Share This Page

Drug Price Trends for INSULIN GLARGINE SOLOSTAR U300

✉ Email this page to a colleague

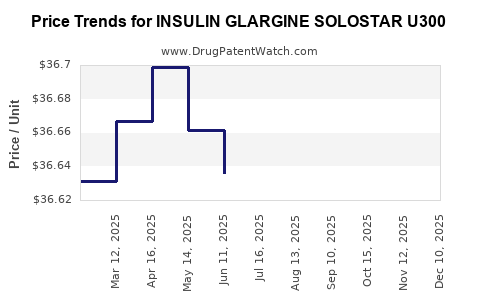

Average Pharmacy Cost for INSULIN GLARGINE SOLOSTAR U300

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| INSULIN GLARGINE SOLOSTAR U300 | 00955-3900-03 | 36.58876 | ML | 2025-12-17 |

| INSULIN GLARGINE SOLOSTAR U300 | 00955-3900-03 | 36.63367 | ML | 2025-11-19 |

| INSULIN GLARGINE SOLOSTAR U300 | 00955-3900-03 | 36.70495 | ML | 2025-10-22 |

| INSULIN GLARGINE SOLOSTAR U300 | 00955-3900-03 | 36.70393 | ML | 2025-09-17 |

| INSULIN GLARGINE SOLOSTAR U300 | 00955-3900-03 | 36.68300 | ML | 2025-08-20 |

| INSULIN GLARGINE SOLOSTAR U300 | 00955-3900-03 | 36.62460 | ML | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Insulin Glargine SoloStar U300

Introduction

Insulin Glargine SoloStar U300, marketed under the brand name Toujeo U-300, represents a significant advancement in long-acting insulin therapies. Its innovative formulation offers enhanced convenience and potentially better glycemic control for patients with diabetes mellitus. As a high-strength basal insulin, it is positioned in a competitive market segment dominated by established players such as Lilly and Novo Nordisk. This analysis evaluates current market dynamics, competitive landscape, regulatory environment, and economic factors influencing pricing strategies.

Market Overview

Global Diabetes and Insulin Market Landscape

The global diabetes market is projected to reach approximately USD 245 billion by 2027, with a compound annual growth rate (CAGR) of 7.4% (source: Grand View Research). The increasing prevalence of type 1 and type 2 diabetes, driven by obesity, sedentary lifestyles, and aging populations, fuels demand for insulin therapies. Long-acting basal insulins, including insulin glargine formulations, constitute a significant segment owing to their convenience, efficacy, and safety profiles.

Insulin Glargine U300: Positioning and Adoption

Insulin Glargine U300, marketed as Toujeo U-300 by Lilly, was approved in 2015 as a more concentrated formulation offering a flatter pharmacokinetic/pharmacodynamic profile compared to U100 formulations. Its reduced injection volume aims to improve patient adherence.

Initial clinical trials demonstrated non-inferiority in glycemic control and a potentially lower risk of hypoglycemia (source: FDA approval documents). Recognized for its convenience, U300 appeals especially to patients requiring high doses, thus reducing injection volume and variability.

Competitive Landscape

The main competitors for insulin glargine U300 include:

- Insulin Glargine U100 (Lantus, Basaglar, Semglee): Established products with considerable market share.

- Insulin Degludec (Tresiba): Ultra-long acting insulin with a different pharmacokinetic profile.

- Biosimilar products: E.g., Semglee, Basaglar, offering cost-effective alternatives.

Market adoption depends on factors such as efficacy, safety profile, injection volume, dosing flexibility, healthcare provider preferences, and reimbursement policies.

Market Penetration Dynamics

Lilly's early marketing strategies emphasized the benefits of U300, particularly for patients on high doses, with subsequent expansion through physician education and insurance reimbursements. Despite high retail prices (see below), U300 maintains strong adoption in segments prioritizing optimal glycemic stability.

Insurance coverage and cost-effectiveness debates influence penetration. Additionally, recent influxes of biosimilars for U100 formulations exert downward pressure on prices, influencing the overall market dynamics for high-concentration insulins.

Price Analysis and Projections

Current Pricing Benchmarks

As of early 2023, the retail price for a pre-filled SoloStar U300 pen averages approximately USD 350–400 per prescription, depending on insurance coverage, region, and pharmacy variables. For comparison:

- Lantus U100: Approx. USD 300–350 per pen.

- Tresiba (U100 and U200): Approx. USD 450–500 per pen.

These prices position U300 at a premium segment owing to its convenience and pharmacokinetic advantages. However, actual costs to patients depend significantly on insurance and rebates.

Factors Influencing Future Pricing

-

Market Competition: Entry of biosimilars reduces price points of U100, potentially prompting Lilly and Novo Nordisk to adjust U300 pricing to maintain premium positioning.

-

Regulatory and Reimbursement Policies: Increasing emphasis on cost-effectiveness could compel manufacturers to offer discounts or tiered pricing, influencing net prices.

-

Manufacturing and R&D Costs: Advancements in manufacturing efficiency could stabilize or lower production costs, allowing pricing flexibility.

-

Global Market Expansion: Emerging markets often demand lower-cost formulations; thus, price projections will vary regionally.

Price Projection Scenarios (2023–2028)

| Scenario | Assumptions | Price Trend | Estimated Price Range (USD) per pen |

|---|---|---|---|

| Conservative | Continued premium positioning with modest discounts | Stabilization or slight decline | USD 340–370 (USD 350 baseline) |

| Moderate | Entry of biosimilars or biosimilar-like products | Competitive pressure reduces premium | USD 300–330 |

| Aggressive | Price war driven by biosimilar growth and healthcare cost controls | Significant discounts | USD 250–280 |

Based on these scenarios, the most probable outcome over the next five years involves a gradual price decline, particularly influenced by biosimilar competition and payer negotiations, though U300 may retain a premium bracket for specific patient segments.

Regulatory and Reimbursement Impact

Global regulatory landscapes increasingly favor biosimilars, facilitating market entry and prompting pricing adjustments. Coverage restrictions and formulary tier placements also incentivize discounts to enhance formulary placement. For example, in the U.S., Centers for Medicare & Medicaid Services (CMS) policies and private insurers' formulary decisions impact retail pricing and market share.

Market Growth and Revenue Projections

Assuming a conservative annual growth rate of 5% for insulin U300 prescriptions, driven by increasing diabetes prevalence and physician preference for stable insulin profiles, global sales could approach USD 10–12 billion by 2028. Growth will be tempered by biosimilar competition and regulatory pressures.

Conclusions

Insulin Glargine SoloStar U300 is positioned as a premium long-acting insulin with a strong clinical profile appealing to subpopulations requiring high-dose insulin therapy. While current pricing reflects its clinical advantages, future projections indicate gradual price erosion driven by biosimilar entry, shifting healthcare policies, and market competition.

Manufacturers and stakeholders should monitor biosimilar developments and payer negotiations to optimize long-term market positioning and revenue streams.

Key Takeaways

-

Market Opportunity: The global insulin market continues to expand, propelled by rising diabetes prevalence; U300 is positioned as a premium product catering to high-dose insulin users.

-

Competitive Pressures: Biosimilar entries for U100 formulations are poised to reduce overall insulin prices, pressuring premium formulations like U300 to adapt pricing strategies.

-

Pricing Dynamics: Expect a gradual decline in retail prices over the next five years, averaging 10–20%, driven by biosimilar competitiveness, payer policies, and manufacturing efficiencies.

-

Regional Variability: Pricing varies significantly across regions, with emerging markets demanding lower-cost options, affecting global price strategies.

-

Strategic Consideration: Manufacturers must navigate balancing premium pricing advantages against increasing biosimilar competition and health economics considerations to sustain revenue growth.

FAQs

1. How does insulin Glargine U300 differ from U100 formulations?

U300 offers a more concentrated formulation, resulting in a longer, flatter pharmacokinetic profile that provides more stable blood glucose control, fewer injections for some patients, and a reduced risk of hypoglycemia compared to U100.

2. What are the main factors influencing the pricing of insulin U300?

Key factors include manufacturing costs, competition from biosimilars, healthcare reimbursement policies, market demand, and regional economic considerations.

3. Will biosimilars significantly reduce the price of insulin Glargine U300?

While biosimilars are expected to exert downward pricing pressure on U100 formulations, their impact on U300 depends on clinical differentiation and regulatory approval pathways. U300 may retain a premium niche but could face eventual price drops as biosimilars gain market share.

4. How does insurance coverage affect insulin prices for patients?

Insurance plans and pharmacy benefit managers negotiate rebates and formulary placements that influence copays and out-of-pocket expenses. High coverage and favorable formulary tier assignments typically reduce patient costs but may not significantly alter public list prices.

5. What are the prospects for insulin U300 in emerging markets?

In developing regions, pricing strategies often adapt to local economic conditions, and biosimilar alternatives are more prevalent. Manufacturers may need to offer lower-cost versions or tiered pricing models to penetrate these markets effectively.

Sources

[1] Grand View Research. Diabetes Market Size & Share Analysis. 2022.

[2] FDA. Toujeo (insulin glargine) injection, for subcutaneous use. Approval documentation. 2015.

[3] EvaluatePharma. World Review of Diabetes Treatment & Market Analysis. 2022.

More… ↓