Share This Page

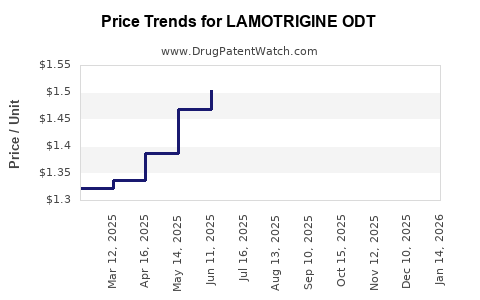

Drug Price Trends for LAMOTRIGINE ODT

✉ Email this page to a colleague

Average Pharmacy Cost for LAMOTRIGINE ODT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LAMOTRIGINE ODT 100 MG TABLET | 43598-0552-30 | 2.04666 | EACH | 2025-11-19 |

| LAMOTRIGINE ODT KIT (ORANGE) | 49884-0882-99 | 9.32217 | EACH | 2025-11-19 |

| LAMOTRIGINE ODT 100 MG TABLET | 00115-9941-01 | 2.04666 | EACH | 2025-11-19 |

| LAMOTRIGINE ODT 100 MG TABLET | 49884-0486-54 | 2.04666 | EACH | 2025-11-19 |

| LAMOTRIGINE ODT 100 MG TABLET | 49884-0486-11 | 2.04666 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Lamotrigine ODT

Introduction

Lamotrigine orally disintegrating tablets (ODT) represent a significant segment within the antiepileptic and mood-stabilizing drug market. Designed to improve patient compliance, particularly among those with swallowing difficulties or pediatric populations, Lamotrigine ODT combines efficacy with administration convenience. This analysis explores the current market landscape, competitive environment, and future pricing trajectories for Lamotrigine ODT, considering factors such as patent status, manufacturing trends, and healthcare policies.

Market Overview

Global Market Size and Growth Trends

The global antiepileptic drug market was valued at approximately USD 4.5 billion in 2022, with Lamotrigine establishing a dominant position due to its efficacy in managing epilepsy and bipolar disorder (Grand View Research). The demand for ODT formulations, including Lamotrigine ODT, is expected to grow at a CAGR of 5–7% over the next five years, driven by demographic shifts, increased awareness, and improved drug delivery options.

Segment-Specific Dynamics

ODT formulations account for roughly 20–25% of Lamotrigine sales, with preferences fueled by:

- Patient Compliance: Ease of administration enhances adherence, especially in pediatric and geriatric groups.

- Pharmacokinetic Advantages: Rapid onset and reduced gastrointestinal irritation.

- Market Penetration: Availability of ODTs in developed regions such as North America and Europe, with emerging markets gradually adopting advanced formulations.

Key Market Players

Major pharmaceutical companies manufacturing Lamotrigine ODT include:

- GlaxoSmithKline (GSK): A pioneer with extensive patent coverage.

- Sun Pharmaceutical Industries: Produces generics, including Lamotrigine ODT, post patent expiry.

- Mylan (now part of Viatris): Offers competitive generic formulations.

- Teva Pharmaceuticals: Engages in producing various Lamotrigine formulations.

The competitive landscape is characterized by patent protections, which historically restricted generic entry until patent cliffs ensued.

Regulatory and Patent Landscape

Patent Status and Exclusive Rights

GSK held key patents for Lamotrigine formulations, including ODT, expiring in major markets between 2017 and 2020. Such patent expirations facilitated an influx of generics, intensifying price competition [1].

Regulatory Approvals

Regulatory agencies such as the FDA and EMA have approved multiple generic Lamotrigine ODT products, which has increased market availability and lowered prices.

Pricing Analysis

Historical Price Trends

Prior to patent expiration, branded Lamotrigine ODT prices ranged between USD 300–400 for a 30-tablet pack. Post patent expiry, average prices declined significantly:

- Generics: USD 50–150 per pack, depending on manufacturer and region.

- Branded vs. Generic: A typical 60% reduction in price has been observed in markets with multiple generics.

Current Pricing Environment

In 2023, the average retail price for Lamotrigine ODT in the U.S. is approximately USD 100–150 per month supply for generics, with branded options commanding a premium of up to USD 300–350 [2].

Factors Influencing Future Pricing

- Market Saturation: Increased generic competition tends to suppress prices further.

- Manufacturing Costs: Enhancements in production efficiency and patent protections for new formulations may influence pricing.

- Regulatory Developments: Potential restrictions or incentives for generic substitution could affect prices.

- Healthcare Policies: Price controls and reimbursement policies, especially in emerging markets, will impact consumer prices.

Price Projections for the Next Five Years

Short-Term Outlook (2024–2026)

- Price Stabilization: Given current generic saturation, prices are likely to plateau around USD 80–120 per pack.

- Market Penetration: Broader adoption in cost-sensitive regions will sustain pressure on prices.

- Premium Segment: Branded versions may maintain a 20–30% premium, especially if marketed with improved bioavailability or formulations.

Long-Term Projections (2027–2030)

- Further Price Reductions: With the entry of new generics and biosimilars, prices could decline by an additional 15–25%, possibly reaching USD 50–100 per pack.

- Innovative Delivery Systems: Introduction of advanced formulations or combination therapies could stabilize or increase pricing for premium offerings.

- Market Maturation: Price erosion will stabilize as the market approaches saturation.

Implications for Stakeholders

- Manufacturers: Investing in process efficiencies and patent strategies will be crucial to maintain margins.

- Healthcare Providers: Favoring generics could reduce treatment costs, expanding access.

- Patients: Cost reductions will improve adherence and treatment outcomes.

- Regulators: Monitoring for price gouging and ensuring equitable access remains paramount.

Conclusion

Lamotrigine ODT's market is characterized by a mature generic landscape with declining prices. Growth drivers include demographic trends and increasing acceptance of ODT formulations. Future price trajectories suggest continued diminution, especially in regions with active generic competition. Stakeholders must navigate a landscape of evolving patent laws, regulatory policies, and manufacturing innovations to optimize market share and patient access.

Key Takeaways

- Patent expirations led to a surge in generic Lamotrigine ODT options, drastically reducing prices.

- The global market is expected to grow steadily, driven by demand for patient-friendly formulations.

- Pricing trends anticipate continued decline, with generic prices potentially halving by 2030.

- Market competition and technological advancements will shape pricing and accessibility.

- Strategic investments in patent portfolios and manufacturing efficiencies are vital for market success.

FAQs

1. How has patent expiration impacted Lamotrigine ODT pricing?

Patent expirations around 2017–2020 led to an influx of generic formulations, significantly lowering retail prices—reducing costs by approximately 50–70%, thereby increasing accessibility.

2. What are the key factors influencing future Lamotrigine ODT prices?

Market competition from generics, manufacturing costs, regulatory policies, and healthcare reimbursement strategies primarily dictate future price trajectories.

3. Are branded Lamotrigine ODT formulations likely to retain a price premium?

Yes. Branded versions with improved formulations, bioavailability, or added convenience may retain a 20–30% premium, especially if supported by regulatory exclusivity or clinical advantages.

4. How does market saturation affect Lamotrigine ODT prices?

As the market becomes saturated with generics, prices tend to stabilize at lower levels. Further reductions depend on new entrants and technological innovations.

5. What regional differences exist in Lamotrigine ODT pricing?

Developed markets like the U.S. and Europe benefit from intense generic competition and regulatory standards, resulting in lower prices. Emerging markets may have higher costs due to limited competition and regulatory barriers.

Sources:

[1] Grand View Research, "Antiepileptic Drugs Market Size, Share & Trends Analysis," 2022.

[2] GoodRx, "Lamotrigine (Oral Disintegrating Tablets) Prices," 2023.

More… ↓