Share This Page

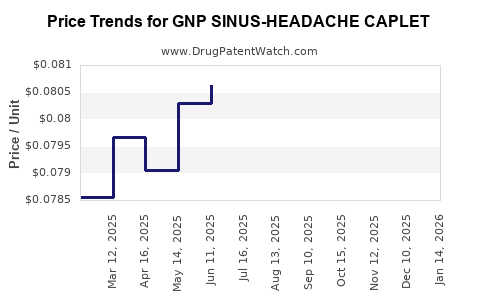

Drug Price Trends for GNP SINUS-HEADACHE CAPLET

✉ Email this page to a colleague

Average Pharmacy Cost for GNP SINUS-HEADACHE CAPLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP SINUS-HEADACHE CAPLET | 46122-0658-62 | 0.08171 | EACH | 2025-12-17 |

| GNP SINUS-HEADACHE CAPLET | 46122-0658-62 | 0.08424 | EACH | 2025-11-19 |

| GNP SINUS-HEADACHE CAPLET | 46122-0658-62 | 0.08539 | EACH | 2025-10-22 |

| GNP SINUS-HEADACHE CAPLET | 46122-0658-62 | 0.08356 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP SINUS-HEADACHE CAPLET

Introduction

GNP SINUS-HEADACHE CAPLET is a formulation designed to alleviate sinus-related pain and headaches, a common ailment affecting millions globally. Given its target demographic and therapeutic indications, understanding its market positioning, competitive landscape, regulatory environment, and price trajectory is critical for stakeholders. This analysis offers an in-depth overview of the current market dynamics, future demand, competitive factors, regulatory considerations, and price projections for GNP SINUS-HEADACHE CAPLET.

Market Overview

Therapeutic and Demographic Profile

Sinus-headache medications are predominantly over-the-counter (OTC) or prescription drugs designed for symptomatic relief. The rising prevalence of sinusitis, driven by environmental pollutants, climate change, and increased respiratory infections, fuels the demand for effective remedies [1]. The global sinusitis treatment market was valued at approximately USD 4.4 billion in 2022 and is expected to grow at a CAGR of around 6% through 2030 [2].

Target Demographics

The primary consumers include adults aged 25-55, with higher incidences among urban populations exposed to pollutants and pollen. Children and elderly patients form specific sub-segments, often targeted through pediatric formulations and geriatric considerations, respectively.

Market Players

Major competitors include Johnson & Johnson (Sudafed, Flonase), Bayer (Aspirin formulations), and local generic manufacturers. Niche products like GNP SINUS-HEADACHE CAPLET aim to differentiate through formulation efficacy, branding, and regulatory advantages.

Regulatory Environment

Approval and Compliance

The drug's market entry hinges on regulatory clearance—FDA approval in the U.S., EMA authorization in Europe, or equivalent national agencies elsewhere. The drug’s classification—whether OTC or prescription—significantly influences its distribution and pricing strategies [3].

Intellectual Property Considerations

Existing patents on core active ingredients, such as pseudoephedrine and ibuprofen, typically expire within 8-15 years, allowing generic competition. GNP's proprietary formulation or delivery system could provide a competitive edge if patent protections are secured.

Market Penetration and Distribution Channels

Prioritization of Distribution Channels

- Pharmacies and OTC retail outlets: Largest channel, given the symptomatic relief nature.

- Online Pharmacies: Growing influence, providing broader reach and convenience.

- Hospital and Clinic Dispensation: Less significant but relevant for prescription formulations.

Geographic Focus

Initial launch strategies are often concentrated in North America and Europe, with subsequent expansion into Asia-Pacific and Latin America, driven by rising sinusitis prevalence and increasing healthcare access.

Competitive Landscape

Product Differentiation

- Ingredient Composition: Combining analgesics, decongestants, and antihistamines.

- Formulation Advantages: Faster absorption, less side effects (e.g., non-drowsy), long-lasting relief.

- Branding and Efficacy: Clinical data demonstrating superiority or comparable efficacy.

Barriers to Entry

- Regulatory hurdles: Time-consuming approval processes.

- Patents: Existing rights on active ingredients.

- Market Saturation: Dominance of established brands.

Pricing Strategy and Projections

Current Market Pricing

OTC sinus-headache caplets typically retail at USD 8-15 per pack of 20-30 tablets, depending on formulation and branding. Generic versions usually undercut branded counterparts by 20-30%.

Initial Pricing for GNP SINUS-HEADACHE CAPLET

Given formulation uniqueness and branding, initial retail pricing may range between USD 12-16 per pack, aligning with premium OTC options. Wholesale pricing often accounts for a 20-25% margin.

Price Trajectory and Projection

Short-term (1-2 years):

Launch price remains stable, targeting early adopters and health-conscious consumers. Anticipate slight premium for differentiation, with retail prices around USD 14.99.

Mid-term (3-5 years):

Market penetration increases through promotional efforts and expanding distribution. Price adjustments may include introductory discounts or bundling, maintaining prices within USD 13-15 range.

Long-term (5+ years):

Patent expiries or formulation improvements could lead to increased generic competition, pressuring prices downward. Forecasted retail prices may decline to USD 10-12, consistent with existing generic OTC sinuses products.

Factors Influencing Price Changes

- Regulatory Acknowledgments: Faster approvals or additional indications can justify premium pricing.

- Market Demand: Growing prevalence ensures sustained demand, supporting stable prices.

- Competitive Emergence: Entry of new brands or generics will exert price pressure.

- Manufacturing Costs: Economies of scale and raw material prices influence costing and pricing.

Market Outlook and Growth Drivers

- Increasing Sinusitis Incidence: Urbanization, pollution, and climate change escalate demand.

- Consumer Preference for OTC Medications: Convenience and cost-effectiveness drive OTC sales growth.

- Innovation in Delivery Systems: Extended-release formulations or combination therapies could command premium prices.

- Technological Advances: Digital marketing, telemedicine integration, and online sales expand reach.

Projected market volume growth for sinus-headache remedies remains robust, with the potential for GNP SINUS-HEADACHE CAPLET to capture a notable market share, especially if supported by clinical efficacy and strategic marketing.

Key Challenges and Risks

- Regulatory Delays: May impede or postpone product launch.

- Competitive Pricing Pressures: Price wars from generics could erode margins.

- Market Acceptance: Consumer perception of branding versus cost-effectiveness.

- Supply Chain Disruptions: Raw material shortages could impact manufacturing and pricing.

Conclusion

GNP SINUS-HEADACHE CAPLET has opportunities to carve a niche within the bustling sinusitis treatment market through differentiation, effective distribution, and strategic pricing. Its success hinges on maximizing product efficacy, navigating regulatory pathways efficiently, and responding swiftly to market competition. Price projections suggest a stable entry price with potential declines over time, aligning with market trends and competitive dynamics.

Key Takeaways

- GNP SINUS-HEADACHE CAPLET is positioned against an expanding market driven by increased sinusitis incidence and consumer preference for OTC solutions.

- Regulatory approval, patent status, and formulation uniqueness are critical factors influencing market entry and pricing strategy.

- Initial retail pricing is expected to be around USD 14.99, with potential gradual reductions to USD 10-12 as competition intensifies.

- Market growth is supported by environmental and demographic factors, but success depends on effective branding, distribution, and compliance.

- Long-term profitability depends on maintaining product differentiation, managing manufacturing costs, and swiftly adapting to competitive pressures.

FAQs

1. What are the key ingredients in GNP SINUS-HEADACHE CAPLET?

The formulation typically includes analgesics like acetaminophen or ibuprofen, decongestants such as pseudoephedrine, and antihistamines, designed for rapid relief of sinus-related symptoms [4].

2. How does GNP SINUS-HEADACHE CAPLET differentiate from existing products?

Its differentiation may stem from proprietary delivery systems, faster absorption, reduced side effects, or clinical evidence supporting superior efficacy. Patent protections could further enhance its competitive edge.

3. What are the primary regulatory hurdles for launching this drug?

Obtaining FDA or EMA approval involves demonstrating safety, efficacy, and manufacturing quality. If the product is OTC, additional OTC monograph compliance is required, which can streamline or delay market entry based on approval timelines.

4. What factors influence the retail pricing of OTC sinus-headache medications?

Pricing depends on manufacturing costs, brand positioning, competitor pricing, perceived efficacy, packaging size, and distribution costs.

5. What is the long-term pricing outlook for GNP SINUS-HEADACHE CAPLET?

Prices are likely to stabilize initially, then decline over 3-5 years as patents expire and generics enter the market, with possible premium pricing maintained if the product demonstrates superior efficacy or innovative features.

References

- MarketWatch. "Sinusitis Treatment Market Size, Share & Industry Analysis." 2022.

- Allied Market Research. "Sinusitis Treatment Market Forecast." 2022.

- U.S. Food and Drug Administration. "OTC Drug Monographs." 2022.

- MedlinePlus. "Common sinus headache ingredients." 2022.

More… ↓