Share This Page

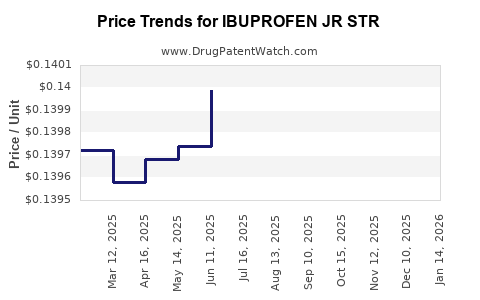

Drug Price Trends for IBUPROFEN JR STR

✉ Email this page to a colleague

Average Pharmacy Cost for IBUPROFEN JR STR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| IBUPROFEN JR STR 100 MG TB CHW | 70000-0239-01 | 0.14450 | EACH | 2025-12-17 |

| IBUPROFEN JR STR 100 MG TB CHW | 70000-0239-01 | 0.14201 | EACH | 2025-11-19 |

| IBUPROFEN JR STR 100 MG TB CHW | 70000-0239-01 | 0.13932 | EACH | 2025-10-22 |

| IBUPROFEN JR STR 100 MG TB CHW | 70000-0239-01 | 0.14023 | EACH | 2025-09-17 |

| IBUPROFEN JR STR 100 MG TB CHW | 70000-0239-01 | 0.14083 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for IBUPROFEN JR STR

Introduction

Ibuprofen Jr STR is a pediatric analgesic and antipyretic commonly used to reduce fever and alleviate mild to moderate pain in children. As a well-established pharmaceutical product, its market dynamics are influenced by factors including demographic shifts, regulatory landscape, competitive landscape, manufacturing costs, and evolving healthcare policies. This analysis evaluates current market trends and offers price projections, supporting stakeholders in strategic decision-making.

Market Overview

Global Pediatric Analgesics Market

The global pediatric analgesics market has experienced steady growth, driven by increasing awareness of children's health, rising prevalence of pediatric pain and fever-related conditions, and expanding healthcare infrastructure. According to a report by MarketsandMarkets, the pediatric pain management market is projected to grow at a compound annual growth rate (CAGR) of approximately 7% from 2023 to 2030 [1].

Product Profile: Ibuprofen Jr STR

Ibuprofen Jr STR, packaged in standardized strengths and easy-to-administer formats such as syrups or suspensions, appeals to caregivers seeking convenient and reliable dosing options. Its brand variants, including proprietary and generic formulations, compete across healthcare markets worldwide. The product's success hinges on efficacy, safety profile, regulatory approvals, and marketing strategies.

Regulatory Status and Approvals

Most jurisdictions, including the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), recognize ibuprofen as an active ingredient with a well-established safety and efficacy profile. While over-the-counter (OTC) formulations are common, prescription analgesic variants also exist, influencing market segmentation.

Current Market Dynamics

Key Market Drivers

- Growing Pediatric Population: A steady increase in global pediatric demographics, compounded by higher healthcare access, reinforces demand for pediatric analgesics.

- Rising Incidence of Fever and Pain: Common colds, flu, and other conditions stimulate consistent demand.

- Healthcare Awareness: Elevated parental awareness and healthcare provider endorsement of pediatric pain management support sustained sales.

- Regulatory Approvals for Generics: Expanding approval of generic ibuprofen formulations increases market competition but also broadens access.

Key Market Constraints

- Market Saturation: Mature markets, particularly North America and Europe, face saturation, limiting growth potential.

- Pricing Pressures: Regulatory and payer-driven cost containment measures enforce price sensitivity.

- Competition from Alternatives: Other NSAIDs, acetaminophen, and novel formulations challenge market share.

- Safety Concerns and Regulations: Warnings on overdose risks necessitate precise dosing, impacting manufacturing and branding strategies.

Competitive Landscape

The market features a blend of multinational pharmaceutical companies and local generics manufacturers. Notable global players include Johnson & Johnson, Pfizer, and Teva. Generic manufacturers often dominate due to aggressive pricing strategies. Differentiation primarily relies on formulation, branding, and distribution channels.

Distribution Channels

- Pharmacies & Drug Stores: Primary channels for OTC and prescription pediatric ibuprofen products.

- Hospital Formularies: Used in clinical settings, impacting sales volumes.

- E-commerce Platforms: Growing due to convenience and rising digital healthcare adoption.

Price Trends and Projections

Historical Pricing Patterns

Historically, pediatric ibuprofen formulations, such as Ibuprofen Jr STR, have been priced competitively, with retail prices varying based on region, packaging, and brand. For example, in the U.S., a 4 oz (120 ml) bottle historically ranged between $3 to $7, reflecting significant generic competition.

Market Influences on Pricing

- Regulatory Changes: Stringent manufacturing standards and labeling requirements may slightly escalate costs.

- Raw Material Prices: Fluctuations in chemical and packaging material costs influence procurement prices.

- Market Competition: Increased generic entry continues to exert downward pressure on prices.

- Inflation and Distribution Costs: These factor into marginal price increases over time.

Projected Price Trends (2023–2028)

Considering the current market landscape, we project a moderate decline in retail prices, approximately 1-2% annually, driven by intensified generic competition and regulatory price controls. Nonetheless, branded formulations may sustain premium pricing through branding and formulation advantages.

Estimated Price Range by 2028:

- Retail Price (per 4 oz bottle): $2.50 to $5.00

- Average Price Reduction: 10-15% over five years from the 2023 benchmark of $3 to $7.

Note: These projections assume no significant regulatory shifts or breakthroughs in alternative pediatric formulations, which could alter demand dynamics.

Market Entry and Pricing Strategy Recommendations

- Value Differentiation: Emphasize safety data, flavor, and dosing convenience to justify premium pricing.

- Cost Optimization: Streamlining manufacturing and supply chain efficiencies can sustain margins amidst competitive pricing.

- Market Segmentation: Tailor formulations and packaging for different regions and healthcare systems.

- Dynamic Pricing Models: Employ tiered pricing strategies aligned with healthcare infrastructure and reimbursement policies.

Conclusion

The pediatric ibuprofen market remains stable, driven by persistent demand and expanding healthcare access. Price trends suggest a gradual decline, emphasizing the need for manufacturers to differentiate through formulation, branding, and distribution. Strategic positioning, cost efficiency, and agility will be crucial to maintaining profitability and capturing market share.

Key Takeaways

- Stable Market with Growth Potential: The global pediatric analgesics market, including Ibuprofen Jr STR, is poised for steady growth, albeit with mature markets experiencing slow expansion.

- Competitive Landscape Drives Down Prices: Increasing generic availability exerts downward pressure on retail prices, with an expected 1-2% annual decrease over the next five years.

- Strategic Differentiation Critical: Branding, formulation, and distribution will determine profitability amidst intense price competition.

- Regulatory Environment: Ongoing compliance and safety considerations will impact manufacturing costs and marketability.

- Digital Transformation: E-commerce and telehealth channels are emerging avenues for distribution and sales, influencing pricing strategies.

FAQs

Q1: How does the entry of generic ibuprofen formulations influence price projections for Ibuprofen Jr STR?

A: Increased generic competition typically drives prices downward, leading to a projected 1-2% annual decline in retail prices due to price sensitivity and the availability of comparable alternatives.

Q2: What regulatory factors could impact future pricing of pediatric ibuprofen products?

A: Regulations relating to safety labeling, manufacturing standards, and packaging can increase compliance costs. Any new safety warnings or restrictions could elevate costs or influence pricing strategies.

Q3: Are there regional differences in the pricing and market growth of Ibuprofen Jr STR?

A3: Yes. Developed regions like North America and Europe generally have higher prices and saturated markets, while emerging markets exhibit growth potential due to expanding healthcare access but often face price sensitivities.

Q4: Will innovations in pediatric pain management affect the demand or pricing of existing ibuprofen formulations?

A4: Yes. Advances like novel delivery systems or alternative medications can either complement or replace traditional formulations, potentially impacting demand and pricing strategies for current products.

Q5: How might digital health initiatives influence the pricing and distribution of pediatric analgesics?

A: Digital health platforms facilitate wider access and streamline supply chains, possibly reducing distribution costs and enabling dynamic pricing models, with potential for increased competition and lower prices.

Sources:

- [MarketsandMarkets, "Pediatric Pain Management Market," 2022]

More… ↓