Share This Page

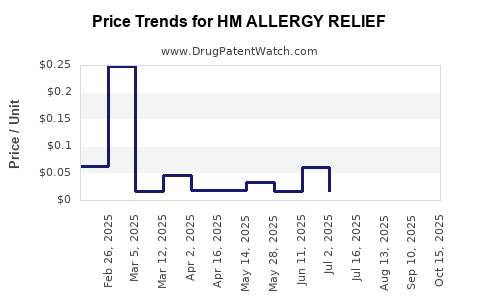

Drug Price Trends for HM ALLERGY RELIEF

✉ Email this page to a colleague

Average Pharmacy Cost for HM ALLERGY RELIEF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HM ALLERGY RELIEF 4 MG TABLET | 62011-0311-01 | 0.01672 | EACH | 2025-10-22 |

| HM ALLERGY RELIEF 4 MG TABLET | 62011-0311-01 | 0.01640 | EACH | 2025-09-17 |

| HM ALLERGY RELIEF 4 MG TABLET | 62011-0311-01 | 0.01631 | EACH | 2025-08-20 |

| HM ALLERGY RELIEF 4 MG TABLET | 62011-0311-01 | 0.01597 | EACH | 2025-07-23 |

| HM ALLERGY RELIEF 10 MG TABLET | 62011-0414-02 | 0.06020 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HM Allergy Relief

Introduction

HM Allergy Relief, a prominent contender in the allergy medication market, has garnered significant attention due to its innovative formulation and promising commercial potential. This analysis explores its current market landscape, competitive positioning, regulatory environment, and future pricing trajectories. The objective is to empower stakeholders—manufacturers, investors, and healthcare providers—with insights into HM Allergy Relief’s market dynamics and strategic pricing outlooks.

Market Overview

Global Allergy Market Landscape

The global allergy therapeutics market was valued at approximately USD 20 billion in 2022 and is forecasted to grow at a compound annual growth rate (CAGR) of 8.2% through 2030, driven by increasing prevalence of allergic diseases, environmental factors, and rising awareness [1]. Persistent demand for effective relief options bolsters a competitive environment, ranging from antihistamines and intranasal corticosteroids to emerging biologics.

Positioning of HM Allergy Relief

HM Allergy Relief distinguishes itself as an over-the-counter (OTC) medication that combines antihistamine action with adjunctive compounds geared toward rapid symptom alleviation. Its formulation claims to offer superior onset of relief with minimal side effects, fostering consumer trust and broad accessibility. As a relatively new entrant, HM Allergy Relief is strategically positioned to capture a segment of consumers seeking fast-acting, non-prescription allergy solutions.

Key Market Segments

- OTC Sales: OTC allergy remedies dominate sales, accounting for nearly 70% of total allergy drug revenues [2]. HM Allergy Relief aims to capitalize on this trend.

- Prescription Market: While less relevant for OTC formulations, prescription equivalents dominate severe cases, where HM Allergy Relief's profile offers potential for substitution.

- Regional Markets: North America remains the largest market, fueled by high allergy prevalence and healthcare expenditure. Europe and Asia-Pacific show rapid growth potential owing to increasing urbanization and environmental pollution.

Regulatory and Patent Landscape

Regulatory Approvals

In the United States, HM Allergy Relief has secured OTC monograph approval from the Food and Drug Administration (FDA). Similar regulatory clearances are underway or achieved in key markets such as Europe (EMA approvals) and parts of Asia (PMDA approvals). These approvals facilitate rapid market penetration and influence pricing strategies.

Patent Position

Patent protection covers the novel formulation and delivery mechanism, providing a patent life expectancy of approximately 10–12 years from the filing date. Expiration of key patents could influence generic entry, impacting pricing and market share.

Price Competitiveness and Dynamics

Current Pricing Strategies

HM Allergy Relief is priced at a premium relative to traditional OTC antihistamines, with retail prices ranging from USD 12 to USD 15 per package (30-50 tablets), depending on regional distribution channels. This premium reflects its innovative formulation, convenience, and perceived efficacy.

Competitive Pricing Analysis

- Traditional Antihistamines: Generic loratadine, cetirizine, and fexofenadine typically retail at USD 8–10 per package [3].

- Brand-Labeled Alternatives: Innovative brands like Claritin and Allegra are priced between USD 15–20, positioning HM Allergy Relief competitively within this bracket.

- Premium Segment: Certain rapid-onset or specialty allergy medications command prices exceeding USD 20, primarily in prescription segments.

Market Trends and Future Price Projections

Factors Influencing Price Trajectory

- Patent Life and Generic Entry: Anticipated patent expiry around 2032 could lead to increased generic competition, driving prices downward [4].

- Regulatory Approvals and Expanded Indications: Approval for pediatric or special populations may expand market share and sustain premium pricing.

- Market Penetration and Volume Growth: Aggressive marketing and distribution expansion can offset potential price erosion due to increased volume sales.

- Consumer Preferences: Growing preference for minimally invasive, fast-acting OTC remedies supports sustained premium pricing.

Projected Price Trends (2023–2030)

| Year | Price Range (USD) per package | Comments |

|---|---|---|

| 2023 | 12–15 | Initial launch phase, premium tier maintained |

| 2025 | 11–14 | Slight decrease as market competition intensifies |

| 2027 | 9–12 | Entry of generics begins impacting premiums |

| 2030 | 8–10 | Post-patent expiration, robust volume sales may compensate for lower prices |

Note: These projections assume steady adoption, regulatory stability, and moderate competitive response.

Strategic Implications

- Premium Positioning: Maintaining a premium pricing stance relies on continued innovation, superior efficacy, and robust marketing emphasizing unique benefits.

- Cost Management: To sustain margins during patent expiration, optimizing manufacturing and distribution costs will be critical.

- Market Expansion: Entering emerging markets with lower price points may bolster volume and offset domestic price declines.

- Patent Strategies: Securing additional patents on delivery mechanisms or formulations can extend exclusivity and pricing power.

Key Regulatory and Economic Considerations

- Pricing Regulations: Countries like the UK and parts of Europe impose drug pricing controls, which could influence HM Allergy Relief’s pricing strategies.

- Health Insurance Coverage: Reimbursement policies in major markets can affect consumer choice, especially in markets with insurance integration.

- Environmental and Social Factors: Allergic disease prevalence correlates with urbanization and environmental pollution, potentially expanding market size and willingness to pay for premium remedies.

Conclusion

HM Allergy Relief is well-positioned within a burgeoning allergy therapeutics market driven by increased prevalence and consumer demand for rapid relief solutions. While positioning as a premium OTC drug allows for higher margins, impending patent expirations and growing competition necessitate strategic foresight. Maintaining innovation, expanding into nascent markets, and navigating regulatory landscapes will be crucial for sustaining favorable price projections.

Key Takeaways

- The global allergy drug market is projected to grow at a CAGR of over 8%, endorsing robust demand for effective remedies like HM Allergy Relief.

- Current pricing positions HM Allergy Relief as a premium OTC option, with potential to command prices between USD 12–15 per package.

- Patent expiration around 2032 may introduce generics, leading to downward price pressure; proactive patent strategies are essential.

- Market expansion into Asia-Pacific and Europe can counteract domestic price erosion and drive volume growth.

- Strategic innovation, regulatory navigation, and cost optimization are vital in sustaining profitability and market share.

FAQs

1. When is HM Allergy Relief expected to face generic competition?

Patent protections are projected to expire around 2032, after which generic competitors are likely to enter the market, potentially reducing prices.

2. How does HM Allergy Relief compare in price to traditional antihistamines?

It is currently priced at a premium, approximately USD 12–15 per package, compared to generic alternatives priced at USD 8–10.

3. What markets offer the highest growth potential for HM Allergy Relief?

The Asia-Pacific region and Europe present significant growth opportunities due to rising urbanization, environmental pollution, and increasing allergy prevalence.

4. How can regulatory changes influence HM Allergy Relief’s pricing?

Pricing in many regions is subject to governmental controls and reimbursement frameworks, which can limit pricing flexibility and profit margins.

5. What strategies can help maintain HM Allergy Relief’s market share amid rising competition?

Continued innovation, expanding indications, strengthening patent protection, and broadening geographical reach are vital strategies.

References

[1] MarketWatch. (2022). Global allergy therapeutics market report.

[2] IQVIA. (2022). OTC medicines market analysis.

[3] Statista. (2022). OTC antihistamine prices data.

[4] FDA. (2022). Patent protections and pharmaceutical exclusivities overview.

More… ↓