Last updated: July 27, 2025

Introduction

Memantine hydrochloride (HCl) is an established pharmacological agent primarily used for the treatment of moderate to severe Alzheimer’s disease. As an NMDA receptor antagonist, Memantine moderates glutamate activity, reducing neurotoxicity associated with neurodegeneration. Since its approval by the U.S. Food and Drug Administration (FDA) in 2003, Memantine HCl has maintained a significant market presence, driven by the global rise in dementia and Alzheimer's disease prevalence. This analysis examines the current market landscape, key drivers, competitive dynamics, and provides detailed price projections over the next five years.

Market Overview

Global Market Size and Growth Trends

The global Alzheimer’s disease therapeutics market, valued at approximately USD 9.2 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of 7.2% from 2023 to 2028 [1]. Memantine’s market share constitutes roughly 20-25% of this total, positioning it as a pivotal medication in Alzheimer’s management.

Key Markets

- North America: Remains the dominant region due to high disease prevalence, favorable reimbursement policies, and well-established healthcare infrastructure.

- Europe: Exhibits steady growth, supported by aging populations and proactive disease management programs.

- Asia-Pacific: Anticipated to witness the fastest growth, driven by increasing healthcare expenditure, urbanization, and rising awareness.

Market Drivers

-

Rising Aging Population: Globally, individuals aged 65 and older comprise increasing proportions, with projections indicating over 1 billion seniors worldwide by 2030 [2].

-

Growing Alzheimer’s Prevalence: Alzheimer’s disease affects an estimated 55 million people globally, expected to triple by 2050 [3].

-

Late-Stage Treatment Accessibility: Memantine remains a core option for moderate to severe stages, especially where acetylcholinesterase inhibitors are insufficient.

-

Healthcare Policy and Reimbursement: Favorable reimbursement in developed markets enhances drug accessibility and usage.

Competitive Landscape

Leading Brands and Formulations

- Namenda (Merz): The original branded formulation in the U.S.

- Axura (avizafone) and Ebixa (AstraZeneca): Approved in different markets, competed through regional preferences.

- Generic Memantine: Available since patent expirations around 2010, significantly impacting pricing.

Market Dynamics

Generic availability has precipitated price erosion yet expanded access. Patent cliffs prompted several manufacturers to enter the generics space, intensifying price competition. Some regions have strict price controls, influencing market profitability.

Emerging Developments

- Combination Therapies: Research into memantine combinations with other agents (e.g., donepezil) for enhanced efficacy, potentially impacting market segmentation.

- Novel Delivery Systems: Investigations into formulations improving bioavailability or reducing side effects could set the stage for premium pricing strategies.

Price Analysis

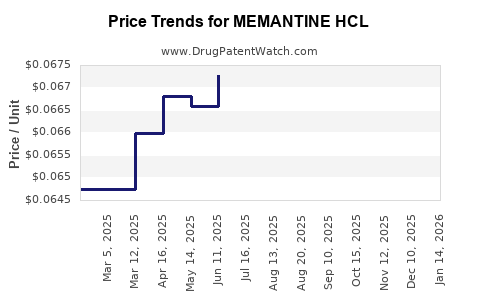

Historical Pricing Trends

- Brand-name Memantine: Historically priced between USD 300–400 per month in the U.S.

- Generic Memantine: Reduced costs, often below USD 50–100 per month, depending on the manufacturer and insurance coverage.

Current Pricing Landscape

According to recent pharmacy data:

- Brand Name (Namenda): Approx. USD 400–500 per month.

- Generic Versions: Range from USD 15–50 per month.

Pricing varies significantly across regions, influenced by regulatory policies, insurance coverage, and market competition.

Price Projections (2023-2028)

Factors Influencing Future Pricing

- Patent Expiry & Generics: Continued proliferation of generics will sustain downward pressure on prices.

- Reimbursement Policies: Shifts towards value-based care may influence pricing strategies, encouraging discounts or premium formulations.

- Market Penetration of Biosimilars & Alternatives: Innovations could affect demand and pricing.

- Regulatory Changes: Stringent price control measures in countries like Germany and Canada could cap cost increases.

Forecasted Price Trajectories

| Year |

Estimated Avg. Price (USD/month) |

Notes |

| 2023 |

USD 20–50 (generics dominant) |

Stable prices with some regional variation |

| 2024 |

USD 18–45 |

Slight decline due to increased generic competition |

| 2025 |

USD 15–40 |

Market saturation; potential price stabilization |

| 2026 |

USD 15–38 |

Possible slight decline, regional disparities persist |

| 2027 |

USD 14–36 |

downward pressure maintained |

| 2028 |

USD 13–34 |

Prices likely plateau; niche premium formulations may retain higher costs |

Market Opportunities & Challenges

Opportunities

- Expanding in Emerging Markets: As healthcare infrastructure improves, demand for affordable generics will grow.

- Development of Extended-Release Formulations: Could command premium pricing.

- Strategic Partnerships: Collaborations for formulation innovations or new delivery methods.

Challenges

- Pricing Pressures: Due to widespread generic competition.

- Regulatory Hurdles: Variability and increased scrutiny worldwide.

- Market Saturation: Limited scope for significant price increases in mature markets.

Conclusion

Memantine HCl remains a strategically important drug within the Alzheimer’s therapeutics landscape. Despite patent expirations and rising generic competition, the drug’s essential role guarantees sustained demand, especially in aging populations. Price reductions are anticipated, with generic versions dominating the landscape and maintaining affordability. Innovative formulations and market expansion into emerging economies could offer new revenue streams, although overall price erosion is expected to persist.

Key Takeaways

- The global Memantine HCl market is expected to grow modestly, driven by rising Alzheimer’s cases and aging demographics.

- Generic versions have significantly lowered prices, especially in mature markets, intensifying competition.

- Price projections suggest a steady decline over the next five years, with average monthly prices decreasing from USD 20–50 to approximately USD 13–34.

- Emerging markets and formulation innovations present growth opportunities, whereas price pressures and regulatory hurdles remain challenges.

- Stakeholders should focus on increased access strategies, formulation differentiation, and regional market adaptations to maximize value.

FAQs

1. What is the typical pricing range for Memantine HCl?

In developed markets, brand-name Memantine (e.g., Namenda) costs around USD 400–500 per month, while generic versions range from USD 15–50 monthly, reflecting substantial price erosion post-patent expiry.

2. How will patent expirations influence market prices?

Patent expirations have led to a proliferation of generics, significantly lowering prices and intensifying competition, which is projected to continue for several years.

3. Are there upcoming formulations or combination therapies involving Memantine?

Research into combination therapies (e.g., memantine with cholinesterase inhibitors) and novel delivery systems is ongoing; however, their commercial impact remains uncertain in the near term.

4. Which regions offer the highest growth potential for Memantine HCl?

Emerging markets in Asia-Pacific and Latin America are poised for rapid growth due to increasing healthcare access, rising awareness, and demographic shifts.

5. How can manufacturers maintain profitability amidst price pressures?

Innovating with differentiated formulations, exploring niche premium segments, and expanding into underserved markets can help sustain margins despite aggressive generic pricing.

References

[1] Markets and Markets. Alzheimer’s Disease Therapeutics Market. 2022.

[2] United Nations. World Population Prospects 2022.

[3] World Health Organization. Dementia Fact Sheet. 2022.