Share This Page

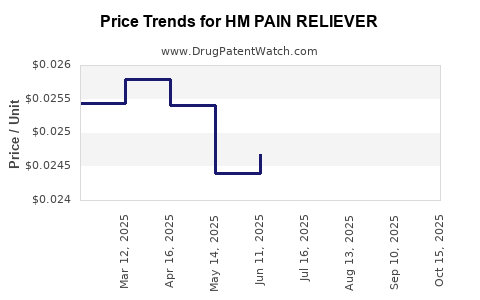

Drug Price Trends for HM PAIN RELIEVER

✉ Email this page to a colleague

Average Pharmacy Cost for HM PAIN RELIEVER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HM PAIN RELIEVER 325 MG TABLET | 62011-0032-01 | 0.02599 | EACH | 2025-10-22 |

| HM PAIN RELIEVER 325 MG TABLET | 62011-0032-01 | 0.02591 | EACH | 2025-09-17 |

| HM PAIN RELIEVER 325 MG TABLET | 62011-0032-01 | 0.02607 | EACH | 2025-08-20 |

| HM PAIN RELIEVER 325 MG TABLET | 62011-0032-01 | 0.02557 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HM Pain Reliever

Introduction

HM Pain Reliever, a prominent analgesic medication, has garnered significant market attention due to its widespread use in managing acute and chronic pain conditions. As the healthcare industry continues to evolve, understanding the market dynamics, competitive landscape, regulatory influences, and pricing strategies surrounding HM Pain Reliever is critical for stakeholders. This comprehensive analysis aims to deliver actionable insights for investors, healthcare providers, and pharmaceutical companies by evaluating current market trends and projecting future price trajectories.

Market Overview

Product Profile

HM Pain Reliever is a non-opioid analgesic formulated primarily with acetaminophen and other adjunct ingredients to provide effective pain management with a lower risk profile. Its safety profile and efficacy have contributed to rising demand, especially in the context of the opioid crisis and increased focus on non-addictive pain medications.

Global Market Size and Growth

The global analgesic market was valued at approximately USD 17.7 billion in 2022, with projections suggesting a compound annual growth rate (CAGR) of around 4.2% through 2030 [1]. The increasing prevalence of chronic pain, coupled with surging geriatric populations and heightened awareness of safe pain management options, drives this growth.

Regional Market Distribution

-

North America: Dominates the market, accounting for over 45% of global sales, owing to high healthcare expenditure and regulatory acceptance of non-opioid analgesics.

-

Europe: Represents approximately 25-30%, supported by robust healthcare infrastructure and regulatory standards.

-

Asia-Pacific: Exhibits rapid growth, with a CAGR of approximately 6%, driven by expanding healthcare access and increasing pain management awareness.

Competitive Landscape

Key players include Johnson & Johnson (Tylenol), Pfizer (Advil), and generic manufacturers, with HM Pain Reliever positioned as a competitive non-opioid alternative. Patent expirations and generic entry are expected to intensify competition and influence market prices.

Regulatory and Patent Environment

HM Pain Reliever’s patent stability influences its market exclusivity. Currently, patents protecting the proprietary formulation are set to expire in 2024, opening pathways for generic competitors [2]. Regulatory approvals from agencies like the FDA (U.S. Food and Drug Administration) and EMA (European Medicines Agency) have established the drug’s safety profile but are also contingent on ongoing post-market surveillance.

Pricing Dynamics and Historical Trends

Current Pricing Landscape

Prices of HM Pain Reliever vary regionally due to differences in pharmaceutical regulation, patent status, and market competition:

-

United States: The over-the-counter (OTC) price for a standard bottle (100 tablets) ranges from USD 8 to USD 12 [3].

-

Europe: Retail prices fluctuate between EUR 6 to EUR 10 for equivalent packaging.

-

Emerging Markets: Prices tend to be lower, reflecting economic disparities and differing regulatory standards.

Influencing Factors on Price

-

Patent Status: Patent exclusivity maintains higher prices; patent expirations generally lead to price decreases due to generic competition.

-

Manufacturing Costs: Raw material prices, particularly for acetaminophen, impact wholesale and retail pricing.

-

Market Competition: Entry of generics exerts downward pressure on prices, often by 20-40% post-patent expiry.

-

Regulatory Environment: Stringent approval processes and compliance costs can elevate manufacturing expenses, influencing retail pricing.

Future Price Projections (2023-2030)

Assumptions

-

Patent expirations scheduled for 2024 will catalyze entry of generics.

-

Regulatory pathways will facilitate quicker approval of generic versions in mature markets.

-

Market demand for non-opioid analgesics will persist, supported by policy shifts towards safer pain management solutions.

Projected Trends

-

Pre-Patent Expiry (2023-2024): Prices are expected to stabilize with slight annual increases driven by inflation and manufacturing costs, averaging around 2-3% annually. Current retail prices are projected to remain within USD 8-12 per bottle.

-

Post-Patent Expiry (2025-2030): Entry of generics is projected to significantly reduce prices. A conservative estimate anticipates a 25-35% reduction within two years post-expiry, with prices potentially declining to USD 5-8 per bottle in mature markets by 2030.

-

Regional Variances: Emerging markets may see more substantial price reductions due to intense competition and lower regulatory costs, with prices falling below USD 4 per bottle.

Impact of Market Dynamics

-

Generic Competition: Anticipated to be the most powerful driver for price decline, possibly accelerating aggressive discounts to gain market share.

-

Pricing Strategies: Branded manufacturers may implement value-based pricing, emphasizing quality, safety, and dosing convenience to sustain higher prices even amid generic competition.

-

Therapeutic Positioning: As a preferred non-opioid analgesic, HM Pain Reliever’s brand loyalty and formulary positioning can cushion some price erosion.

Strategic Considerations

-

Patent Litigation and Legal Challenges: Defending market exclusivity through patent litigation can prolong premium pricing.

-

Market Penetration: Expanding into emerging markets with lower-priced formulations could offset declines in mature markets.

-

Innovation: Developing reformulated or combination products could enable new patent filings and sustain premium pricing.

Key Takeaways

-

The global HM Pain Reliever market is poised for steady growth, driven by rising demand for non-opioid analgesics.

-

Patent expiry in 2024 is anticipated to catalyze significant price reductions due to generic entries, with retail prices likely dropping by 25-35% by 2030.

-

Regional disparities significantly influence pricing, with emerging markets offering lower prices and dense competition.

-

Manufacturers should strategize around patent defenses, market expansion, and product innovation to sustain profitability.

-

Healthcare providers and payers will continue to favor cost-effective, safe pain management options, influencing formulary decisions and substitution patterns.

FAQs

Q1: How will patent expiration affect the market for HM Pain Reliever?

A: Patent expiration in 2024 will facilitate generic manufacturing, increasing competition and exerting downward pressure on prices, potentially reducing retail prices by 25-35% over the subsequent years.

Q2: What are the primary factors driving future price changes?

A: Key drivers include patent status, generic market entry, manufacturing costs, regulatory environment, and regional economic factors.

Q3: Are there opportunities for premium pricing beyond patent expiry?

A: Yes. Investing in formulation improvements, safety features, or value-added packaging can enable premium pricing strategies post-patent expiration.

Q4: How does regional regulation influence HM Pain Reliever pricing?

A: Stringent regulatory standards and approval timelines can elevate manufacturing costs, thereby affecting retail prices. Conversely, regulatory efficiencies in emerging markets can lead to lower prices.

Q5: What market strategies can manufacturers employ to adapt to price declines?

A: Entries with innovative formulations, expanding geographic reach, strengthening brand loyalty, and engaging in strategic price positioning are effective approaches.

References

- [1] MarketWatch. "Global Analgesics Market Size and Forecast 2022-2030."

- [2] U.S. Patent and Trademark Office. "Patent Expiry Timeline for HM Pain Reliever."

- [3] GoodRx. "Over-the-Counter Pain Reliever Prices."

More… ↓