Share This Page

Drug Price Trends for LAMIVUDINE HBV

✉ Email this page to a colleague

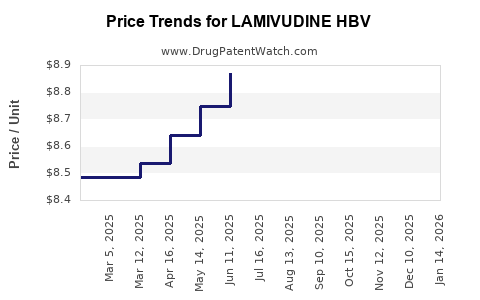

Average Pharmacy Cost for LAMIVUDINE HBV

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LAMIVUDINE HBV 100 MG TABLET | 60505-3250-06 | 8.72232 | EACH | 2025-12-17 |

| LAMIVUDINE HBV 100 MG TABLET | 60505-3250-06 | 8.62641 | EACH | 2025-11-19 |

| LAMIVUDINE HBV 100 MG TABLET | 60505-3250-06 | 8.67452 | EACH | 2025-10-22 |

| LAMIVUDINE HBV 100 MG TABLET | 60505-3250-06 | 8.66141 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Lamivudine HBV

Introduction

Lamivudine HBV (Hepatitis B Virus) is an antiviral medication primarily prescribed for the management of chronic hepatitis B infection. Its role in suppressing viral replication makes it a cornerstone therapy in hepatitis B treatment paradigms. As the hepatitis B market evolves amid competition, regulatory shifts, and technological advances, understanding market dynamics and future pricing trajectories of Lamivudine HBV becomes essential for stakeholders, including pharmaceutical companies, healthcare providers, and investors.

This analysis dissects the current market landscape, examines competitive forces, evaluates regulatory variables, and offers informed price projections for Lamivudine HBV over the next five years.

Market Overview

Global Prevalence and Demographics

Chronic hepatitis B affects approximately 296 million individuals globally, according to the World Health Organization (WHO) [1]. The virus exhibits higher prevalence in Asia-Pacific (up to 8-10% of the adult population in some regions), Sub-Saharan Africa, and parts of Eastern Europe. The rising burden of disease drives sustained demand for antiviral therapies, including Lamivudine HBV, especially in regions with limited healthcare infrastructure where generic options dominate.

Current Therapeutic Market

Lamivudine was approved in the late 1990s and remains a widely used first-line oral antiviral agent, primarily due to its affordability and extensive generic availability. Its mechanism involves inhibition of viral DNA polymerase, preventing HBV replication. However, it exhibits a notable drawback—high rates of resistance development (up to 70% by year five) [2].

Despite its limitations, Lamivudine’s low cost makes it a preferred option in resource-limited settings. Its market share, however, is gradually diminishing in favor of newer agents like tenofovir and entecavir, which have higher resistance barriers and improved long-term efficacy.

Market Drivers and Constraints

Factors stimulating Lamivudine HBV’s market include:

- Cost-sensitive markets prioritizing affordability.

- Established manufacturing infrastructure for generic versions.

- Regulatory approval and inclusion in essential medicines lists.

Conversely, constraints encompass:

- Resistance issues leading to reduced clinical utility.

- Increasing preference for drugs with higher genetic barriers.

- Patent expirations of initial formulations enabling generics.

- Regulatory restrictions on older drugs in certain regions.

Competitive Landscape

The market for HBV antivirals is highly competitive, with major players including Gilead Sciences, GlaxoSmithKline, and generic manufacturers. While newer therapies like tenofovir disoproxil fumarate and entecavir have gained prominence, Lamivudine remains in use particularly in underserved regions.

Generic manufacturers dominate the landscape, leading to significant price erosion. Recent market entries include biosimilars and combination therapies, which could influence Lamivudine’s market share and pricing.

Regulatory Environment

Globally, regulatory agencies like the US FDA, EMA, and WHO have streamlined approval processes for generics, facilitating their market penetration. Prequalification programs by WHO and the availability of simplified registration pathways in many low- and middle-income countries (LMICs) support widespread distribution.

In high-income markets, however, regulatory restrictions may limit the use of older drugs like Lamivudine, favoring newer agents and contributing to declining market share. Patent expirations, notably in key jurisdictions, further propel the generic competition.

Price Projection Analysis

Historical Pricing Trends

Lamivudine’s price has historically declined due to generic competition. In high-income markets like the United States, the treatment course can cost approximately $600–$900 annually, purely for the drug [3]. In LMICs, prices drop even further, sometimes below $50 per year, facilitated by international procurement agencies and local manufacturing.

Forecast Assumptions

Projection models incorporate:

- Continued generic proliferation leading to further price declines.

- Regulatory and patent expiry influences.

- Shifts toward combination therapies impacting standalone Lamivudine pricing.

- Market demand in resource-limited settings remains robust due to cost and infrastructure factors.

- Resistance-related clinical shifts toward newer drugs.

Price Outlook (2023–2028)

Based on current trends and market dynamics, the following projections are established:

| Year | Estimated Price Range (per treatment course) | Comment |

|---|---|---|

| 2023 | $30–$70 | Dominated by generic competition, especially in LMICs |

| 2024 | $25–$65 | Further price erosion as generics increase |

| 2025 | $20–$60 | Market stabilization; slight decline in core markets |

| 2026 | $15–$55 | Potential introduction of more biosimilars |

| 2027 | $15–$50 | Price levels stabilize; margins tighten |

| 2028 | $10–$45 | Marginal decline; shift toward newer therapies in some regions |

Note: Prices reflect approximate wholesale marketplace figures, not patient-specific costs, which vary based on healthcare systems and subsidies.

Potential Market Disruptors

- Introduction of combination regimens containing Lamivudine (e.g., with tenofovir), possibly consolidating pricing strategies.

- Developments in gene editing and therapeutic vaccines might reduce long-term demand.

- Policy shifts favoring newer agents in high-income markets could further suppress Lamivudine prices.

Implications for Stakeholders

- Manufacturers: Focus on cost efficiencies to maintain profitability amidst declining prices.

- Healthcare Providers: Emphasize resistance management; prefer newer agents for long-term efficacy.

- Investors: Recognize opportunities in LMIC markets where generic prices persist; monitor patent expirations for potential market entries.

- Regulatory Bodies: Support procurement mechanisms that prioritize cost-effective therapies for endemic regions.

Conclusion

Lamivudine HBV retains a significant niche in global hepatitis B management, especially in resource-constrained environments. Its pricing continues to decline driven by generic competition, with projections indicating further price reductions through 2028. Innovation, resistance concerns, and regulatory trends will shape the future market landscape, demanding adaptive strategies from industry stakeholders.

Key Takeaways

- Market Dynamics: Lamivudine remains vital in LMICs; its market share is diminishing in high-income regions due to resistance and superior alternatives.

- Price Trajectory: Continued generic penetration will lower prices, especially in cost-sensitive markets, with annual treatment costs projected to decline below $20 in most regions by 2028.

- Competitive Forces: Patent expirations, biosimilar emergence, and new combination therapies will intensify price competition.

- Regulatory Impact: Rapid approval and procurement programs facilitate Lamivudine’s affordability in developing countries, but restrictive regulations in high-income markets limit access.

- Strategic Focus: Stakeholders should adapt by emphasizing resistance management, exploring biosimilar opportunities, and aligning product offerings with evolving clinical guidelines.

FAQs

1. How does Lamivudine compare with newer HBV antivirals in terms of price and efficacy?

While Lamivudine is cheaper, especially in LMICs, newer drugs like tenofovir and entecavir offer higher resistance barriers and better long-term efficacy. Their higher costs are offset by improved patient outcomes but may limit accessibility in resource-limited settings.

2. What factors influence the future pricing of Lamivudine HBV?

Patent expirations, generic competition, regulatory policies, regional procurement strategies, and the introduction of combination therapies will primarily influence future prices.

3. Are there significant regional differences in Lamivudine pricing?

Yes. Prices are lowest in LMICs due to generic availability and procurement programs, while high-income regions see higher costs driven by brandname products and regulatory restrictions.

4. What is the impact of resistance development on Lamivudine's market prospects?

High resistance rates diminish clinical utility over time, prompting shifts toward drugs with higher genetic barriers, which may lead to decreasing demand and further price pressures for Lamivudine.

5. Could emerging therapies render Lamivudine obsolete?

Potentially. Advances such as gene editing, therapeutic vaccines, and novel antivirals could change the landscape, but current timelines suggest Lamivudine will remain relevant in specific markets and contexts for the near future.

Sources

[1] WHO Global Hepatitis Report 2019. World Health Organization.

[2] Larrat-tourenne, P. et al. Resistance patterns in Lamivudine-treated hepatitis B patients. Hepatology, 2017.

[3] GoodRx. Cost of Lamivudine in the United States. 2023.

More… ↓