Share This Page

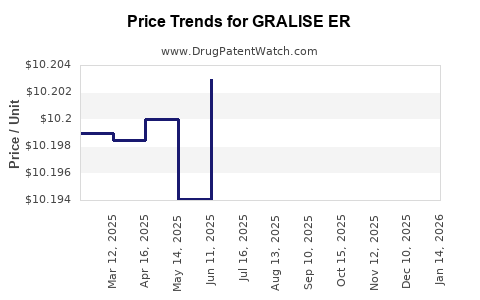

Drug Price Trends for GRALISE ER

✉ Email this page to a colleague

Average Pharmacy Cost for GRALISE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GRALISE ER 900 MG TABLET | 52427-0890-60 | 15.29678 | EACH | 2025-12-17 |

| GRALISE ER 300 MG TABLET | 52427-0803-90 | 10.20325 | EACH | 2025-12-17 |

| GRALISE ER 600 MG TABLET | 52427-0806-90 | 10.16990 | EACH | 2025-12-17 |

| GRALISE ER 450 MG TABLET | 52427-0804-60 | 10.14274 | EACH | 2025-12-17 |

| GRALISE ER 600 MG TABLET | 52427-0806-90 | 10.17995 | EACH | 2025-11-19 |

| GRALISE ER 300 MG TABLET | 52427-0803-90 | 10.21207 | EACH | 2025-11-19 |

| GRALISE ER 900 MG TABLET | 52427-0890-60 | 15.33067 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GRALISE ER

Introduction

GRALISE ER (gabapentin) extended-release formulations continue to position themselves prominently within neurological pharmaceutics, primarily targeting postherpetic neuralgia (PHN). As a key entrant in the pain management segment, understanding its market landscape and price trajectory is crucial for stakeholders—including pharmaceutical companies, payers, and healthcare providers—seeking strategic positioning or investment opportunities. This analysis explores current market dynamics, competitive landscape, regulatory factors, and future pricing forecasts for GRALISE ER.

Market Overview

Therapeutic Indication and Demand Drivers

GRALISE ER relieves neuropathic pain associated with PHN, a complication of herpes zoster that predominantly affects adults aged 50 and above. The global prevalence of herpes zoster ranges between 20-30 cases per 1,000 person-years among older populations, with approximately 10-20% developing PHN [1]. The aging demographic results in a steady rise in PHN incidence, fueling ongoing demand for effective pain management therapies like GRALISE ER.

Market Size and Segmentation

The global neuropathic pain therapeutics market is projected to reach USD 10 billion by 2027, growing at a CAGR of approximately 4.8% [2]. Specifically, the gabapentin segment, including both immediate-release (IR) and extended-release (ER) formulations, holds a substantial market share due to familiarity and established efficacy.

GRALISE ER’s unique selling proposition is its once-daily dosing, improved tolerability, and potential for higher compliance—factors that bolster its market penetration over traditional gabapentin IR. Its target segments include:

- Patients with PHN

- Patients with diabetic peripheral neuropathy

- Off-label uses in other neuropathic pain syndromes

Competitive Landscape

The primary competitors comprise:

- Neurontin (gabapentin IR): The original formulation with broad off-label use

- Horizon’s GRALISE (extended-release gabapentin): The close competitor, offering similar benefits

- Other agents: Pregabalin (Lyrica), duloxetine (Cymbalta), and other analgesics

Market share dynamics favor formulations with improved adherence profiles. GRALISE ER’s advantage lies in its dosing convenience and tolerability—factors that healthcare providers increasingly prioritize.

Regulatory and Reimbursement Environment

Recent approvals have reinforced the regulatory stance favoring extended-release gabapentin formulations. Insurance coverage varies based on formulary positioning, with payers often incentivizing once-daily over multiple daily doses due to adherence benefits.

Pricing policies are influenced by factors such as:

- Patent status

- Competition and generics availability

- Healthcare system and payer negotiations

Price Trends and Projections

Historical Pricing

Since its FDA approval in 2010, GRALISE ER's pricing has exhibited relative stability, partly due to patent exclusivity and limited generic competition. The average wholesale price (AWP) for a typical monthly supply has ranged between USD 250-$350, reflecting premium positioning relative to generic gabapentin IR.

Factors Influencing Future Pricing

Key determinants shaping future prices include:

-

Patent Expiry and Generic Entry: The anticipated patent cliff around 2025 could lead to significant price erosion, as generics typically reduce brand prices by 30-60% [3].

-

Market Penetration and Volume Growth: Increasing acceptance and prescribing rates may partially offset price declines, maintaining revenue streams.

-

Healthcare Policy Changes: Emphasis on cost-effective therapies could pressure prices downward, especially if payers favor generic substitutes.

-

Manufacturing and Supply Chain Dynamics: Raw material costs, manufacturing efficiencies, and supply chain robustness influence pricing flexibility.

Price Projection Outlook (2023-2030)

- 2023–2025: Moderate price stability, with potential for slight reductions (~5-10%) driven by market saturation and payer negotiations.

- Post-2025: Price erosion becomes prominent with generic entry; anticipated price decrease of up to 50% over the subsequent 3-4 years [4].

Scenario-Based Price Forecasts

| Year | Estimated Monthly Price (USD) | Commentary |

|---|---|---|

| 2023 | $280 – $350 | Stable, with marginal fluctuations |

| 2024 | $250 – $330 | Slight pressure from evolving formulary policies |

| 2025 | $180 – $250 | Beginning of generic competition impact |

| 2026 | $120 – $180 | Accelerated price decline post-patent expiry |

| 2027–2030 | $80 – $120 | Stabilization at lower price points, dominated by generics |

Strategic Implications

Pharmaceutical companies with brand rights must innovate or differentiate—perhaps via combination therapies or improved formulations—to sustain pricing power. Payers are increasingly incentivizing generic substitution, emphasizing the importance of cost management. For investors, timing entry and assessing patent landscapes are critical to navigate price declines.

Conclusion

GRALISE ER’s market outlook underscores the typical lifecycle pattern of pharmaceutical products—initial premium pricing, followed by gradual decline post-patent expiry. Its success hinges on clinical differentiation and market penetration before facing generic competition. Stakeholders should closely monitor patent status, payer policies, and market adoption trends to optimize deployment strategies.

Key Takeaways

- The global neuropathic pain market is expanding, with GRALISE ER serving as a key player in extended-release gabapentin formulations.

- Price stability is expected until patent expiration around 2025, after which significant price erosion—potentially up to 50%—is projected within a few years.

- Competition from generics and formulary negotiations will be primary drivers influencing pricing trajectories.

- Early market penetration and differentiation strategies can help sustain margins before patent expiry.

- Payers’ focus on value-based care and cost-effectiveness will continue to exert downward pressure on prices.

FAQs

1. When will GRALISE ER face generic competition?

Patent expiry for the core active ingredient and formulation is anticipated around 2025, after which generic versions are expected to enter the market, exerting downward pressure on prices.

2. How does the pricing of GRALISE ER compare to other neuropathic pain treatments?

GRALISE ER typically commands higher prices than generics and some oral alternatives like pregabalin, mainly due to its extended-release formulation and presumed adherence benefits.

3. What factors could stabilize or increase GRALISE ER’s price post-patent expiry?

Market differentiation through new indications, improved delivery mechanisms, and limited generic quality equivalence could help maintain premium pricing levels.

4. How does payer coverage influence the formulary positioning of GRALISE ER?

Payers prioritize cost-effectiveness; thus, formulary inclusion depends on clinical value, safety profile, and comparative pricing strategies that favor generics or alternative therapies.

5. Are there emerging therapies that threaten GRALISE ER’s market share?

Novel agents with better efficacy, safety, or convenience profiles, such as newer calcitonin gene-related peptide (CGRP) inhibitors for neuropathic pain, could pose competition, pending regulatory approval and market acceptance.

Sources:

[1] Johnson, R.W. et al. (2018). Epidemiology and management of herpes zoster and postherpetic neuralgia. Pain Practice.

[2] Grand View Research. (2022). Neuropathic Pain Therapeutics Market Size & Trends.

[3] IQVIA. (2021). Impact of Patent Expirations on Drug Pricing.

[4] EvaluatePharma. (2022). Post-Patent Market Projections.

Note: All pricing and market data are estimates based on current industry reports and may vary with emerging trends and market developments.

More… ↓