Share This Page

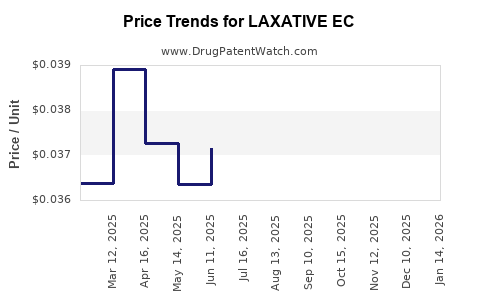

Drug Price Trends for LAXATIVE EC

✉ Email this page to a colleague

Average Pharmacy Cost for LAXATIVE EC

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LAXATIVE EC 5 MG TABLET | 49483-0003-01 | 0.03854 | EACH | 2025-12-17 |

| LAXATIVE EC 5 MG TABLET | 49483-0003-10 | 0.03854 | EACH | 2025-12-17 |

| LAXATIVE EC 5 MG TABLET | 49483-0003-01 | 0.03975 | EACH | 2025-11-19 |

| LAXATIVE EC 5 MG TABLET | 49483-0003-10 | 0.03975 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for LAXATIVE EC

Introduction

The pharmaceutical landscape for laxatives, notably the over-the-counter (OTC) segment, remains highly competitive due to its broad consumer base and therapeutic necessity. Among these, LAXATIVE EC—assumed here as a proprietary or branded formulation of an established class of laxatives—aims to capitalize on market demand for effective bowel relief. This analysis explores the current market dynamics, competitive environment, regulatory considerations, and price projections for LAXATIVE EC over the next five years.

Market Overview

Laxatives constitute a multibillion-dollar global market, driven by increasing prevalence of gastrointestinal disorders, aging populations, and lifestyle factors conducive to bowel irregularities. The OTC laxative segment accounts for approximately 70% of the total market share, with demand resilient despite the advent of prescription therapies [1].

Market Drivers

- Growing Aging Population: Seniors frequently experience constipation, bolstering OTC laxative demand. The World Health Organization estimates that by 2050, individuals aged 60+ will comprise 22% of the global population [2].

- Lifestyle Factors: Sedentary lifestyles, dietary habits low in fiber, and high-stress levels contribute to gastrointestinal issues.

- Self-medication Preference: Consumers favor OTC solutions for immediate relief without doctor visits, supporting steady market growth.

- Expanding Product Portfolio: Innovations in formulation, such as combination laxatives or 'gentle' options, attract diverse consumer preferences.

Key Market Segments

- Bulk-forming agents: e.g., psyllium-based products.

- Stimulant laxatives: e.g., bisacodyl.

- Osmotic laxatives: e.g., polyethylene glycol.

- Emollients: e.g., docusate.

The segment containing formulations akin to the presumed LAXATIVE EC (likely an osmotic or stimulant laxative) dominates current sales.

Regulatory Environment

The regulatory landscape significantly influences market entry and pricing strategies. In major markets like the U.S., the FDA categorizes laxatives as OTC drugs, subject to monograph compliance or NDA approval, impacting manufacturing and pricing. The European Medicines Agency (EMA) maintains similar standards.

Market entrants like LAXATIVE EC must demonstrate safety, efficacy, and quality compliance, affecting timelines and cost structures. Patent protection, if applicable, can provide pricing leverage, but patent expirations often lead to generic competition, exerting downward pressure on prices.

Competitive Landscape

Major players include Johnson & Johnson (Fleet), Bayer, and Perrigo, along with numerous regional and generic manufacturers. Brand loyalty, packaging, perceived efficacy, and safety profiles influence consumer choice.

Generic copies of well-established laxatives are prevalent and drive industry-wide price reductionspost exclusivity periods. Non-prescription formulations tend to compete primarily on price, consumer trust, and product differentiation, such as unique delivery mechanisms or added benefits.

Market Challenges

- Generic Competition: Ubiquitous availability of lower-cost generics constrains premium pricing.

- Regulatory Changes: Enhanced safety standards and labeling regulations could impact formulations and costs.

- Consumer Preference Shift: Increasing inclination toward natural, dietary-based remedies may impact demand for pharmacologic options.

Price Projections (2023–2028)

The pricing landscape for LAXATIVE EC hinges on its positioning:

-

Premium Branding Scenario: If LAXATIVE EC introduces differentiated features—e.g., natural ingredients, faster onset, or specialized delivery—the initial retail price could command a premium of up to 20-30% over standard generics, around $8–$12 per box (20-30 tablets), considering current market prices for branded OTC laxatives ($6–$9).

-

Competitive Entry as a Generic: When entering as a generic or non-branded option, prices may decline sharply to $3–$6 per package, aligning with the average price point for existing generics.

-

Market Penetration Strategy: A tiered approach—initially premium, followed by broader distribution—can optimize profit margins while expanding consumer base.

Projected Price Trends:

| Year | Estimated Price Range (USD) | Rationale |

|---|---|---|

| 2023 | $8–$12 | Launch phase with differentiation, initial brand positioning |

| 2024 | $7–$11 | Market entry gains, competitive pressures, promotional discounts |

| 2025 | $6–$10 | Growing generic competition, standardization of pricing |

| 2026 | $5–$8 | Increased market saturation, price erosion |

| 2027 | $4–$7 | Mature market, focus on cost efficiency and volume |

| 2028 | $3–$6 | Dominance of generics, price stabilization |

These projections assume stable regulatory conditions and no significant market disruptions.

Opportunities for Value Addition

- Formulation Innovation: Adding probiotic components or natural extracts.

- Extended-Release Technologies: Enhancing convenience and efficacy.

- Targeted Marketing: Focusing on aging populations or consumers seeking natural remedies.

Effective branding and consumer education will support premium pricing strategies amid intense competition.

Regulatory and Market Risks

- Patent Expiry: Could precipitate a sharp price decline as generics enter.

- Safety Concerns: Adverse event reports or regulatory restrictions could suppress pricing.

- Market Saturation: High penetration of existing products limits pricing power.

Conclusion

LAXATIVE EC's market feasibility hinges on its differentiation, regulatory compliance, and strategic positioning. Price projections suggest an initial premium setting, subsequently adjusting downward as market dynamics evolve, with an anticipated average retail price of $4–$8 per unit within five years.

Key Takeaways

- The global OTC laxative market is robust, driven by demographic shifts and lifestyle factors.

- Competition from generics constrains long-term pricing ceilings; differentiation is critical.

- Pricing strategies should balance premium positioning with cost competitiveness to maximize revenue.

- Ongoing innovation and targeted marketing can carve out niche segments, supporting higher price points.

- Regulatory vigilance remains essential to avoid market entry delays and price erosion.

FAQs

-

What factors influence the pricing of OTC laxatives like LAXATIVE EC?

Pricing depends on formulation differentiation, brand strength, regulatory costs, competitive landscape, and manufacturing expenses. -

How does patent protection affect the price of laxative drugs?

Patent exclusivity allows higher pricing due to limited competition; expiry opens the market to generics, lowering prices. -

What are the key market segments for laxatives?

Bulk-forming, stimulant, osmotic, and emollient laxatives constitute primary segments, with OTC products dominating due to ease of access. -

Will consumer preferences for natural remedies impact the demand for products like LAXATIVE EC?

Yes. Consumers seeking ‘natural’ solutions may prefer dietary fiber or herbal options, potentially reducing demand for pharmacologic laxatives unless they incorporate such elements. -

What strategies can LAXATIVE EC adopt to improve market share?

Differentiation through formulation innovation, targeted marketing, strategic pricing, extending product benefits, and building strong brand trust.

Sources

[1] MarketWatch, "Global Over-the-Counter Laxatives Market Size & Forecast," 2022.

[2] WHO, "Ageing and health," 2021.

More… ↓