Share This Page

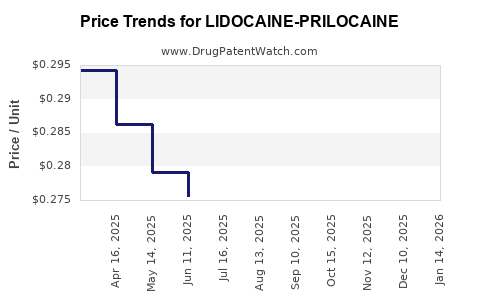

Drug Price Trends for LIDOCAINE-PRILOCAINE

✉ Email this page to a colleague

Average Pharmacy Cost for LIDOCAINE-PRILOCAINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LIDOCAINE-PRILOCAINE 2.5%-2.5% CREAM | 00574-2042-30 | 0.27156 | GM | 2025-12-17 |

| LIDOCAINE-PRILOCAINE 2.5%-2.5% CREAM | 00121-1002-30 | 0.27156 | GM | 2025-12-17 |

| LIDOCAINE-PRILOCAINE 2.5%-2.5% CREAM | 21922-0076-05 | 0.27156 | GM | 2025-12-17 |

| LIDOCAINE-PRILOCAINE 2.5%-2.5% CREAM | 81033-0025-51 | 1.46699 | GM | 2025-12-17 |

| LIDOCAINE-PRILOCAINE 2.5%-2.5% CREAM | 00168-0357-30 | 0.27156 | GM | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Lidocaine-Prilocaine

Introduction

Lidocaine-Prilocaine is a topical anesthetic combination widely utilized in various medical procedures, ranging from minor skin interventions to dental surgeries. Its dual-action formulation offers rapid onset and effective localized anesthesia, making it a preferred choice across healthcare settings. As the pharmaceutical industry evolves with technological advancements and shifts in regulatory policies, understanding the market dynamics and pricing trends for Lidocaine-Prilocaine is essential for stakeholders, including manufacturers, investors, and healthcare providers.

Market Overview

Global Market Size and Growth Trajectory

The global topical anesthetic market, which includes Lidocaine-Prilocaine, was valued at approximately USD 400 million in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 6.2% through 2030 [1]. The increasing prevalence of outpatient procedures, cosmetic dermatology, and dental interventions significantly contributes to this growth trajectory.

Lidocaine-Prilocaine, marketed under brands like EMLA and others, holds a substantial share within this segment due to its safety profile and efficacy. Its primary application areas include dermatology, dentistry, and minor surgical procedures, with expanding interest in pediatric anesthesia and cosmetic treatments fostering market expansion.

Key Market Drivers

-

Rising Cosmetic and Dermatology Procedures: The surge in minimally invasive cosmetic procedures, such as laser treatments and filler injections, heightens demand for topical anesthetics, specifically Lidocaine-Prilocaine [2].

-

Growing Dental Interventions: Patients increasingly seek dental surgeries, especially in aging populations, elevating the need for effective topical anesthetics.

-

Preference for Non-Invasive Anesthesia: Shift towards patient-friendly, non-invasive anesthesia options stimulates demand, favoring formulations like Lidocaine-Prilocaine.

-

Regulatory Approvals and Patent Expirations: Regulatory approvals in emerging markets and patent expirations in developed regions foster competitive manufacturing and organic growth.

Market Challenges

-

Stringent Regulatory Landscape: Variability in approval processes across regions complicates market entry and product commercialization.

-

Pricing Pressures: Competitive dynamics and reimbursement policies exert downward pressure on pricing.

-

Availability of Alternatives: Emergence of alternative anesthetic formulations, including nerve-block formulations and newer compounds, may impact market share.

Competitive Landscape

Major players include companies like AstraZeneca (EMLA), Novartis, and other regional manufacturers. While patent protections bolster exclusive positioning in specific formulations, patent expirations have led to the proliferation of generic Lidocaine-Prilocaine products, intensifying price competition.

In recent years, biosimilars and novel drug delivery systems (e.g., patch formulations) are emerging, potentially disrupting traditional market structures. EMLA remains a dominant brand due to brand recognition and established manufacturing standards.

Price Trends and Projections

Historical Pricing Dynamics

Historical data indicate a steady decline in unit prices for Lidocaine-Prilocaine formulations, primarily driven by patent expirations and increased manufacturing scale. In developed markets such as the U.S. and Europe, a standard 5-gram topical cream, historically priced around USD 15-20 per tube, has observed prices reducing by approximately 20-30% over the past five years.

Current Pricing Landscape

-

Brand-Name Products: EMLA (AstraZeneca) maintains premium pricing, approximately USD 18-22 for a 5g tube, leveraging brand recognition and regulatory approvals.

-

Generic Products: Multiple generic versions are priced between USD 6-12, offering cost-effective alternatives with similar efficacy.

-

Emerging Markets: Prices are often lower, averaging USD 3-8 per tube, driven by local manufacturing and lower regulatory hurdles.

Forecasted Price Trends (2023–2030)

Based on industry analyses, the following projections are anticipated:

-

Stabilization of Brand-Name Prices: Given intensified competition and patent expirations, brand-name drug prices are expected to stabilize or decline marginally, approximately 3-5% annually.

-

Decline in Generic Prices: Generic formulations are projected to decrease in price by an average of 4-6% annually, driven by market saturation and manufacturing efficiencies.

-

Impact of Innovative Delivery Systems: Patch formulations or controlled-release versions are expected to command premium pricing, potentially maintaining higher margins until widespread adoption occurs.

-

Regional Variations: Prices in developing regions may stabilize or slightly decrease, contingent on regulatory reforms, import tariffs, and local manufacturing capacity.

Market Opportunities and Future Directions

-

Product Innovation: Development of novel delivery systems (e.g., transdermal patches, nanocarrier technology) will enable premium pricing and expanded market reach.

-

Regulatory Expansion: Entry into emerging markets with increasing procedural volumes offers significant growth potential.

-

Therapeutic Expansion: Broader usage in pediatric, cosmetic, and chronic pain management can sustain demand.

-

Cost Optimization: Manufacturers investing in scalable production and supply chain efficiencies can maintain competitive pricing, increasing market share.

Regulatory and Economic Impacts

Regulatory pathways remain critical influencers of market dynamics. Approval of generic and biosimilar products facilitates pricing competition, directly impacting profit margins. Conversely, regulatory delays for new formulations limit pricing flexibility initially but provide market exclusivity, allowing premium pricing strategies.

Economic factors such as healthcare spending, reimbursement policies, and procurement protocols further shape the pricing landscape. Governments emphasizing outpatient and minimally invasive procedures propel market growth, while reimbursement restrictions may constrict pricing flexibility.

Key Takeaways

-

The global Lidocaine-Prilocaine market exhibits steady growth driven by procedural volume increases in dermatology, dentistry, and cosmetic surgery.

-

Patent expirations have accelerated price competition, leading to a downward trend in generic prices, while brand-name products maintain premium pricing levels.

-

Innovative delivery methods and formulations can create premium segments, offering growth avenues for manufacturers.

-

Market expansion into emerging economies presents significant opportunities but requires navigating regulatory complexities and price sensitivity.

-

Cost containment and product differentiation remain vital strategies for competing effectively in this evolving landscape.

FAQs

1. What factors most influence the pricing of Lidocaine-Prilocaine formulations?

Pricing is predominantly affected by patent status, manufacturing costs, regulatory approval processes, competitive generic offerings, and regional reimbursement policies. Brand recognition and perceived efficacy also sustain premium pricing for certain formulations.

2. How will patent expirations impact the market over the next decade?

Patent expirations will intensify competition, lowering prices and increasing the availability of generic formulations. This shift will drive market consolidation, encourage innovation in delivery systems, and potentially lead to price stabilization or further reductions.

3. Are there emerging therapies threatening Lidocaine-Prilocaine’s market share?

Yes. Novel formulations such as transdermal patches, nanocarrier systems, and alternative anesthetic compounds are gaining traction, offering comparable or improved efficacy with different delivery profiles, thereby potentially capturing market segments.

4. How do regional regulations influence pricing strategies?

Stringent regulatory requirements can delay product launches and increase compliance costs, often leading to higher prices initially. Conversely, regions with streamlined approval processes facilitate faster market entry and competitive pricing. Additionally, pricing regulations and reimbursement policies directly impact profitability margins.

5. What is the outlook for innovative delivery methods of topical anesthetics?

Emerging delivery systems like medicated patches and biodegradable carriers promise enhanced efficacy and user experience, enabling premium pricing. Adoption rates depend on clinical validation, manufacturing scalability, and regulatory approvals, but they are poised to shape future market dynamics significantly.

References

[1] MarketsandMarkets. "Topical Anesthetics Market by Product, Application, and Region — Global Forecast to 2030," 2022.

[2] Allied Market Research. "Topical Anesthetics Market Trends and Forecast," 2021.

More… ↓