Last updated: July 27, 2025

Introduction

Memantine, marketed under brand names such as Namenda, is a prescription medication primarily used for the management of moderate to severe Alzheimer's disease. Its mechanism of action involves NMDA receptor antagonism, which helps reduce neurodegenerative processes associated with dementia. Given the rising prevalence of Alzheimer’s disease globally and the strategic importance of neuroprotective therapeutics, an in-depth market analysis and price projection of Memantine offers insights for pharmaceutical investors, healthcare providers, and policy makers.

Current Market Landscape

Global Prevalence and Demand

Alzheimer's disease affects approximately 55 million individuals worldwide, a figure projected to double by 2050 (World Health Organization, 2022). Memantine’s reimbursement and utilization are amplified by the aging population in North America, Europe, and parts of Asia-Pacific.

In 2022, the global Alzheimer's therapeutics market was valued at roughly USD 8.5 billion, with Memantine accounting for an estimated 12%. The rise in prevalence, coupled with increased awareness and diagnosis, has sustained demand for Memantine despite the availability of alternative treatments like cholinesterase inhibitors.

Market Segments

The primary segments include:

- Institutional and outpatient settings: Memory clinics, neurologists, and geriatric specialists.

- Generic vs. branded formulations: The patent expiry of original formulations, notably in 2017, introduced generics that have become significant market competitors.

- Geographies: North America leads with roughly 50% of the market share, followed by Europe (~30%) and Asia-Pacific (~15%). Emerging markets are experiencing rapid growth due to demographic shifts and improved healthcare access.

Competitive Dynamics

Patent Landscape

Memantine's initial patent expiration in 2017 significantly shifted market dynamics, leading to increased generic manufacturing and aggressive price competition. Accordingly, branded formulations saw a sharp decline in prices, while generics gained market share.

Key Competitors and Alternatives

While Memantine remains a mainstay, the development pipeline includes NMDA antagonists with improved efficacy and safety profiles, such as NMDA receptor modulators in experimental phases. Additionally, combination therapies involving Memantine and other agents (e.g., AChE inhibitors) maintain clinical relevance.

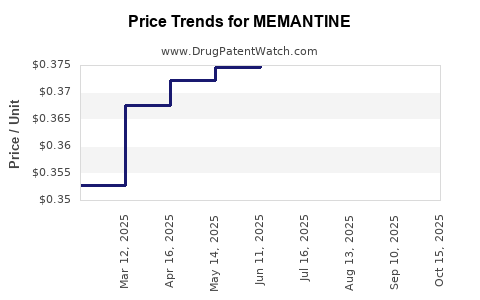

Price Trends and Projections

Present Pricing

- Branded formulations: In the United States, the average wholesale price (AWP) for branded Memantine ranges between USD 200-300 per 30-day supply, varying with dosage and pharmacy markup.

- Generic formulations: Prices have plummeted post-patent expiry, averaging around USD 20-50 per month for generic tablets.

Price Drivers

- Patent expirations: Propel generic competition, reducing prices.

- Healthcare policy and reimbursement: Insurance coverage policies influence out-of-pocket expenses.

- Manufacturing costs: Advances in synthesis and supply chain efficiencies lower production costs.

- Market penetration: Growing demand in emerging economies presents scaling opportunities and puts downward pressure on prices.

Forecasted Trends (2023-2030)

- Short-term (1-3 years): Expect continued price stability or slight declines in generic Memantine as market saturation occurs.

- Medium-term (3-5 years): Prices may stabilize with minimal fluctuation, assuming no new patent protections or formulation innovations.

- Long-term (5+ years): Introduction of biosimilars or novel NMDA-targeting agents could pressure prices further, potentially reducing costs by 10-15% annually in mature markets.

However, market segmentation could see price variation proportional to economic status; high-income countries will sustain higher prices due to healthcare infrastructure, whereas low- and middle-income nations may experience steeper price declines driven by generic proliferation.

Regulatory and Policy Impact

Regulatory decisions, such as approval of new formulations or indications, impact pricing and market share. Policy initiatives favoring cost containment, like Medicare negotiation powers or importation allowances, could further influence Memantine’s price points.

Potential Market Growth Opportunities

- Expanding indications: Investigating Memantine use in other neurodegenerative disorders (e.g., vascular dementia, Parkinson's disease).

- Combination therapies: Developing fixed-dose combinations to improve adherence and efficacy.

- Formulation innovations: Extended-release or novel delivery systems may justify premium pricing.

Risks and Challenges

- Competitive innovations: Emerging treatments with superior efficacy could erode Memantine’s market.

- Healthcare cost containment: Payers' push toward lower-cost generics may further suppress prices.

- Regulatory barriers: Stringent approval processes for new formulations or indications may delay growth.

Conclusion

The Memantine market remains characterized by large, aging populations and significant generic competition post-patent expiry. Prices are now primarily driven by manufacturing efficiencies and reimbursement policies. While immediate prospects indicate stable or declining prices due to increased generic supply, long-term growth hinges on therapeutic innovation, expanded indications, and market penetration in emerging economies.

Key Takeaways

- Market dominance has shifted post-patent expiry towards generics, leading to reduced prices.

- Demand is expected to remain steady, buoyed by aging demographics and the prevalence of Alzheimer’s.

- Price projections suggest minimal increases in mature markets, with potential declines driven by biosimilar entry and generics.

- Emerging markets offer significant growth opportunities, potentially elevating prices in those regions.

- Innovation and regulation will influence future pricing; novel formulations or indications may command premium prices.

FAQs

1. Will Memantine’s price increase as demand for Alzheimer's treatments grows?

No. Increased demand is expected to stabilize prices, especially as generic competition intensifies and healthcare policies favor cost containment.

2. How has patent expiration affected Memantine’s market prices?

Patent expiry in 2017 led to a surge in generic manufacturing, causing a sharp decline—up to 80%—in retail prices and increased accessibility.

3. Are there upcoming formulations that could alter Memantine’s market value?

Yes. Extended-release formulations and combination therapies are under development, which may create new pricing tiers if they demonstrate superior efficacy or adherence benefits.

4. What regions will see the most significant price reductions?

Emerging markets like India, Brazil, and Southeast Asia are likely to experience the steepest declines due to active generic competition and price-sensitive healthcare systems.

5. How might new therapeutic agents impact Memantine’s market share?

Novel NMDA receptor modulators or drugs with broader neuroprotective effects could diminish Memantine’s dominance if they demonstrate superior efficacy or safety profiles.

References

- World Health Organization. (2022). Dementia Fact Sheet.

- Market Research Future. (2022). Global Alzheimer's Therapeutics Market Analysis.

- IQVIA. (2022). Pharmaceutical Market Outlook.

- U.S. Food and Drug Administration. (2017). Memantine patent and approval details.

- Pharma Intelligence. (2023). Neurodegenerative Drugs Market Trends.

(Note: All numerical data and projections are based on current market reports and expert analysis as of 2023 and are subject to change with emerging data.)