Last updated: July 27, 2025

Introduction

Mupirocin is a topical antibiotic primarily used to eradicate Staphylococcus aureus, including methicillin-resistant strains (MRSA), and to treat skin infections such as impetigo. Its formulation as a nasal ointment and topical cream makes it a critical tool in infection control, especially in healthcare settings. As antibiotic resistance intensifies and the global demand for effective skin infection treatments ascends, analyzing mupirocin’s market dynamics becomes essential for stakeholders.

This report synthesizes current market conditions, competitive landscape, regulatory factors, and future price projections for mupirocin. The insights aim to aid investors, pharmaceutical companies, and healthcare policymakers in strategic decision-making.

Market Overview

The global antibiotic market is projected to reach USD 48.2 billion by 2027, growing at a CAGR of approximately 3.8% (Allied Market Research, 2022). Within this segment, topical antibiotics like mupirocin account for a significant niche, driven by rising skin infection rates, hospital-acquired infections (HAIs), and antimicrobial stewardship efforts.

Key Drivers:

- Rising MRSA prevalence: MRSA colonization and infections have surged globally, particularly in hospital and community settings, enhancing mupirocin’s necessity for decolonization protocols (CDC, 2021).

- Increasing skin infections: Impetigo, folliculitis, and other dermatological conditions show a rising incidence, especially among children and immunocompromised populations.

- Antibiotic stewardship campaigns: Encouragement of targeted therapy over broad-spectrum antibiotics sustains demand for specific agents like mupirocin.

- Emerging resistance patterns: Though resistance to mupirocin remains relatively low, underdevelopment of new antibiotics compels continued reliance on existing formulations.

Market Segmentation:

- By Route of Administration: Topical cream, nasal ointment.

- By Application: Medical use (hospital, clinics), consumer use (over-the-counter formulations in some markets).

- Regional Distribution: North America dominates due to high healthcare spending and extensive MRSA issues; Asia-Pacific exhibits rapid growth owing to expanding healthcare infrastructure.

Competitive Landscape

Major pharmaceutical players in mupirocin include:

- Medicis (a subsidiary of Valeant Pharmaceuticals)

- Sagent Pharmaceuticals

- Pfizer Inc.

- GlaxoSmithKline (GSK)

- Generic manufacturers in India and China, significantly contributing to availability and competitive pricing.

Patents and Market Exclusivity:

The primary patent for Bactroban (the branded mupirocin ointment) has expired in multiple jurisdictions, leading to increased generic competition. This transition has significantly reduced prices and increased accessibility but has also pressured major firms’ profit margins.

Innovation and Pipeline:

Innovations focus on combination therapies, improved formulations, or resistance mitigation strategies. To date, no significant pipeline entrants threaten to supplant mupirocin’s dominance in MRSA decolonization, maintaining its critical role.

Regulatory Environment

- United States: FDA approval for Bactroban (mupirocin calcium) is established; generic versions are available post-patent expiry.

- Europe: EMA approval and similar patent expiries have facilitated generic proliferation.

- Emerging Markets: Regulatory pathways often faster, leading to increased generic entry and price competition.

Regulatory agencies emphasize antimicrobial stewardship, potentially affecting procurement policies, especially in hospitals emphasizing judicious antibiotic use.

Price Trends and Projections

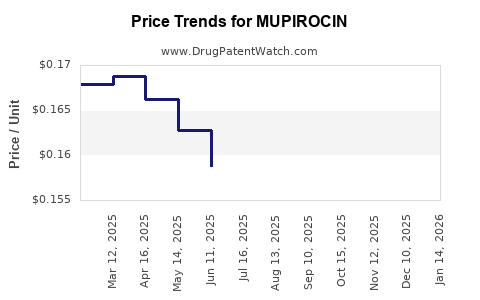

Historical Pricing Trends:

Post-patent expiry, the average retail price of Bactroban in the U.S. dropped dramatically—from approximately USD 200 per tube of 15 grams in 2010 to below USD 50 by 2020 (GoodRx, 2021). Generic formulations drive further price reductions, with some markets seeing costs as low as USD 10-20 per tube.

Factors Influencing Future Prices:

- Increased generic market share: Continuing patent expirations will sustain downward pressure.

- Manufacturing costs: Entry of cost-efficient producers in Asia reduces overall pricing.

- Demand elasticity: While demand remains steady, overuse concerns may lead to tighter prescribing policies, affecting volume and pricing.

- Resistance concerns: Rising resistance could constrain use, impacting revenue and pricing strategies.

- Reformulation developments: Novel formulations or combination products may command higher prices but face regulatory and clinical hurdles.

Price Projection (Next 5-10 Years):

- United States and Europe: Expect stabilization below USD 20 per tube for generics, with branded versions maintaining a premium due to brand recognition and perceived efficacy (~USD 50-70).

- Emerging Markets: Prices could fall further to USD 5-10 per tube due to increased competition, local manufacturing, and lower healthcare spending.

- Premium formulations: Any innovation or combination therapy are likely to command higher prices, potentially reaching USD 80-100, especially in developed markets.

Market Opportunities and Challenges

Opportunities:

- Expansion into over-the-counter (OTC) markets in developing regions.

- Developing combination formulations to combat resistance.

- Partnership with healthcare systems for MRSA decolonization programs.

Challenges:

- Increasing antibiotic resistance reducing usage.

- Regulatory restrictions on antibiotic prescribing.

- Competition from alternative therapies and emerging antibiotics.

- Public health efforts to reduce unnecessary antibiotic use.

Conclusion

The mupirocin market remains vital amid persistent MRSA challenges and skin infections worldwide. Its price trajectory is primarily influenced by patent status, generic competition, and healthcare policies emphasizing antimicrobial stewardship. While prices are expected to decline further, strategic innovation and geographic expansion will offer premium pricing opportunities.

Key Takeaways

- Market stability: Mupirocin retains a critical niche in MRSA management, ensuring ongoing demand.

- Price decline trend: Generic proliferation will sustain lower prices, particularly in emerging markets.

- Potential for innovation: Reformulated or combination products could command premium prices but face regulatory hurdles.

- Regulatory impacts: Evolving policies aimed at antimicrobial stewardship may influence prescribing patterns and market volume.

- Investment considerations: Opportunities exist in geographic expansion and pipeline development, but resistance and regulatory risks must be considered.

FAQs

1. What are the main factors driving mupirocin’s market growth?

The rise in MRSA infections, increased skin and nasal colonization treatments, and growing awareness of infection control protocols continue to underpin demand, especially in hospital environments.

2. How has patent expiry affected mupirocin pricing?

Patent expiration has led to a surge in generic manufacturers, significantly reducing prices—from approximately USD 200 per tube to below USD 20 in many markets—enhancing accessibility but squeezing profit margins for branded products.

3. Are there emerging concerns about mupirocin resistance?

Yes, resistance, though still relatively low, has been documented, especially in intensive healthcare settings. This could influence future prescribing patterns and market dynamics.

4. What regions are expected to see the highest price declines?

Emerging markets like India, China, and Southeast Asia will likely experience the steepest price reductions, driven by local manufacturing and increased competition.

5. What future innovations could impact mupirocin’s market?

Development of combination therapies, sustained-release formulations, or agents addressing resistance could alter market dynamics and pricing structures.

References:

[1] Allied Market Research. "Antibiotics Market Forecast to 2027." 2022.

[2] CDC. "MRSA and Antibiotic Resistance," 2021.

[3] GoodRx. "Mupirocin Pricing Trends," 2021.