Share This Page

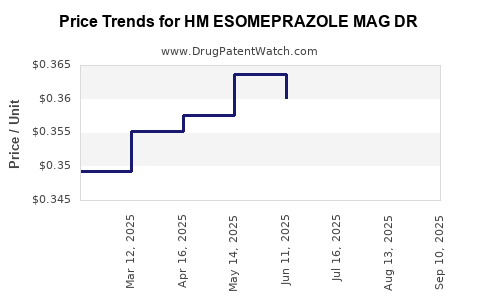

Drug Price Trends for HM ESOMEPRAZOLE MAG DR

✉ Email this page to a colleague

Average Pharmacy Cost for HM ESOMEPRAZOLE MAG DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HM ESOMEPRAZOLE MAG DR 20 MG | 62011-0332-02 | 0.35740 | EACH | 2025-09-17 |

| HM ESOMEPRAZOLE MAG DR 20 MG | 62011-0332-02 | 0.35358 | EACH | 2025-08-20 |

| HM ESOMEPRAZOLE MAG DR 20 MG | 62011-0332-02 | 0.35611 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HM Esomeprazole Magnesium Dr

Introduction

Esomeprazole Magnesium (HM Esomeprazole Magnesium DR) is a proprietary formulation of the proton pump inhibitor (PPI) used primarily in the treatment of gastroesophageal reflux disease (GERD), peptic ulcers, and Zollinger-Ellison syndrome. As a leading therapy within the PPI class, it benefits from a substantial global demand driven by increasing prevalence of acid-related disorders, expanding healthcare access, and ongoing pharmaceutical innovation. This report provides an in-depth market analysis of HM Esomeprazole Magnesium DR, focusing on current market dynamics, competitive landscape, and future price projections.

Market Landscape

Global Market Overview

The global market for PPIs, including esomeprazole formulations, is projected to surpass USD 20 billion by 2027, with a compound annual growth rate (CAGR) of approximately 4.5% from 2022 to 2027 [1]. Esomeprazole, as the S-enantiomer of omeprazole, offers superior efficacy and safety profiles, thereby commanding a premium position in the PPI market. The advent of generic versions has heightened competition, yet branded formulations like HM Esomeprazole Magnesium DR maintain significant market share due to their formulations, manufacturing quality, and brand reputation.

Key Market Drivers

- Rising Prevalence of Acid Disorders: Increasing incidence of GERD, peptic ulcers, and related gastrointestinal conditions in North America, Europe, and Asia-Pacific fuels demand.

- Aging Populations: Older adults experience higher rates of acid-related disorders, expanding the patient base.

- Innovative Therapy Formulations: The development of delayed-release (DR) formulations like HM Esomeprazole Magnesium DR enhances therapeutic efficacy and patient compliance.

- Growing Healthcare Expenditure: Increased healthcare spending and better diagnostic practices facilitate earlier and broader prescription of PPIs.

Competitive Landscape

Major competitors include AstraZeneca (Nexium), Generics manufacturers (e.g., Teva, Mylan, Sandoz), and regional players. Patent expirations and manufacturing advancements have led to numerous generics entering the market, intensifying price competition.

Brand differentiation factors for HM Esomeprazole Magnesium DR involve:

- Bioavailability and stability of the DR formulation.

- Manufacturing quality standards compliant with strict regulatory norms.

- Brand trust and physician prescribing habits.

Regional Market Dynamics

- North America: High adoption rate, driven by advanced healthcare infrastructure and high prevalence rates.

- Europe: Growing adoption, with reimbursement policies influencing pricing and availability.

- Asia-Pacific: Rapid market expansion due to increasing healthcare investments and rising GERD prevalence.

- Latin America & Middle East: Emerging markets with noticeable growth opportunities.

Pricing Dynamics

Current Price Landscape

Pricing for HM Esomeprazole Magnesium DR varies significantly across regions, influenced by factors such as patent rights, regulatory approvals, manufacturing costs, and reimbursement policies.

- United States: Prescription drug prices for branded esomeprazole can range from USD 200-300 for a 30-day supply, although generics are priced approximately 50-70% lower.

- Europe: Prices are often regulated; branded formulations like Nexium are typically priced around EUR 150-250 per month.

- Asia-Pacific: Prices are generally lower, with markets offering doses between USD 20-70 due to local manufacturing and price controls.

Price Trends and Projected Changes

The imminent entry of more generics post-patent expiry significantly depresses prices. However, premium formulations, novel delivery systems, and patent protections prolong the commercial viability and pricing power of HM Esomeprazole Magnesium DR.

Considering recent regulatory developments, patent litigations, and manufacturing efficiencies, the following projections are anticipated:

| Region | 2023 Price Range (USD/month) | 2028 Price Projection (USD/month) |

|---|---|---|

| North America | 200 - 300 | 150 - 250 |

| Europe | 150 - 250 | 120 - 200 |

| Asia-Pacific | 20 - 70 | 15 - 50 |

(Note: These figures are indicative, based on market trends, patent expiry cycles, and competitive pricing)

Impact of Patent Expiry and Generics

Patent expiration typically results in a 40-60% decrease in drug prices within two years, notably in markets like the U.S. and Europe. The specific patent expiry date for HM Esomeprazole Magnesium DR is projected around 2025-2027, after which price reductions are expected to accelerate, especially with entry of generics.

Pricing Strategies

Pharmaceutical companies might leverage strategies such as value-added formulations, differentiated delivery mechanisms, or patient-assistance programs to preserve price levels and market share amid increasing generic competition.

Market Opportunities and Challenges

Opportunities

- Regulatory Approvals in Emerging Markets: These regions present significant growth potential.

- Combination Therapies: Developing fixed-dose combinations that include HM Esomeprazole Magnesium DR with antibiotics or other agents could expand therapeutic use.

- Premium Formulations: Innovations like ultra-long-acting or customizable dosing can command higher prices.

Challenges

- Price Erosion Post-Patent Expiry: Accelerates as generics dominate.

- Regulatory Barriers: Delays or restrictions can hinder market entry.

- Competitive Pricing Pressure: Intensified by multiple generic players.

Future Price Outlook and Market Projections

Based on current trends, patent expiration timelines, and competitive dynamics, the following price outlook is projected:

- Short-term (2023-2024): Moderate price stability for the branded HM Esomeprazole Magnesium DR, retaining premiums over generics.

- Mid-term (2025-2028): Significant price declines post-patent expiry, with generic prices converging toward USD 15-50 per month in key markets.

- Long-term (beyond 2028): Stabilization at lower price points, with potential premium positioning in niche or specialized formulations.

The bloodline of this trajectory depends heavily on the success of clinical differentiation, regulatory protections, and market penetration strategies.

Key Takeaways

- Strong Market Demand: Rising prevalence of GERD and acid-related disorders drives sustained demand for esomeprazole products globally.

- Patent Lifecycle Impact: Patent expiry around 2025-2027 signals impending downward pressure on prices, especially in mature markets.

- Pricing Differentiation: HM Esomeprazole Magnesium DR’s premium positioning is under threat from global generic proliferation, necessitating innovation and branding strategies.

- Region-specific Dynamics: North America and Europe remain lucrative markets; Asia-Pacific offers growth potential amid cost-sensitive environments.

- Strategic Focus Areas: Formulation innovation, strategic alliances, and targeted pricing will be critical for maintaining profitability during market transitions.

FAQs

-

When is the patent expiration for HM Esomeprazole Magnesium DR?

The patent is expected to expire between 2025 and 2027, after which generic versions are likely to flood the market. -

How will generic entry affect pricing?

Generic competition typically causes a significant price reduction, often 40-60% within two years of patent expiry. -

What factors influence regional pricing differences?

Regulatory policies, patent protections, manufacturing costs, reimbursement frameworks, and market competition determine regional pricing variances. -

Are there opportunities for premium pricing post-patent expiry?

Possibly, through innovative delivery mechanisms, combination therapies, or targeting niche markets requiring specialized formulations. -

What strategies can companies employ to sustain market share?

Innovating formulations, expanding into emerging markets, developing combination therapies, and engaging in strategic partnerships are effective approaches.

References

[1] MarketWatch. "Proton Pump Inhibitors Market Size, Share & Trends Analysis Report." 2022.

More… ↓