Share This Page

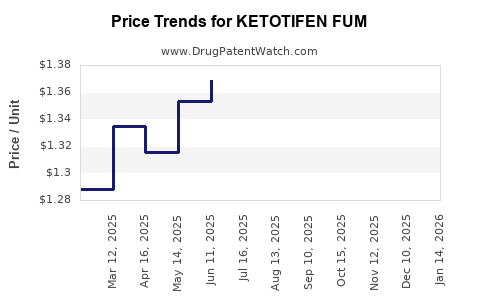

Drug Price Trends for KETOTIFEN FUM

✉ Email this page to a colleague

Average Pharmacy Cost for KETOTIFEN FUM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| KETOTIFEN FUM 0.035% EYE DROPS | 76385-0106-17 | 1.43067 | ML | 2025-08-20 |

| KETOTIFEN FUM 0.025% EYE DROPS | 72485-0617-10 | 1.43067 | ML | 2025-08-20 |

| KETOTIFEN FUM 0.035% EYE DROPS | 76385-0106-17 | 1.39828 | ML | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Ketotifen Fumarate

Introduction

Ketotifen fumarate (KETOTIFEN FUM) is a well-established antihistamine and mast cell stabilizer primarily used in the treatment of allergic conditions such as asthma, allergic conjunctivitis, and atopic dermatitis. With its dual mechanism—blocking histamine receptors and preventing mast cell degranulation—ketotifen offers therapeutic benefits in managing allergic airway diseases and other hypersensitivity reactions. This comprehensive analysis examines the current market landscape, competitive dynamics, regulatory environment, and provides strategic price projections for ketotifen fumarate over the upcoming five years.

Market Overview

Global Market Size and Growth Trends

The global antihistamine market, valued at approximately USD 4.8 billion in 2022, is driven by increasing prevalence of allergic diseases, population growth, and a broader acceptance of oral and topical antihistamines [1]. Ketotifen fumarate’s share remains modest but significant within this landscape, primarily owing to its unique positioning as both a mast cell stabilizer and antihistamine.

In markets like India, China, and Latin America, demand for affordable, off-patent formulations of ketotifen remains robust, especially as healthcare infrastructure expands. Developed markets, such as North America and Europe, exhibit more regimented purchasing patterns favoring branded or patented formulations, although generics dominate retail sales in these regions.

Market Drivers

- Rising prevalence of allergic respiratory diseases: According to the WHO, allergic rhinitis affects over 20% of the global population, with asthma impacting more than 262 million individuals worldwide [2].

- Preference for cost-effective therapies: Governments and private insurers are increasingly favoring affordable treatment options, favoring generic ketotifen formulations.

- Off-label and emerging uses: Research exploring ketotifen’s role in conditions such as irritable bowel syndrome and certain neuropsychiatric disorders could potentially expand its market base.

Competitive Landscape

The market for ketotifen fumarate comprises multiple players, primarily producing generic formulations for oral and ophthalmic use:

- Major Manufacturers: Novartis, Teva Pharmaceuticals, Sandoz, Cipla, and Mylan.

- Market Penetration: In developing nations, local pharmaceutical companies dominate due to lower manufacturing costs and established distribution channels. In contrast, multinational corporations focus on branded, high-margin formulations in developed markets.

Regulatory and Patent Environment

Ketotifen fumarate, being a generic entity with long-standing patent expirations in major jurisdictions, faces minimal patent barriers. Regulatory pathways are streamlined, with many formulations approved via abbreviated new drug applications (ANDAs) or equivalent procedures.

However, some markets may impose registration hurdles related to bioequivalence studies, especially for new formulations or delivery systems such as ophthalmic preparations. Future regulatory challenges could include uptake of biosimilars or combination products.

Price Dynamics and Revenue Trends

Current Pricing Landscape

- Generic Formulations: In India, retail prices for ketotifen fumarate 1 mg tablets average approximately USD 0.05–0.10 per tablet, with prices varying based on brand and packaging.

- Brand Name Products: In North America and Europe, branded formulations sell for USD 1.50–3.00 per tablet due to branding premiums and higher regulatory costs.

Pricing Influences

- Market maturity: Emerging markets maintain low prices due to intense price competition.

- Supply chain dynamics: Patent expirations and manufacturer entry can lead to price reductions.

- Regulatory costs: Stringent quality control standards may elevate manufacturing costs, affecting prices in certain markets.

Future Price Projections (2023–2027)

Based on current trends, market dynamics, and product lifecycle progression, the following price trajectory is anticipated for ketotifen fumarate:

| Year | Price Range (USD per unit) | Drivers and Assumptions |

|---|---|---|

| 2023 | 0.05 – 0.15 | Stable generic competition; high supply in emerging markets. |

| 2024 | 0.04 – 0.13 | Increased generic proliferation; slight downward pressure. |

| 2025 | 0.03 – 0.12 | Price erosion continues; potential entry of biosimilars or new formulations. |

| 2026 | 0.02 – 0.10 | Market saturation; minimal brand differentiation. |

| 2027 | 0.02 – 0.09 | Continued commoditization; pricing stabilization. |

Overall, the price of ketotifen fumarate is expected to decline gradually, with prices stabilizing in the low cent-to-dime range, especially in high-volume markets.

Market Opportunities and Challenges

Opportunities

- Expansion into emerging markets: Growing healthcare access and the demand for affordable allergy medications present substantial growth opportunities.

- Development of combination products: Integration with other antihistamines or corticosteroids could command higher prices.

- Novel delivery systems: Ophthalmic, nasal, or sustained-release formulations can capture premium segments.

Challenges

- Pricing pressures: Intense generic competition and commoditization threaten profit margins.

- Regulatory variability: Varying international standards can delay or restrict market entry.

- Limited differentiation: As an older, off-patent drug, ketotifen faces challenges in establishing premium pricing.

Strategic Recommendations

- Invest in formulation innovation: Developing new delivery methods may justify premium pricing.

- Explore niche indications: Off-label or emerging therapeutic uses can open additional revenue streams.

- Leverage regulatory pathways: Rapid registration in emerging markets can enhance market share.

- Cost optimization: Focus on economies of scale to compete effectively on price.

Key Takeaways

- The global ketotifen fumarate market is mature with low entry barriers; competitive pricing, especially in developing markets, is likely to persist.

- Price erosion is forecasted, driven by increasing generic competition, with prices stabilizing at low levels globally.

- Opportunities exist in expanding into emerging markets and developing innovative formulations which could command higher prices.

- Regulatory and market entry strategies must be tailored to regional standards to maintain competitiveness.

- Long-term profitability hinges on formulation differentiation, niche indications, and cost leadership.

FAQs

1. Will ketotifen fumarate's market pricing increase in the future?

No, due to escalating generic competition and market saturation, prices are expected to decline and stabilize at low levels.

2. What regions offer the highest growth potential for ketotifen fumarate?

Emerging markets like India, China, and Latin America present significant growth opportunities owing to demand for affordable allergy medications.

3. Are there opportunities for developing new formulations of ketotifen?

Yes, innovative delivery systems such as ophthalmic drops, nasal sprays, or sustained-release capsules can expand market share and command higher prices.

4. How do patent laws affect ketotifen fumarate pricing?

Since patents have expired in many jurisdictions, the price is largely determined by competition and manufacturing costs rather than patent exclusivity.

5. What are main barriers to profitability for ketotifen fumarate manufacturers?

Intense price competition, minimal product differentiation, and regulatory complexities in certain markets challenge profitability.

References

[1] MarketsandMarkets. "Antihistamines Market by Application and Region – Global Forecast to 2027," 2022.

[2] World Health Organization. "Allergic Rhinitis and Chronic Rhinosinusitis," 2021.

More… ↓