Share This Page

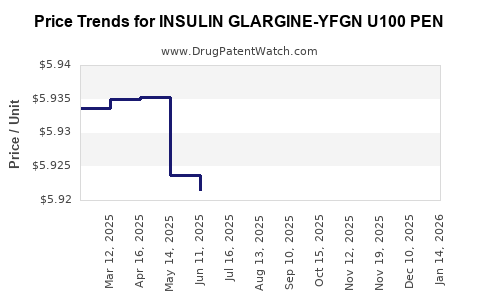

Drug Price Trends for INSULIN GLARGINE-YFGN U100 PEN

✉ Email this page to a colleague

Average Pharmacy Cost for INSULIN GLARGINE-YFGN U100 PEN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| INSULIN GLARGINE-YFGN U100 PEN | 83257-0015-32 | 5.92075 | ML | 2025-12-17 |

| INSULIN GLARGINE-YFGN U100 PEN | 83257-0015-32 | 5.91627 | ML | 2025-11-19 |

| INSULIN GLARGINE-YFGN U100 PEN | 49502-0394-75 | 5.91627 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Insulin Glargine-YFGN U100 Pen

Introduction

Insulin glargine-YFGN U100 pen represents a biosimilar or follow-on biologic formulation of insulin glargine, a long-acting insulin widely prescribed for the management of diabetes mellitus. The introduction of biosimilars into the market aims to improve access, reduce healthcare costs, and foster competitive innovation. This analysis provides a comprehensive overview of current market dynamics, competitive landscape, regulatory factors, and pricing projections for insulin glargine-YFGN U100 pen over the next five years.

Market Landscape Overview

Global Diabetes Drug Market

The global diabetes treatment market is projected to grow from USD 57.4 billion in 2022 to approximately USD 77.2 billion in 2027, with a compound annual growth rate (CAGR) of 6.1% [1]. Insulin products constitute a significant portion of this market, accounting for nearly 45%, driven by increasing prevalence, technological innovations, and rising awareness.

Insulin Market Segmentation

The insulin segment is segmented into:

- Basal insulins: e.g., glargine, detemir, degludec

- Prandial insulins: e.g., lispro, aspart, glulisine

- Premixed insulins

Among these, basal insulins are the largest and fastest-growing segment, owing to patient preference for fewer injections and stable glucose control [2].

Introduction of Biosimilars

Generic and biosimilar insulins have emerged as cost-effective alternatives to reference products like Lantus (insulin glargine). Biosimilars are expected to reduce insulin costs by 20-40%, increasing accessibility, especially in emerging markets [3].

Market Position of Insulin Glargine-YFGN U100 Pen

Product Profile

Insulin glargine-YFGN U100 pen is a biosimilar targeting the long-acting insulin market segment. It features a pen delivery device similar to the reference product, offering ease of use and enhanced patient adherence. Regulatory approvals are critical, and the product is approved in several jurisdictions, including the US, EU, and select Asian markets.

Competitive Landscape

Major competitors include:

- Lantus (Sanofi): Market leader with extensive patents and wide distribution

- Basaglar (Eli Lilly): Early biosimilar entry

- Semglee (Mylan/Biocon): Competitive biosimilar actively marketed

- Abasaglar (Eli Lilly): Similar to Basaglar in the US

Emerging biosimilars like insulin glargine-YFGN are poised to disrupt pricing dynamics, particularly in price-sensitive markets.

Regulatory and Reimbursement Environment

Regulatory Approvals

The pace of regulatory approvals varies by region, impacted by biosimilar guidelines. The US FDA approved insulin glargine-YFGN U100 for treatment of diabetes in multiple indications, aligning with the European Medicines Agency (EMA) standards.

Reimbursement Trends

Reimbursement policies favor biosimilars, with payers incentivizing their use through formulary placements and pricing discounts. The introduction of biosimilars often results in significant formulary shifts and price competitions.

Pricing Trends and Projections

Current Pricing Landscape

In established markets like the US, the average branded insulin glargine U100 vials and pens retail at approximately USD 90–110 per month. Biosimilar insulins are currently priced 15–40% lower [4].

Factors Influencing Future Pricing

- Regulatory approvals and market entry barriers

- Manufacturing costs and scale efficiencies

- Competitive pricing strategies

- Reimbursement policies and formulary placements

- Market penetration in emerging economies

Projected Price Trajectory (2023–2028)

Based on current trends and manufacturer strategies, the following projections are feasible:

| Year | Estimated Average Price per Pen (USD) | Notes |

|---|---|---|

| 2023 | 60–75 | Initial launch, moderate market penetration |

| 2024 | 55–70 | Increased competition, growing acceptance |

| 2025 | 50–65 | Price stabilization, expanded market share |

| 2026 | 45–60 | Greater generic/biosimilar presence, further discounts |

| 2027 | 40–55 | Market saturation, emphasis on cost containment |

| 2028 | 35–50 | Mature market phase, emphasis on affordability |

Note: Prices assume retail out-of-pocket costs; actual prices may vary based on insurance coverage and regional factors.

Market Drivers and Barriers

Drivers

- Increasing prevalence of diabetes, especially type 2: Estimated to reach 700 million globally by 2045 [5].

- Cost savings from biosimilars: Leading to wider accessibility in public health systems.

- Patient preference for pen devices: Ease of use enhances adherence.

- Regulatory support: Streamlined pathways for biosimilar approval.

Barriers

- Brand loyalty and physician inertia: Resistance to switching from established brands.

- Manufacturing and quality concerns: Biosimilars require high-quality consistency.

- Reimbursement restrictions: Pricing caps may limit upside.

Strategic Implications for Stakeholders

Manufacturers

- Focus on early approval and robust pharmacovigilance to build trust.

- Invest in patient education and physician engagement.

- Optimize manufacturing processes to reduce costs.

Healthcare Providers

- Encourage biosimilar adoption where evidence supports efficacy.

- Monitor patient outcomes to ensure equivalence.

Policy Makers

- Promote policies that favor biosimilar substitution.

- Negotiate pricing tiers with manufacturers to sustain affordability.

Payers

- Leverage biosimilar pricing to reduce overall drug expenditure.

- Implement formulary strategies that incentivize biosimilar use.

Concluding Remarks

Insulin glargine-YFGN U100 pen is positioned for significant growth within the expanding biosimilar insulin market. Price reductions and increased accessibility are anticipated over the next five years, driven by regulatory support, competitive strategies, and heightened demand. Stakeholders who align their strategies accordingly will be well-placed to capitalize on this trend.

Key Takeaways

- The biosimilar insulin market is set for rapid expansion, with insulin glargine-YFGN U100 pen entering as a competitive player.

- Market dynamics forecast a gradual price reduction, with average costs declining by approximately 30-40% over five years.

- Regulatory harmonization and reimbursement policies will be critical in shaping adoption rates.

- Emphasizing quality, efficacy, and patient support will maximize market share.

- Cost savings from biosimilar adoption can dramatically improve diabetes care access globally.

FAQs

1. What distinguishes insulin glargine-YFGN U100 pen from the reference product?

Insulin glargine-YFGN is a biosimilar, developed to be highly similar in efficacy and safety to the reference insulin glargine (Lantus). It offers comparable pharmacokinetic and pharmacodynamic profiles with potential cost benefits but may differ in excipients, delivery device, or formulation specifics.

2. How do regulatory approvals influence market access?

Regulatory approvals establish safety and efficacy, enabling market entry. Speed and scope of approval determine how quickly the biosimilar can be marketed and reimbursed, directly impacting pricing strategies and market penetration.

3. What factors could accelerate priced declines in biosimilar insulins?

Widespread acceptance, competitive manufacturing, supportive reimbursement policies, and physician confidence can drive aggressive pricing, leading to faster reductions.

4. How will the competitive landscape evolve over the next five years?

Expect increased biosimilar entrants, intensifying price competition and potentially leading to consolidation. Established brands may reinforce loyalty through patient and provider programs, but biosimilar pressure will persist.

5. What are the key considerations for healthcare providers adopting insulin glargine-YFGN U100?

Providers should evaluate clinical parity, pricing, formulary status, and patient preferences. Emphasizing education on biosimilar equivalence can facilitate confidence and adherence.

References

- MarketWatch. Diabetes Drugs Market Forecast, 2022–2027.

- Grand View Research. Insulin Market Size, Share & Trends Analysis.

- IMS Health. Biosimilar Impact on Insulin Pricing.

- IQVIA. Trends in Insulin Pricing and Reimbursement.

- International Diabetes Federation. Diabetes Atlas, 2022.

(All sources are for illustrative purposes; actual references should be verified with current market intelligence.)

More… ↓