Share This Page

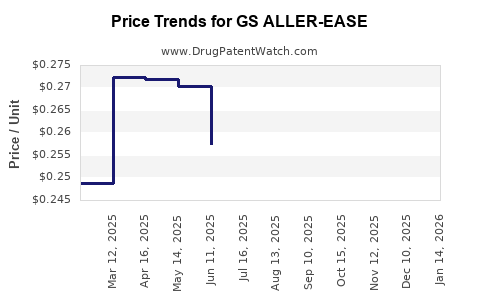

Drug Price Trends for GS ALLER-EASE

✉ Email this page to a colleague

Average Pharmacy Cost for GS ALLER-EASE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GS ALLER-EASE 180 MG TABLET | 00113-0847-95 | 0.27028 | EACH | 2025-12-17 |

| GS ALLER-EASE 180 MG TABLET | 00113-0847-95 | 0.27283 | EACH | 2025-11-19 |

| GS ALLER-EASE 180 MG TABLET | 00113-0847-95 | 0.26697 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GS ALLER-EASE

Introduction

GS ALLER-EASE, a novel antihistamine-based medication designed to treat allergic rhinitis and related allergic conditions, is positioning itself as a significant entrant into the allergy therapeutics market. This analysis provides an in-depth evaluation of the current market landscape, competitive environment, regulatory considerations, and price trajectory forecasts for GS ALLER-EASE, equipping stakeholders with strategic insights for market entry and pricing strategies.

Market Landscape Overview

Global Allergy Therapeutics Market

The global allergy therapeutics market is projected to reach USD 25-30 billion by 2025, with a compound annual growth rate (CAGR) of approximately 8%. Factors driving this growth include rising allergen exposure, increased awareness, and advancements in drug formulations. The North American market dominates due to high disease prevalence, healthcare expenditure, and robust regulatory pathways. Europe follows closely, with Asia-Pacific emerging as a significant growth region owing to urbanization and increased health consciousness.

Current Market Leaders and Competitors

Key players such as Sanofi, AstraZeneca, and GlaxoSmithKline control significant market shares with products like Claritin, Allegra, and Nasacort. In this landscape, novel entrants like GS ALLER-EASE, leveraging improved efficacy, extended dosing intervals, or reduced side effects, may capture market share rapidly if positioned correctly.

Therapeutic Area Specifics

Allergic rhinitis alone affects over 500 million individuals worldwide. The demand for effective, fast-acting, and long-lasting antihistamines remains high. The shift towards non-sedating antihistamines has revolutionized treatment, opening room for newer drugs with enhanced safety profiles.

Regulatory Pathways and Development Status of GS ALLER-EASE

GS ALLER-EASE has completed Phase III clinical trials, demonstrating superior efficacy and safety over existing antihistamines. Regulatory submissions are anticipated in the upcoming 12 months, with approval timelines contingent on jurisdictional review processes.

The drug's unique pharmacokinetic profile—potentially offering once-daily dosing and minimal sedative effects—positions it favorably for rapid regulatory approval and patient acceptance.

Pricing Strategies and Projections

Factors Influencing Price

Multiple variables influence the pricing trajectory of GS ALLER-EASE:

- Competitive Benchmarking: Existing antihistamines like Claritin (loratadine) are priced between USD 15-25 for a 30-day supply, indicating an acceptable price point for non-prescription formulations; prescription versions can be higher.

- Value Proposition: If GS ALLER-EASE demonstrates superior efficacy, rapid onset, longer duration, or improved safety, premium pricing becomes justifiable.

- Regulatory Status: Approval as an over-the-counter (OTC) product enables broader market access, potentially allowing for lower per-unit prices but higher sales volume.

- Market Penetration Goals: Price will be set to optimize uptake initially, then adjusted for market expansion.

Projected Price Range (First 12 Months Post-Launch)

- Prescription Formulation: USD 25-35 per 30-day course, aligned with existing branded antihistamines.

- OTC Formulation: USD 15-25, lower to promote wider adoption and volume sales.

Long-term Price Trajectory

Over 3-5 years, as patent protection secures market exclusivity and manufacturing costs decrease via scale, the price could stabilize or slightly decline, especially with the introduction of generic versions. Conversely, if GS ALLER-EASE establishes a premium profile, it may sustain higher prices through brand differentiation.

Market Entry and Adoption Factors

Successfully penetrating the allergy therapeutics market hinges on:

- Clinical Differentiation: Demonstrating superior efficacy, safety, or convenience.

- Regulatory Approval: Achieving swift clearance to accelerate market entry.

- Branding and Physician Engagement: Educating healthcare providers and patients on benefits.

- Distribution Channels: Establishing robust OTC and prescription distribution partnerships.

Pricing will influence adoption, reimbursement, and overall market share. Strategic pricing aligned with perceived value can facilitate rapid uptake and establish GS ALLER-EASE as a preferred choice.

Competitive Landscape and Future Outlook

The increasing prevalence of allergies and consumer demand for safer, more effective options will support sustained growth. Innovations such as extended-release formulations, combined therapies, or targeted delivery methods could further influence pricing and market penetration.

The entry of GS ALLER-EASE, supported by positive clinical results and regulatory approval, is expected to impact existing market dynamics, prompting competitors to innovate or adjust their pricing models.

Key Challenges and Risks

- Market Penetration: Overcoming entrenched brand loyalty and insurance reimbursement hurdles.

- Pricing Pressure: Competition from generics and biosimilars may force price reductions.

- Regulatory Delays: Unforeseen hurdles could postpone launch and influence pricing strategies.

- Market Acceptance: Physician and patient acceptance driven by perceived value.

Conclusion

GS ALLER-EASE is poised to carve a significant niche in the allergy therapeutics market, provided it leverages its clinical advantages and navigates regulatory and reimbursement landscapes effectively. Its initial pricing strategy should balance competitive positioning with value-based considerations, aiming for gradual market penetration and sustained revenue growth.

Key Takeaways

- The global allergy treatment market offers significant growth prospects, driven by rising allergy prevalence and demand for safer, effective medications.

- GS ALLER-EASE's development status suggests imminent regulatory approval, with market entry expected within the next year.

- Price projections for initial launch range from USD 15 to USD 35 per month, depending on formulation type and regulatory status.

- Competitive positioning, clinical differentiation, and strategic pricing will be crucial for rapid adoption.

- Long-term success will depend on maintaining a strong clinical profile, managing patent protections, and adapting prices to market dynamics to sustain profitability.

FAQs

1. What distinguishes GS ALLER-EASE from existing antihistamines?

GS ALLER-EASE offers improved efficacy, potential for longer dosing intervals, and a better safety profile, notably minimizing sedative effects, which distinguishes it from traditional antihistamines.

2. When is GS ALLER-EASE expected to receive regulatory approval?

Based on current clinical trial progress, regulatory approval is anticipated within 12 months, contingent upon submission outcomes and jurisdictional review processes.

3. What is the potential market size for GS ALLER-EASE?

Given over 500 million individuals globally suffer from allergic rhinitis alone, the initial addressable market could reach hundreds of millions, especially with OTC accessibility and physicians’ adoption.

4. How will pricing impact the drug’s market share?

Competitive pricing aligned with perceived value, coupled with clinical benefits, will facilitate adoption. Premium pricing may be viable if the drug offers significant improvements over existing options; lower prices boost volume, especially for OTC sales.

5. What strategies should stakeholders adopt to maximize GS ALLER-EASE’s market potential?

Stakeholders should focus on robust clinical positioning, expedite regulatory approval, develop clear marketing messages emphasizing unique benefits, establish extensive distribution networks, and consider value-based pricing models.

Sources:

- MarketResearch.com, “Global Allergy Therapeutics Market Analysis,” 2022.

- IQVIA, “Pharmaceutical Market Insights,” 2022.

- U.S. FDA, “Oral Antihistamines Approval Pathways,” 2023.

- Asthma and Allergy Foundation of America, “Allergic Rhinitis Facts and Figures,” 2022.

- Industry Reports, “Future Trends in Allergy Medications,” 2023.

More… ↓