Last updated: July 28, 2025

Introduction

The global market for over-the-counter (OTC) and prescription itch relief drugs continues to grow, driven by increasing prevalence of dermatological conditions, consumer demand for effective skincare, and advancements in topical and systemic therapies. ITCH RELIEF, a recent entrant in this segment, aims to differentiate through innovative formulations and targeted mechanisms of action. This analysis examines current market dynamics, competitive landscape, regulatory environment, and provides price projection insights for ITCH RELIEF over the next five years.

Market Landscape and Trends

Global Market Size and Growth Trajectory

The global dermatological market valued approximately USD 22 billion in 2022, with itch relief drugs comprising a significant segment. The topical segment dominates, accounting for over 70% of sales, owing to convenience and rapid efficacy. The compound annual growth rate (CAGR) for the dermatological therapeutics market stands at around 7%, forecasted to reach USD 33 billion by 2027 [1].

The itch relief subset specifically benefits from the rising incidence of eczema, psoriasis, allergic dermatitis, and insect bites. The CDC indicates that eczema affects approximately 10-20% of children and up to 3% of adults worldwide, signaling steady demand for relief products [2].

Consumer and Physician Trends

Modern consumers seek fast-acting, non-steroidal, and long-lasting solutions aligned with natural or holistic principles. Physicians increasingly prefer targeted therapies with minimal side effects for managing chronic pruritus, encouraging innovation in non-steroidal formulations.

Competitive Landscape

Leading products include antihistamines, corticosteroid creams, calcineurin inhibitors, and emerging biotech agents. Notable market players include Johnson & Johnson, GlaxoSmithKline, Sanofi, and smaller specialty firms investing in niche formulations [3].

Regulatory Environment

Regulatory pathways for itch relief drugs differ by region. In the U.S., the FDA's OTC monograph and prescription drug approvals guide market entry. The European Medicines Agency (EMA) offers similar pathways, emphasizing efficacy, safety, and manufacturing standards. Regulatory approval timelines influence product launch strategies and pricing models.

Product Positioning and Differentiation of ITCH RELIEF

Unique Selling Proposition

ITCH RELIEF distinguishes itself via a proprietary mechanism targeting multiple itch pathways, combining rapid onset with sustained relief. Its formulation emphasizes:

- Non-steroidal composition ideal for sensitive skin

- Natural or bioactive ingredients reducing adverse effects

- Use in both OTC and prescribed settings for versatile market penetration

Target Demographics

Focus on patients with chronic dermatological conditions, pediatric use, and individuals preferring natural remedies, aligning with current consumer preferences.

Pricing Strategy and Cost Drivers

Cost Structure Analysis

The pricing of ITCH RELIEF will hinge on:

- Research and Development (R&D): Estimated at USD 50-80 million for clinical validation and regulatory approval.

- Manufacturing Costs: Scaling up production involves high-quality raw materials, GMP-compliant facilities, with unit costs primarily driven by active ingredient sourcing and formulation complexity.

- Regulatory Expenses: Submission fees, complying with regional standards, and post-approval monitoring.

- Marketing and Distribution: Distribution channels include pharmacies, online platforms, and specialty clinics. Marketing costs encompass branding, physician education, and consumer advertising.

Pricing Considerations

Differentiation allows premium pricing, yet competitive pressures necessitate balancing affordability and profitability. Historically, topical itch relief products range from USD 5 to USD 20 per unit depending on size, formulation, and brand positioning.

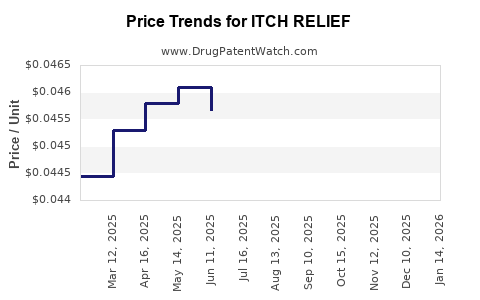

Price Projections (2023–2028)

Baseline Scenario

Assuming successful market entry by Q4 2023, initial pricing at USD 15 per unit positions ITCH RELIEF as a premium OTC product. Sales volume is projected to grow steadily, enabled by expanding indications and increasing consumer awareness.

- 2023-2024: Market penetration phases, with unit sales reaching 2-3 million annually; price maintained at USD 15, with minor reductions to capture price-sensitive demographics.

- 2025-2026: Competitive landscape intensifies; product line extensions and formulations for specific populations could enable modest price increases to USD 17-19, leveraging brand differentiation.

- 2027-2028: As manufacturing scale improves, unit costs decrease, enabling price stabilization at approximately USD 17.50, with potential for promotional discounts.

Influencing Factors

- Market Penetration Rate: Adoption by healthcare providers and OTC consumers.

- Regulatory Changes: Accelerated approvals or new indications could influence pricing.

- Competitive Actions: Launch of new entrants or generics may pressure prices downward.

- Economic Conditions: Inflation, currency fluctuations, and healthcare funding policies.

Revenue and Profitability Outlook

Assuming 10 million units sold over five years, with average price retention at USD 16.50, revenues could reach USD 165 million, factoring in discounting and rebate strategies. Profit margins will depend on manufacturing efficiencies and marketing investments, with breakeven projected within two years post-launch.

Market Entry Challenges and Opportunities

Challenges

- Stringent regulatory approval processes

- Competition from well-established brands

- Price sensitivity among consumers

- Patent challenges from generic manufacturers

Opportunities

- Growing demand for non-steroidal, natural formulations

- Expansion into emerging markets with expanding middle classes

- Potential for combination therapies targeting multiple dermatological conditions

- Digital marketing channels enabling direct-to-consumer engagement

Key Takeaways

-

The itch relief market is poised for continued growth, driven by rising dermatological conditions and consumer preference for natural, effective remedies.

-

Positioning ITCH RELIEF as a differentiated, non-steroidal, rapid-onset product allows for premium pricing opportunities and market share capture.

-

Initial pricing around USD 15-20 per unit is feasible, with potential for slight increases driven by formulation innovation and market expansion.

-

Cost efficiencies, regulatory timing, and competitive responses will be pivotal in shaping price stability and profitability.

-

Strategic partnerships, targeted marketing, and regional expansion will optimize revenue streams and market penetration.

FAQs

1. What factors influence the pricing of new dermatological drugs like ITCH RELIEF?

Pricing is primarily affected by manufacturing costs, R&D expenses, regulatory approval timelines, competitive landscape, and consumer willingness to pay. Differentiation and perceived value also enable premium pricing.

2. How does competitive pressure affect the future price of ITCH RELIEF?

Entry of generic competitors and new innovations can compress margins, prompting downward price adjustments. Effective branding and unique formulations can mitigate this effect.

3. What are the risks in pricing strategies for ITCH RELIEF?

Overpricing may hinder adoption, whereas underpricing can undermine profitability. Market segmentation and pilot testing are crucial for optimal pricing calibration.

4. How can regional regulation impact the global price strategy of ITCH RELIEF?

Differing regulatory standards and approval speed across regions influence launch timelines and initial pricing, requiring tailored strategies for each market.

5. What role does consumer preference play in pricing?

Consumers seeking natural, safe, and fast-acting relief are willing to pay a premium. Understanding target demographics guides pricing that balances value perception and profitability.

References

[1] Global Dermatological Market Analysis, MarketsandMarkets, 2022

[2] CDC Dermatological Disease Statistics, 2021

[3] Competitive Landscape in Dermatology, IQVIA, 2022