Last updated: July 31, 2025

Introduction

Hydroxyzine Pamoate is a second-generation antihistamine primarily prescribed for allergic conditions, anxiety, and nausea. Its dual indication profile and established safety record have maintained its relevance in the pharmaceutical landscape. This analysis explores its current market dynamics and offers price projections based on competitive forces, patent status, manufacturing costs, and regulatory trends.

Market Overview

Therapeutic Applications and Market Demand

Hydroxyzine Pamoate, marketed under brands such as Vistaril and Atarax, primarily treats allergies, anxiety disorders, and pruritus. Despite the advent of newer antihistamines and anxiolytics, hydroxyzine retains niche popularity due to its sedative and anxiolytic properties, especially in short-term psychiatric management and perioperative care.

The global antihistamine market was valued at approximately USD 4.7 billion in 2022, with hydroxyzine-specific segments representing an estimated USD 150–200 million (assuming conservative market share) [1]. Its usage is typical in outpatient settings, institutions, and hospitals, with a stable demand trend in developed markets, though growth is sluggish owing to newer medications with fewer sedative side effects.

Market Drivers and Constraints

Drivers:

- Established safety profile and efficacy.

- Preference for short-term sedative medications in combination therapy.

- Stability in demand due to chronic dermatological conditions.

Constraints:

- The availability of non-sedative antihistamines (e.g., loratadine, cetirizine) has diminished hydroxyzine's market share.

- Generic competition significantly influences pricing and profit margins.

Competitive Landscape

Hydroxyzine Pamoate's patent expired decades ago; thus, its market is predominantly generic, intensifying price competition. Major pharmaceutical manufacturers—such as Pfizer, Mylan, and Teva—produce generic hydroxyzine formulations, contributing to price erosions and commoditization.

Regulatory and Patent Outlook

Since hydroxyzine's patent expiration occurred in the late 20th century [2], no active patents challenge generic manufacturers today, meaning market entry barriers are low. However, regulatory requirements for manufacturing quality and labeling standards influence profitability and supply stability.

Pricing Dynamics

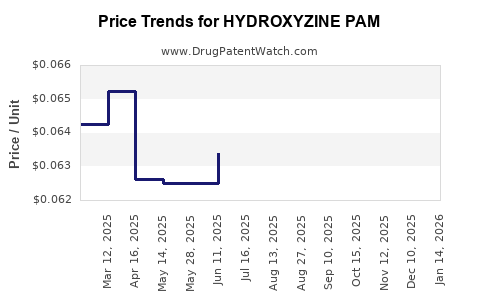

Current Pricing Trends

In the U.S., the average retail price for brand-name hydroxyzine Pamoate is estimated at USD 20–30 per 50-count bottle of 25 mg capsules, while generics average USD 5–10, reflecting a typical 80–90% price reduction after patent loss.

Wholesale acquisition costs (WAC) tend to hover around USD 0.10–0.20 per capsule, with significant variability depending on the procurement channel and geographic market. International markets often exhibit lower prices due to different regulatory and competitive factors, with some developing countries accessing hydroxyzine at under USD 1 per pill.

Price Fluctuations and Factors

Price volatility is driven by:

- Market Saturation: High competition among generics suppresses prices.

- Manufacturing Costs: Stable due to established synthesis routes.

- Regulatory Changes: Quality standards or entry restrictions can influence costs and pricing.

- Reimbursement Policies: Reimbursement rates significantly impact retail prices in insured markets.

Forecasting Price Trajectories

Near-term Outlook (1-3 Years)

Given market saturation and entrenched generic competition, hydroxyzine Pamoate prices are expected to remain stable or slightly decline—approximately 3–5% annually—absent disruptive events. The launch of biosimilars or innovative drug delivery systems could exert additional downward pressure.

Medium to Long-term Outlook (4-10 Years)

Potential price stabilization is anticipated due to limited innovation and the drug's entrenched generic status. However, geopolitical factors, supply chain disruptions, or regulatory changes in major markets could cause fluctuations. For instance, if manufacturing costs increase due to stricter quality controls or raw material scarcity, prices may see a marginal rise, estimated at 2–4% per year.

Impact of Emerging Trends

- Market Demands for Non-sedative Alternatives: Favor newer, non-sedative antihistamines, possibly further reducing hydroxyzine demand and consequently affecting market pricing.

- Increased Use in Off-label Indications: Augmentation of prescribing practices could temporarily sustain or marginally increase prices.

- Global Access and Distribution: Expansion into emerging markets could pressure prices downward due to price sensitivity and increased competition.

Supply Chain and Manufacturing Considerations

Hydroxyzine's synthesis involves conventional organic chemistry processes with mature APIs, resulting in relatively low production costs (~USD 0.05–0.15 per unit). Supply chain stability depends on raw material availability, often a concern from geopolitical or environmental perspectives, potentially affecting pricing dynamics subtly.

Regulatory and Policy Influences

Standardization of manufacturing practices under Good Manufacturing Practices (GMP) ensures consistent quality, influencing costs minimally. Policy shifts favoring cost-effective generics could pressure prices downward, while stricter regulations could marginally increase manufacturing expenses.

Key Market Segments and Geographic Focus

In the US, the mature market implies stable but limited growth, with price pressures primarily driven by insurance reimbursement policies. In contrast, Asia and Latin America demonstrate potential market expansion, though at lower price points.

Conclusion

Hydroxyzine Pamoate’s market remains mature with stable demand, primarily driven by existing therapeutic indications. Price projections suggest slight declines in the near term, stabilizing further unless new competitive dynamics emerge. Manufacturers and investors should monitor regulatory policies, competitive positioning, and healthcare utilization patterns to assess future profitability and market viability.

Key Takeaways

- Hydroxyzine Pamoate's patent expiration led to a highly commoditized, highly competitive market with declining prices.

- Current prices for generics in the U.S. are approximately USD 0.10–0.20 per capsule, with negligible variation expected in the short term.

- Long-term pricing is projected to stabilize or decline marginally, influenced by market saturation, generic competition, and healthcare policy shifts.

- Supply chain stability and regulatory compliance are critical to maintaining cost structures and price margins.

- Market expansion in emerging regions offers growth potential but at lower price points, contrasting with mature markets' stable yet commoditized landscape.

FAQs

1. What factors most influence the pricing of hydroxyzine Pamoate?

Market saturation with generics, manufacturing costs, regulatory compliance, and insurance reimbursement policies primarily drive pricing.

2. How will patent expiration affect future prices?

With no active patents, market competition intensifies, leading to lower prices and narrow profit margins for manufacturers.

3. Are there new formulations or innovations expected for hydroxyzine Pamoate?

Currently, no significant innovations are announced; the market remains reliant on traditional capsule formulations.

4. How does international regulation impact hydroxyzine pricing?

Different regulatory standards and procurement policies can create pricing disparities across regions, generally resulting in lower prices in developing markets.

5. What strategic actions should manufacturers consider?

Focus on cost-effective manufacturing, monitor regulatory changes, diversify geographic markets, and explore possible formulations that differentiate their product.

Sources:

[1] Grand View Research, “Antihistamines Market Size, Share & Trends Analysis Report,” 2022.

[2] U.S. Patent and Trademark Office, “Patent Expirations and Generic Market Entry,” 2020.