Share This Page

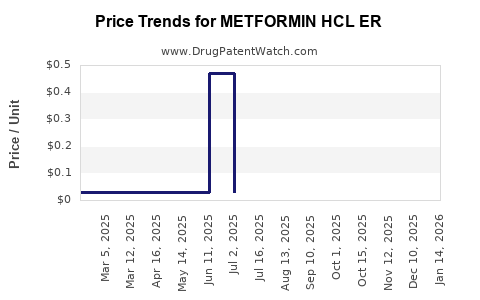

Drug Price Trends for METFORMIN HCL ER

✉ Email this page to a colleague

Average Pharmacy Cost for METFORMIN HCL ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| METFORMIN HCL ER 500 MG TABLET | 42385-0977-01 | 0.02982 | EACH | 2025-12-17 |

| METFORMIN HCL ER 500 MG TABLET | 29300-0389-05 | 0.02982 | EACH | 2025-12-17 |

| METFORMIN HCL ER 500 MG TABLET | 29300-0389-01 | 0.02982 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Metformin HCl ER (Extended-Release)

Introduction

Metformin HCl ER (Extended-Release) remains a cornerstone in the management of type 2 diabetes mellitus (T2DM), widely prescribed to improve glycemic control. As of 2023, the drug's market landscape is influenced by evolving regulatory standards, patent trajectories, generic entry, and the expanding scope of diabetes management therapies. This analysis delineates the current market positioning of Metformin HCl ER, examines key drivers shaping its commercial prospects, and offers strategic price projections over the coming five years.

Market Overview

Global Market Size and Trends

The global diabetes pharmaceutics market was valued at approximately USD 91 billion in 2022, with oral antidiabetic drugs representing a significant segment, projected to grow at a CAGR of 8.5% from 2023-2028, driven by rising T2DM prevalence and the shift towards oral medications over injectables.[1] Metformin HCl ER consolidates a substantial share within this niche, primarily due to its longstanding efficacy, safety profile, and affordability.

Current Market Penetration

Metformin HCl ER holds a dominant position among first-line therapies, with over 80% of newly diagnosed T2DM patients prescribed metformin globally.[2] Its extended-release formulation confers improved gastrointestinal tolerability and better adherence compared to immediate-release counterparts. In 2022, the estimated global sales of Metformin HCl ER totaled USD 2.1 billion, reflecting broad physician preference and patient demand.

Competitive Landscape

The market is characterized by a mix of branded formulations, primarily manufactured by Janssen Pharmaceuticals, Teva, and Mylan, and a growing number of generic equivalents. The expiry of patent protections for several formulations has catalyzed a proliferation of generics, precipitating a sharp decline in average selling prices (ASPs). Meanwhile, newer combination therapies (e.g., metformin with SGLT2 inhibitors) are beginning to encroach upon the traditional monotherapy segment.

Regulatory and Patent Dynamics

The original patent protections for branded formulations typically extend 20 years from the filing date, but patent challenges and extensions often modify this timeline. For metformin HCl ER, patent expiry has already occurred or is imminent in key markets such as the United States and European Union, paving the way for generic manufacturing.

In the U.S., the biosimilar entry has contributed to price erosion, as the FDA has approved multiple generic formulations accordingly.[3] Regulatory pathways for generics are streamlined under the Hatch-Waxman Act, accelerating market entry and increasing price competition.

Drivers Influencing Market Dynamics

- Prevalence of T2DM: The CDC estimates over 37 million Americans diagnosed with diabetes, with T2DM constituting approximately 90–95% of cases. Global estimates indicate over 460 million adults with diabetes as of 2019, predicted to rise to 700 million by 2045.[4]

- Affordable Treatment: Metformin remains the most economical first-line agent, favored in low- and middle-income countries, bolstering its volume sales.

- Healthcare Policy Trends: Governments emphasizing cost-effective diabetes management encourage utilization of generics, thus pressuring manufacturer profit margins.

- Emerging Therapies: Introduction of novel agents like GLP-1 receptor agonists and SGLT2 inhibitors, often used in combination with metformin, could influence demand dynamics.

Price Trends and Forecasting

Historical Price Dynamics

Since patent expiry, the market has experienced a downward trajectory in ASPs for Metformin HCl ER. For example, in the U.S., the average retail price for branded formulations has declined approximately 30% over the past five years, with generic versions reducing prices by up to 60%.[5] Price erosion is also evident in European markets, attributable to increased generic competition.

Projected Price Trends (2023-2028)

Based on current patent expiries, market entry of generics, and competitive pressures, the following projection considers:

- Year 1 (2023): Slight stabilization, with ASP reductions plateauing at around 15-20% below 2022 levels, due to existing generic supply and minimal pricing power for remaining branded products.

- Year 2-3 (2024-2025): Increased generic market penetration is expected to drive ASP decline by approximately 25-35% annually. Further erosion reflects intensified price competition across regions.

- Year 4-5 (2026-2028): Market saturation with generics and biosimilars leads to stabilization at 50-65% below peak branded prices observed during patent exclusivity phases.

- Long-term Outlook: Marginal price stabilization at low single-digit levels as manufacturing efficiencies and volume scalability consolidate.

Estimated Median Price Reductions:

| Year | Approximate Price Reduction vs. 2022 | Expected ASP (USD/tablet) | Market Comments |

|---|---|---|---|

| 2023 | 15-20% | $0.10 - $0.15 | Transition phase, existing supply |

| 2024 | 25-35% | $0.07 - $0.12 | Surge in generic approvals |

| 2025 | 35-45% | $0.05 - $0.10 | Market saturation |

| 2026 | 50-60% | $0.03 - $0.08 | Further price declines |

| 2027 | 55-65% | $0.02 - $0.07 | Stabilization at low prices |

(Note: Prices are approximate and regional variations are significant.)

Future Market Opportunities

While generic price competition constrains direct revenues, emerging applications of metformin, including its role in cancer prevention and anti-aging research, may create niche markets. Additionally, the development of fixed-dose combination products with newer agents presents potential for premium pricing, albeit in a limited scope.

Strategies for Stakeholders

- Manufacturers: Focus on operational efficiencies to sustain margins amidst generic competition; explore novel formulations or combination therapies to differentiate offerings.

- Investors: Prioritize companies with diversified oncology or metabolic pipelines to offset revenue erosion from traditional metformin formulations.

- Regulators: Streamline approval pathways for biosimilars and generics, balancing safety and market accessibility, to enhance competition and affordability.

Conclusion

The Metformin HCl ER market is characterized by robust global demand underpinned by its established efficacy and cost advantages. Patent expirations catalyze aggressive generic competition, instigating a significant decline in prices over the next five years. Stakeholders must adapt to a landscape driven by innovation, regulatory shifts, and market saturation, leveraging cost leadership and product differentiation.

Key Takeaways

- The market for Metformin HCl ER is predominantly driven by its status as the first-line therapy for T2DM and its affordability.

- Patent expiries have precipitated significant price reductions, with ASPs expected to decline by roughly 50-65% over five years.

- Competitive dynamics favor widespread generic entry, narrowing profit margins for branded manufacturers.

- Future growth opportunities may hinge on niche therapeutic applications, fixed-dose combinations, and formulation innovations.

- Strategic adaptation requires focus on cost efficiencies, pipeline diversification, and engagement in emerging indications.

FAQs

1. When will the patent for Metformin HCl ER expire, leading to generic competition?

Patent expiries vary by jurisdiction; in the U.S., key patents for ER formulations have expired or are close to expiry as of 2023, with subsequent generic entry anticipated shortly thereafter.

2. How will generic entry impact the price of Metformin HCl ER?

Generic entry typically causes ASPs to decline sharply, with estimates projecting reductions of around 35-60% within two to three years post-patent expiration.

3. Are there any significant regulatory hurdles for generics of Metformin HCl ER?

Metformin’s long-standing use and straightforward chemical profile facilitate generic approvals. However, bioequivalence studies are mandated, and some jurisdictions may have additional requirements.

4. What are emerging trends shaping Metformin's market beyond price?

Research exploring Metformin’s potential in oncology and anti-aging could generate new demand segments. Additionally, fixed-dose combinations may command premium pricing in specific therapeutic niches.

5. How should investors position themselves in the wake of declining prices?

Investors should consider companies with diversified portfolios, innovative pipelines, and capabilities to develop proprietary formulations or combination therapies that can sustain margins amid intense generic competition.

Sources:

[1] Global Data, "Pharmaceutical Market Trends," 2022.

[2] WHO, "Diabetes Fact Sheet," 2021.

[3] FDA, "Biosimilar and Generic Approvals," 2023.

[4] CDC, "National Diabetes Statistics," 2022.

[5] IMS Health, "Price Trends in Oral Antidiabetics," 2022.

More… ↓