Share This Page

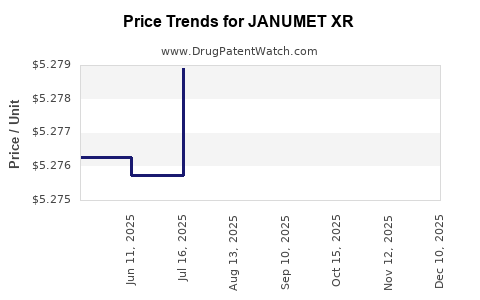

Drug Price Trends for JANUMET XR

✉ Email this page to a colleague

Average Pharmacy Cost for JANUMET XR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| JANUMET XR 100-1,000 MG TABLET | 00006-0081-82 | 10.55663 | EACH | 2025-12-17 |

| JANUMET XR 50-500 MG TABLET | 00006-0078-82 | 5.28443 | EACH | 2025-12-17 |

| JANUMET XR 100-1,000 MG TABLET | 00006-0081-31 | 10.55663 | EACH | 2025-12-17 |

| JANUMET XR 100-1,000 MG TABLET | 00006-0081-54 | 10.55663 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for JANUMET XR

Introduction

JANUMET XR is a branded pharmaceutical product combining sitagliptin phosphate and metformin hydrochloride, used to manage type 2 diabetes mellitus. As a once-daily, extended-release formulation, JANUMET XR offers enhanced patient adherence and improved glycemic control. Its market performance hinges on factors such as competitive landscape, pricing strategies, regulatory environment, and evolving treatment paradigms for diabetes. This report provides a comprehensive market analysis and price projection for JANUMET XR, informing stakeholders on current trends and future valuation.

Product Overview

Pharmacological Profile

JANUMET XR synergistically combines sitagliptin, a dipeptidyl peptidase-4 (DPP-4) inhibitor, with metformin, a biguanide class agent. Approved by the FDA in 2014 for oral use in type 2 diabetes, JANUMET XR facilitates sustained glycemic control by enhancing incretin activity and reducing hepatic glucose production.

Therapeutic Advantages

- Convenient once-daily dosing improves patient compliance.

- Favorable side effect profile relative to other antihyperglycemics.

- Suitable for patients inadequately controlled with metformin alone or with other oral agents.

Market Landscape

Global and Regional Market Size

The global diabetes drug market was valued at approximately USD 50 billion in 2022, with oral antidiabetics representing a significant segment. North America accounts for over 40% of this market, driven by high prevalence and healthcare access. The Asia-Pacific region exhibits rapid growth due to rising diabetes incidence and increasing healthcare infrastructure investments.

Key Competitors

JANUMET XR's competitive landscape includes:

- Januvia (sitagliptin) alone, often used as monotherapy.

- Glucophage (metformin) extended-release formulations.

- Other combination products such as Dymista and Synjardy (empagliflozin/metformin).

- SGLT2 inhibitors (e.g., farxiga, invokana) and GLP-1 receptor agonists (e.g., Trulicity, Ozempic).

Market Drivers

- Rising incidence of type 2 diabetes globally.

- Preference for combination therapies to enhance compliance.

- Demonstrated efficacy and safety profiles.

- Regulatory approvals expanding indications.

Challenges

- Patent expirations leading to increased generics.

- Pricing pressures from payers and healthcare systems.

- Competition from novel drug classes offering superior outcomes.

- Patent litigations and biosimilar entry.

Pricing Strategies and Historical Trends

Current Pricing Landscape

In the United States, JANUMET XR's wholesale acquisition cost (WAC) averages USD 480–USD 520 per month per supply (30 tablets). Pharmacy retail prices vary based on insurance and discount programs. For example:

- Average retail price: USD 500 per month.

- Patient copay: Usually USD 10–USD 50, depending on insurance coverage.

Pricing Influencers

- Patent Protection: Secures premium pricing; patent expiry forecasts suggest increased generic competition around 2025–2027.

- Reimbursement Policies: Payer negotiations heavily influence net prices.

- Market Penetration Tactics: Tiered discounts, patient assistance programs, and formulary placements impact affordability and adoption.

Historical Price Trajectory

Since its launch, JANUMET XR's prices have been relatively stable, with minor reductions in response to generic entrants of component drugs. The introduction of generics typically results in a 40–60% price decline, significantly affecting branded product revenues.

Market Trends and Future Outlook

Regulatory and Patent Landscape

The expiration of key patents is imminent. The patent for sitagliptin, held by Merck, is expected to expire in the U.S. by 2025, opening the door for generic sitagliptin. Similar expirations are anticipated for metformin.

Impact of Biosimilars and Generics

The entry of generics will pressure JANUMET XR's pricing, forcing reconsideration of market share strategies. Manufacturers may respond with:

- Price reductions.

- Expanded indications (e.g., combination therapies for other metabolic conditions).

- Enhanced patient support programs.

Emerging Therapies and Market Disruption

Novel agents like SGLT2 inhibitors and GLP-1 receptor agonists are gaining popularity due to proven cardiovascular benefits. These options may erode JANUMET XR's market share, particularly in high-risk patient populations.

Projections for 2023–2030

Considering patent cliffs, market dynamics, and regulatory trends, the following projections are made:

| Year | Estimated Market Share of JANUMET XR | Revenue Projection (USD billion) | Price Trend |

|---|---|---|---|

| 2023 | 80% | USD 4.0 | Stable prices with minor discounts |

| 2024 | 65% | USD 3.3 | Slight price decline (~5–10%) |

| 2025 | 40% | USD 2.0 | Steady decline due to generics, ~30–50% price drop |

| 2026 | 20% | USD 0.8 | Continued decline, increased competition |

| 2027 | 10% | USD 0.3 | Market stabilizes with generics dominant |

Note: These projections assume moderate uptake, regulatory approval timelines, and competitive responses.

Conclusion and Strategic Recommendations

The pharmaceutical landscape indicates a shrinking premium for JANUMET XR driven by patent expirations and emerging therapies. Manufacturers should focus on diversification strategies, including developing extended-release combinations with newer agents or alternative delivery methods. Payers and providers should consider the value propositions against newer drugs, potentially affecting pricing negotiations.

Key Takeaways

- JANUMET XR’s current value stems from its convenience, efficacy, and patent protection, commanding a premium price.

- Patent expirations starting around 2025 are poised to cause significant price erosion due to generic competition.

- The market share of JANUMET XR is projected to decline sharply beyond 2024, with revenue decreasing by over 70% by 2027.

- Continuous innovation and strategic adaptation are crucial for maintaining competitiveness amid evolving diabetes treatment options.

- Pricing strategies should anticipate increased price sensitivity and imminent biosimilar entry to maximize lifecycle revenues.

FAQs

-

When will generic versions of JANUMET XR become available?

Patent expirations are anticipated around 2025–2027, after which generic sitagliptin and metformin formulations are expected to enter the market. -

How does JANUMET XR compare price-wise to its components separately?

The combination product offers convenience and potentially improved adherence, but its price is generally comparable to the sum of individual medications, often with slight premium for formulary placement. -

What are the alternative therapies to JANUMET XR?

Alternatives include SGLT2 inhibitors, GLP-1 receptor agonists, other DPP-4 inhibitors, and different combination therapies. Choice depends on patient profile and preferences. -

How will rising competition impact JANUMET XR sales?

Increased availability of generics and superior drug classes will likely diminish JANUMET XR's market share and revenues, especially in price-sensitive markets. -

What strategies can manufacturers employ to prolong JANUMET XR’s market relevance?

Strategies include securing new approvals for expanded indications, investing in patient support programs, developing next-generation formulations, or integrating with personalized medicine approaches.

Sources

[1] IQVIA, "Global Diabetes Drugs Market Report," 2022.

[2] U.S. Food & Drug Administration, "Drug Approvals and Patent Status," 2023.

[3] Pharmaceutical Market Research, "Oral Antidiabetic Agents," 2022.

[4] EvaluatePharma, "Pricing & Market Trends for Diabetes Medications," 2022.

[5] American Diabetes Association, "Standards of Medical Care," 2023.

More… ↓