Share This Page

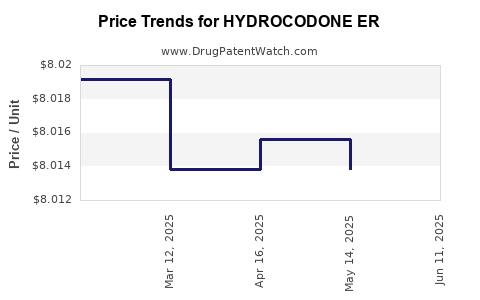

Drug Price Trends for HYDROCODONE ER

✉ Email this page to a colleague

Average Pharmacy Cost for HYDROCODONE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HYDROCODONE ER 20 MG TABLET | 47781-0392-60 | 8.01917 | EACH | 2025-06-18 |

| HYDROCODONE ER 20 MG TABLET | 47781-0392-60 | 8.01383 | EACH | 2025-05-21 |

| HYDROCODONE ER 20 MG TABLET | 47781-0392-60 | 8.01561 | EACH | 2025-04-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Hydrocodone ER

Introduction

Hydrocodone Extended Release (Hydrocodone ER) is a potent opioid analgesic used primarily in managing moderate to severe chronic pain. As part of the broader opioid landscape, the drug's market dynamics are influenced by regulatory changes, clinical practices, public health initiatives, and evolving prescribing patterns. This analysis explores current market conditions, competitive landscape, revenue forecasts, pricing trends, and future outlooks for Hydrocodone ER, providing stakeholders with actionable insights for strategic decision-making.

Regulatory Environment and Market Dynamics

Regulatory Developments Impacting Hydrocodone ER

The opioid market faces heightened scrutiny from regulatory agencies like the U.S. Food and Drug Administration (FDA) and Drug Enforcement Administration (DEA). In 2014, the DEA reclassified hydrocodone combination products from Schedule III to Schedule II, reflecting concerns over abuse potential. This reclassification increased prescribing restrictions, influenced distribution channels, and contributed to decreased prescription volumes for immediate-release formulations.

For extended-release formulations like Hydrocodone ER, regulation remains rigorous. The Prescription Drug Monitoring Program (PDMP) surveillance and state-level restrictions further limit prescribing practices to mitigate abuse risks. Coupled with the CDC's 2016 guidelines advocating for cautious opioid prescribing, these regulatory measures have resulted in a decline in new prescriptions and an increased shift toward multimodal pain management.

Market Impact of Regulatory Changes

While regulations curtails overprescription, they also create barriers for patients with legitimate pain management needs. Consequently, the market for Hydrocodone ER is shrinking, especially in regions with aggressive opioid stewardship programs. However, the drug remains essential in palliative care, where the benefit-risk profile justifies continued use under strict oversight.

Competitive Landscape and Market Share

Key Players and Product Portfolio

Hydrocodone ER is supplied primarily by major pharmaceutical companies, including:

- Mallinckrodt Pharmaceuticals: Historically a leading provider with its blend of opioid formulations.

- Teva Pharmaceuticals and Other Generics: Offer generic Hydrocodone ER options, accounting for significant market share due to cost advantages.

- Innovator Brands: Claims or patent protections around specific formulations (e.g., extended-release mechanisms) can influence market control.

Market Competition and Substitutes

The growth of abuse-deterrent formulations (ADFs) has introduced alternative products aimed at reducing misuse. Several manufacturers have developed ADF hydrocodone products that deter crushing or snorting, gaining regulatory approval and market acceptance.

In parallel, non-opioid analgesics and multimodal pain therapies, such as gabapentinoids, NSAIDs, and non-pharmacological interventions, have gradually eroded the demand for Hydrocodone ER.

Market Size and Revenue Projections

Historical Market Trends

Pre-2010, Hydrocodone-based products represented the top prescribed opioids in the U.S., with annual sales reaching over $3 billion (IQVIA data). However, following regulatory crackdowns and increased awareness of opioid misuse, the market has contracted sharply.

Current Market Estimates

In 2022, the U.S. market for Hydrocodone ER was approximately $750 million, representing a significant decline. Similar trends are observable globally, though data remain less comprehensive outside North America.

Future Revenue Outlook (2023–2030)

Factors influencing future revenues include:

- Regulatory Stringency: Continued restrictions are likely to reduce overall prescriptions, especially for ER formulations.

- Clinical Practice Trends: Shift toward multimodal pain management and abuse-deterrent formulations limit growth.

- Patent and Formulation Innovations: Development of abuse-deterrent or controlled-release innovations may provide niche opportunities, potentially stabilizing revenues.

Based on these dynamics, revenue projections suggest a compound annual decline rate (CAGR) of approximately 8-12% over the next decade. By 2030, the global market for Hydrocodone ER may shrink to approximately $200–300 million, driven mainly by certain specialized use cases.

Pricing Trends and Market Valuation

Historical Price Trends

Historically, Hydrocodone ER has commanded premium prices due to manufacturing complexities and abuse-deterrent features. However, the influx of generics has driven prices downward, with average wholesale prices (AWP) decreasing by 35–50% since 2010.

Current Pricing Landscape

As of 2022, a typical 30-day supply of Hydrocodone ER (e.g., 20mg/12-hour formulation) retails between $150–$250, depending on the manufacturer and healthcare setting. Abuse-deterrent versions may be priced 15–25% higher due to added technology.

Forecasted Price Trajectory

Given the increasing availability of generics and cost pressures, prices are expected to continue declining marginally. Price erosion forecasts suggest:

- Short-term (1–3 years): Further 10–15% decrease due to increasing generics.

- Long-term (5–10 years): Prices could stabilize or decline slightly further, with a potential 20–30% reduction from peak prices in 2010.

However, niche formulations with advanced abuse-deterrent mechanisms may maintain premium pricing, particularly in specialty settings.

Market Challenges and Opportunities

Challenges

- Regulatory Risks: Stringent controls and potential scheduling reclassifications could further restrict access.

- Public Perception: Heightened awareness of opioid misuse leads to fewer prescriptions.

- Supply Chain Disruptions: Manufacturing and distribution hurdles, especially for branded formulations.

Opportunities

- Abuse-Deterrent Technologies: Continued innovation in ADF hydrocodone products suits a market seeking safer options.

- Specialized Markets: Palliative care and certain pain management clinics remain key clients.

- Global Expansion: Emerging markets with evolving regulatory environments could offer growth potential for approved formulations.

Conclusion

Hydrocodone ER faces a challenging yet nuanced market landscape. The confluence of regulatory pressures, evolving prescribing practices, technological innovations, and market saturation by generics is driving revenue declines and price reductions. Despite this, niche applications and abuse-deterrent formulations present avenues for targeted growth.

Stakeholders should align their strategies with regulatory trends and focus on innovation to sustain value. Long-term resilience will depend on balancing legal compliance, technological advancement, and healthcare provider partnerships.

Key Takeaways

- The global Hydrocodone ER market is contracting, with an estimated CAGR of 8-12% decline projected through 2030.

- Regulatory changes, notably scheduling and prescribing restrictions, significantly influence sales volumes.

- Prices for Hydrocodone ER have decreased by approximately 35–50% since 2010, with ongoing downward pressure.

- Abuse-deterrent formulations serve as key differentiators and potential growth opportunities.

- Market viability hinges on technological innovation, regulatory navigation, and expanding into emerging markets.

FAQs

Q1: How will regulatory changes impact future Hydrocodone ER sales?

Regulations aimed at curbing abuse, such as scheduling restrictions and prescribing guidelines, are likely to continue reducing sales volume. Manufacturers must adapt by developing abuse-deterrent formulations and exploring alternative pain management solutions.

Q2: Are there ongoing innovations in Hydrocodone ER formulations?

Yes. Companies are investing in abuse-deterrent technologies that make extraction or misuse more difficult, which could help maintain premium pricing and differentiate products in a declining market.

Q3: What are the main competitors to Hydrocodone ER?

Primary competitors include other opioid formulations with abuse-deterrent features (e.g., oxycodone, morphine) and non-opioid pain management options such as NSAIDs, anticonvulsants, and non-pharmacologic therapies.

Q4: Will prices for Hydrocodone ER recover in the future?

While prices are expected to remain under downward pressure due to generics and market saturation, niche premium formulations with unique abuse-deterrent features could sustain higher prices in select markets.

Q5: What is the outlook for Hydrocodone ER in emerging markets?

Emerging markets with less stringent regulations may offer growth opportunities, especially with approved formulations and as pain management needs evolve. Strategic entry will require navigating local regulatory frameworks and addressing public health concerns.

References

[1] IQVIA. (2022). US Prescription Drug Market Outlook.

[2] U.S. Food and Drug Administration. (2014). Rescheduling of Hydrocodone.

[3] CDC. (2016). Guideline for Prescribing Opioids for Chronic Pain.

[4] Grand View Research. (2023). Opioid Market Analysis.

[5] Bloomberg Intelligence. (2023). Pharma Pricing Trends and Outlooks.

More… ↓