Last updated: July 27, 2025

Introduction

Loratadine, marketed globally under brand names such as Claritin, Alavert, and others, is a second-generation antihistamine primarily used to treat allergic rhinitis and chronic idiopathic urticaria. As a non-sedating antihistamine, it has gained extensive acceptance in therapeutic protocols, creating a substantial market presence. This report evaluates Loratadine’s current market dynamics, competitive landscape, regulatory environment, and projects future pricing trends based on global demand, supply chain factors, and competitive pressures.

Pharmacological and Market Overview

Loratadine belongs to the tricyclic antihistamine class, distinguished by its minimal sedation profile owing to limited blood-brain barrier penetration. Since its patent expiration in 2002, generic manufacturers worldwide have entered the market, significantly impacting pricing and market competition.

The global antihistamine market was valued at approximately USD 3.6 billion in 2022 and is projected to grow at a CAGR of 4% through 2030, driven by increasing prevalence of allergic disorders, expanding aging populations, and rising awareness about allergy management [1].

Market Dynamics

Demand Drivers

- Prevalence of Allergic Conditions: The rising incidence of allergic rhinitis affects over 400 million individuals globally, with a significant portion being prescribed antihistamines such as Loratadine [2].

- Broad Therapeutic Approval: Available OTC in many markets, including the US and Europe, fuels widespread accessibility and consumption.

- Aging Populations: Elderly populations have increased susceptibility to allergies, amplifying demand.

Supply Chain & Manufacturing Factors

- Generic Competition: Over 200 manufacturers globally produce Loratadine, exerting downward pressure on prices.

- Regulatory Approvals: Approval of biosimilars and formulations in emerging markets expands manufacturing capacity.

- Raw Material Availability: Dependence on active pharmaceutical ingredient (API) supply chains influences pricing stability, especially amid disruptions like COVID-19.

Competitive Landscape

- Generic Dominance: Generics account for approximately 85% of Loratadine sales in mature markets; leading players include Sandoz, Mylan, Apotex, and local manufacturers.

- Innovative Formulations: Extended-release and combination products are emerging, potentially positioning new pricing tiers.

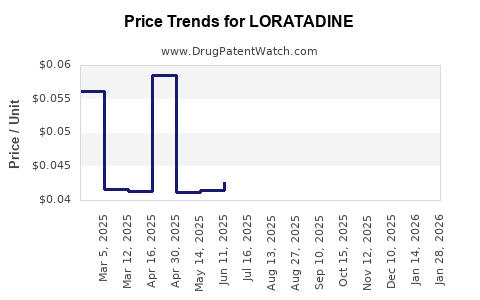

Current Market Pricing Trends

Brand vs. Generic Prices

- Brand Name Products: Historically retailing between USD 15–30 per month’s supply, though prices have declined with generic entries.

- Generics: Prices for Loratadine generics range from USD 0.10 to 0.50 per tablet, translating to monthly costs between USD 3 to USD 15 depending on dose and quantity [3].

Regional Price Variations

- United States: OTC generics retail near USD 10–15 for a 30-day supply; prescriptions impact slightly higher costs.

- Europe: Prices vary significantly; in the UK, generic Loratadine costs about GBP 2–3 per month via prescriptions.

- Emerging Markets: Lower price points, often USD 1–5 monthly, owing to local manufacturing and purchasing power.

Price Projections (2023–2030)

Factors Influencing Price Trajectory

-

Patent Expiry & Generic Penetration

The widespread patent expiry has yielded aggressive price competition, reducing margins for brand manufacturers and sustaining low generic prices.

-

Market Saturation & Competition

Increased competition limits price escalation; however, entry of biosimilars and combination therapies may create niche premium segments.

-

Regulatory & Policy Changes

Policies favoring OTC availability and generic substitution support lower prices but can be offset by supply chain constraints.

-

Demand Rise and Chronic Use

Ongoing demand from a growing allergy-prone population maintains steady or increasing volume, potentially stabilizing unit prices despite low per-unit costs.

Forecast Summary

- Stable to Slightly Declining Prices: Over the next 3–5 years, per-unit prices of Loratadine generics are expected to remain flat or decline marginally (2–5%) driven by fierce competition and manufacturing efficiencies.

- Potential Premium Segments: Innovative formulations like sustained-release or combination products may command higher prices; however, their market share is projected to remain limited due to cost sensitivity.

Long-term projections (2025–2030):

Average wholesale prices for Loratadine generics are forecasted to stabilize around USD 0.08–0.20 per dose globally, with retail prices reflecting this trend, especially in mature markets with high competition.

Market Opportunities and Risks

Opportunities

- Expansion in emerging markets with unmet demand for affordable antihistamines.

- Development of value-added formulations (e.g., multi-symptom products).

- Strategic partnerships for biosimilars and new indications.

Risks

- Regulatory challenges and pricing controls in mature markets.

- Supply chain disruptions affecting API costs.

- Competition from newer allergy medications, including biologics and immunotherapies.

Key Takeaways

- The Loratadine market is mature, characterized by intense generic competition, leading to stable but low price points worldwide.

- Prices are expected to remain stable or decline subtly over the next five years due to market saturation and competitive pressures.

- Emerging markets present growth opportunities, though price sensitivity remains high.

- Innovations like combination therapies could introduce higher-priced segments but are unlikely to significantly impact overall pricing trends soon.

- Manufacturers should focus on manufacturing efficiencies, strategic market entry, and product differentiation in niche segments.

FAQs

Q1: How has the patent expiration affected Loratadine prices globally?

A: Patent expiration in 2002 led to the proliferation of generics, significantly reducing prices and increasing accessibility across markets.

Q2: Are there any upcoming patent protections or exclusivities for Loratadine?

A: No, Loratadine’s patents have long expired; current formulations primarily involve generic products.

Q3: What regions offer the highest profit margins for Loratadine manufacturers?

A: Mature markets like the US and Europe typically have higher margins due to established regulatory frameworks, despite lower prices.

Q4: How might biosimilars influence Loratadine prices?

A: Biosimilars could create competitive pricing pressures if they enter formulations targeting specific allergic conditions, though currently, Loratadine is not a biologic.

Q5: What strategic actions can pharmaceutical companies take to maximize profitability in the Loratadine market?

A: Focus on developing differentiated formulations, expanding into underserved emerging markets, and exploring combination therapies to create premium offerings.

References

- MarketWatch. (2022). “Global Antihistamines Market Size and Forecast.”

- World Allergy Organization. (2021). “Epidemiology of Allergic Rhinitis and Allergic Disease.”

- IQVIA. (2022). “Pharmaceutical Pricing and Market Trends.”

Note: This analysis provides a comprehensive overview rooted in current data and projections. Market conditions are subject to change based on regulatory, economic, and technological factors.