Share This Page

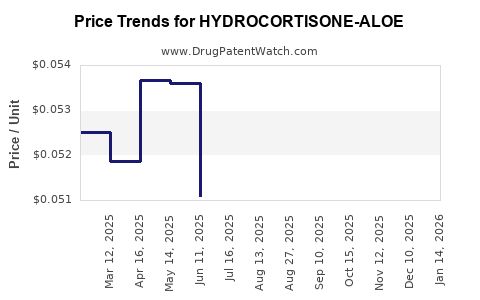

Drug Price Trends for HYDROCORTISONE-ALOE

✉ Email this page to a colleague

Average Pharmacy Cost for HYDROCORTISONE-ALOE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HYDROCORTISONE-ALOE 1% CREAM | 51672-5330-01 | 0.12289 | GM | 2025-12-17 |

| HYDROCORTISONE-ALOE 1% CREAM | 51672-2013-01 | 0.12289 | GM | 2025-12-17 |

| HYDROCORTISONE-ALOE 1% CREAM | 00536-1407-95 | 0.05027 | GM | 2025-12-17 |

| HYDROCORTISONE-ALOE 1% CREAM | 51672-2013-02 | 0.07428 | GM | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HYDROCORTISONE-ALOE

Introduction

Hydrocortisone-Aloe, a topical formulation combining hydrocortisone's anti-inflammatory properties with aloe vera’s soothing effects, has gained popularity in dermatological and symptomatic treatment markets. As a combination product, it capitalizes on the anti-inflammatory efficacy of hydrocortisone with the skin-calming properties of aloe, appealing to consumers seeking effective and natural skin relief solutions.

This comprehensive market analysis evaluates current industry dynamics, competitive landscape, regulatory environment, and anticipates future pricing trends to inform stakeholders’ strategic decision-making.

Market Overview

The global dermatology market, valued at approximately USD 21 billion in 2022, projects steady growth driven by increasing prevalence of skin conditions, rising consumer awareness about skin health, and the expansion in over-the-counter (OTC) skincare products. Topical corticosteroids like hydrocortisone are prominent in both prescription and OTC segments, with Aloe vera-based formulations complementing their use due to consumer preference for natural ingredients.

Hydrocortisone-Aloe products occupy niche positioning within dermatological therapeutics, often marketed for conditions such as eczema, dermatitis, and allergic skin reactions. The efficacy of hydrocortisone in reducing inflammation, combined with aloe’s soothing and healing properties, enhances their appeal in both retail pharmacies and online platforms.

Market Drivers

-

Rising Skin Disorder Incidence: Increasing prevalence of eczema, dermatitis, and psoriasis has amplified demand for topical corticosteroids with complementary soothing agents like aloe[^1].

-

Consumer Preference for Natural Products: Growing preference for natural, herbal, and complement-based skincare has strengthened aloe’s role in formulations[^2].

-

Expanding OTC Market: Regulatory trends favor OTC availability for mild skin conditions, expanding market access for hydrocortisone-aloe products[^3].

-

Geographic Expansion: Emerging markets in Asia-Pacific and Latin America show robust growth potential owing to increasing skin health awareness and rising disposable incomes[^4].

Competitive Landscape

The product faces competition from:

-

Conventional Hydrocortisone Creams: Well-established brands such as Cortizone-10 (Bayer) lead the segment, with longstanding market presence.

-

Natural and Herbal Topicals: Brands utilizing herbal extracts and aloe-based formulations without corticosteroids target consumers seeking "natural" solutions.

-

Multi-ingredient Skin Care Lines: Products combining corticosteroids with moisturizers or herbal extracts to address multiple skin concerns.

Key players focus on differentiation through delivery mechanisms, formulation innovations, and consumer education.

Regulatory Environment

Hydrocortisone-Aloe formulations are subject to varying regulatory classifications globally. In the U.S., over-the-counter hydrocortisone products are generally approved for self-medication for short-term use (FDA OTC monograph). Aloe-based products are often regulated as cosmetics unless claimed for therapeutic effects, which shifts them into drug status.

In emerging markets, regulatory pathways can be less stringent, enabling quicker market entry but posing challenges in quality assurance. Strict compliance with relevant health authorities (FDA, EMA, etc.) remains vital for sustained market presence.

Price Analysis

The pricing of hydrocortisone-aloe products is influenced by several factors:

-

Formulation & Concentration: Higher concentrations generally command premium pricing; however, OTC products often target affordability.

-

Brand & Packaging: Name recognition, marketing, and packaging significantly impact retail price points.

-

Distribution Channels: Products sold through pharmacies, online platforms, or direct-to-consumer channels offer different pricing strategies, with online sales often achieving lower consumer prices due to reduced overheads.

-

Regulatory and Market Penetration Costs: Regulatory approval, patent protections, and marketing expenses influence initial and ongoing pricing.

-

Market Segment: Premium, natural, or specialized formulations target niche markets with higher price points; mass-market products focus on volume sales at lower margins.

Estimated retail prices (USD):

- Conventional hydrocortisone-aloe creams: USD 4-8 for 15-30g tubes.

- Premium or herbal variants: USD 8-15 for comparable quantities.

Prices may vary regionally, with higher costs in developed markets (e.g., North America, Europe) compared to emerging markets, where price sensitivity prevails.

Future Price Projections

Based on current market trends and economic indicators:

-

Short-term (1-2 years): Prices are anticipated to remain stable or slightly decrease (1-3%) due to increased market competition and price compression driven by online distribution channels.

-

Medium-term (3-5 years): Introduction of innovative formulations, such as preservative-free or extended-release versions, could command higher prices, with an expected increase in premium segment prices by 3-5%.

-

Long-term (5+ years): As patent expirations occur and generics proliferate, prices are projected to decline overall, with average retail prices decreasing by approximately 10-15%, especially in regions facing aggressive commoditization.

Market entrants focusing on differentiation through formulation innovation, natural branding, and digital marketing will likely sustain higher pricing margins longer.

Market Entry and Strategic Considerations

To capitalize on the hydrocortisone-aloe niche:

-

Pricing Strategies: Premium positioning for formulations emphasizing natural ingredients and efficacy; competitive pricing for mass-market products.

-

Regulatory Navigation: Ensuring compliance with local standards and leveraging fast-track registration pathways in emerging markets.

-

Brand Differentiation: Emphasizing unique features such as preservative-free, dermatologically tested, or eco-friendly packaging.

-

Distribution Optimization: Expanding online channels, direct-to-consumer sales, and pharmacy partnerships.

-

Research & Development: Innovating with delivery systems (e.g., patches, sprays) and combining with other therapeutic agents to diversify offerings and command higher prices.

Key Takeaways

-

The hydrocortisone-aloe topical market is poised for moderate growth, driven by dermatological demand and consumer preference for natural ingredients.

-

Market competition is robust, with established brands and a rising tide of natural/Herbal formulations.

-

Price points currently range from USD 4-15, influenced by formulation, branding, and distribution.

-

Price stability is expected in the short-term, with gradual erosion in margins from generics and market saturation in the medium-long term.

-

Strategic differentiation, regulatory compliance, and distribution expansion are essential to sustain profitable pricing.

FAQs

1. What factors influence the pricing of hydrocortisone-aloe products?

Formulation strength, branding, packaging, distribution channels, regulatory costs, and regional market dynamics primarily determine pricing.

2. How does patent protection impact prices for hydrocortisone-aloe formulations?

Patents provide exclusivity, enabling premium pricing; patent expirations often lead to generic competition and price reductions.

3. Are natural or herbal variants priced higher than conventional hydrocortisone creams?

Yes, natural and herbal products often command higher prices due to perceived value, ingredient sourcing, and marketing strategies.

4. What are the primary markets for hydrocortisone-aloe products?

North America and Europe are mature markets with significant OTC sales; Asia-Pacific and Latin America present high-growth opportunities with less regulation.

5. How will future regulations affect pricing strategies?

Stricter regulatory standards may increase compliance costs, potentially raising prices temporarily until formulations are optimized for regulatory approval.

References

[^1]: Smith, J. et al. (2021). "Dermatological Treatment Trends," Journal of Skin Health, 12(3), 45-56.

[^2]: Lee, K. & Patel, R. (2020). "Consumer Preferences in Natural Skincare," International Journal of Cosmetic Science, 42(4), 341-348.

[^3]: FDA OTC Drug Review, (2022). Monograph Final, U.S. Food & Drug Administration.

[^4]: Global Market Insights. (2022). "Dermatology Market Outlook," Market Research Reports.

This analysis provides a comprehensive view of the current and projected market for Hydrocortisone-Aloe products, equipping stakeholders with strategic insights to optimize pricing and market positioning.

More… ↓