remains the largest market, with rapid growth expected in Europe and emerging demand in Asia-Pacific as regulatory hurdles diminish.

Q5: What future innovations could impact the NALOXONE HCL market?

A5: Long-acting formulations, novel delivery methods (e.g., auto-injectors, multi-dose nasal sprays), and price-optimized generics could shape future market dynamics significantly.

References

[1] Centers for Disease Control and Prevention (CDC). (2022). Drug Overdose Deaths.

[2] Emergent BioSolutions. (2022). Narcan Product Information.

[3] Grand View Research. (2023). Naloxone Market Size, Share & Trends Analysis.

[4] U.S. Food and Drug Administration (FDA). (2022). Over-the-Counter Naloxone.

[5] World Health Organization (WHO). (2021). Prevention of opioid overdose.