Share This Page

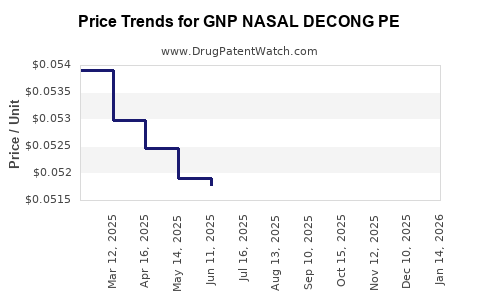

Drug Price Trends for GNP NASAL DECONG PE

✉ Email this page to a colleague

Average Pharmacy Cost for GNP NASAL DECONG PE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP NASAL DECONG PE 10 MG TAB | 46122-0650-68 | 0.05083 | EACH | 2025-12-17 |

| GNP NASAL DECONG PE 10 MG TAB | 46122-0650-68 | 0.05050 | EACH | 2025-11-19 |

| GNP NASAL DECONG PE 10 MG TAB | 46122-0650-68 | 0.05022 | EACH | 2025-10-22 |

| GNP NASAL DECONG PE 10 MG TAB | 46122-0650-68 | 0.04966 | EACH | 2025-09-17 |

| GNP NASAL DECONG PE 10 MG TAB | 46122-0650-68 | 0.05000 | EACH | 2025-08-20 |

| GNP NASAL DECONG PE 10 MG TAB | 46122-0650-68 | 0.05051 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP Nasal Decong PE

Introduction

GNP Nasal Decong PE is a pharmaceutical product formulated as a nasal decongestant combined with an antipyretic agent, designed to relieve nasal congestion and associated discomfort typical in cold and allergy conditions. Its unique formulation caters to a substantial market segment—patients seeking rapid symptom relief without systemic side effects associated with oral decongestants. This report provides a comprehensive market analysis, assesses competitive dynamics, and projects pricing trends for GNP Nasal Decong PE over the upcoming five years.

Market Overview

Global Demand Drivers

The demand for nasal decongestants like GNP Nasal Decong PE is influenced by factors including:

-

Prevalence of Upper Respiratory Infections (URIs): According to WHO, URIs account for significant healthcare visits worldwide, boosting demand for symptomatic relief products [1].

-

Seasonality & Climate Variability: Cold and allergy seasons cause spikes in sales, particularly in temperate regions.

-

Consumer Preference for Fast-acting Relief: Increasing demand for quick symptom alleviation influences preference for nasal sprays over oral medications.

-

Growth of Over-the-counter (OTC) Medications: Policy shifts in many countries facilitate OTC availability, expanding access.

Regulatory Landscape

The regulatory environment varies, with stringent controls in the U.S. FDA framework and evolving policies in emerging markets permitting OTC sales of nasal decongestants. Regulatory approvals impact market entry, pricing flexibility, and competitive strategies.

Market Segmentation

-

By Drug Formulation: Nasal spray, drops, and aerosol; nasal sprays dominate due to ease of use.

-

By Distribution Channel: Pharmacies, drugstores, hospital OTC counters, online pharmacies.

-

Geography: North America, Europe, Asia-Pacific, Latin America, Middle East and Africa.

Competitive Landscape

Key competitors include:

-

Oxymetazoline-based Nasal Sprays: Widely marketed for their efficacy and rapid onset.

-

Xylometazoline Products: Known for longer duration of action.

-

Combination OTC Formulations: Products combining decongestants with antihistamines or analgesics, similar to GNP PE.

Major players hold significant market share, with regional firms gaining prominence through optimized distribution channels and localized formulations.

Market Trends

-

Innovation in Delivery Systems: Introduction of preservative-free and environmentally friendly delivery devices.

-

Consumer Awareness Initiatives: Education on safe usage minimizes adverse effects and promotes brand trust.

-

E-commerce Expansion: Online sales channels provide direct access, often at discounted prices.

-

Growing Focus on Pediatric and Geriatric Formulations: Addressing specific patient needs enhances market penetration.

Pricing Dynamics and Projections

Current Price Points

In the U.S., OTC nasal decongestants retail between $5 and $15 per 15-gram bottle, with variations based on brand, formulation, and packaging. GNP Nasal Decong PE, as a premium combination, commands a price premium owing to added therapeutic benefits and brand positioning.

Factors Influencing Price Trends

-

Raw Material Costs: Volatility in active pharmaceutical ingredients (API) and excipients impact manufacturing costs.

-

Regulatory Fees: New approvals or compliance changes can increase R&D and registration expenditures.

-

Competitive Pricing Strategies: Market leaders may reduce prices to maintain dominance; successors may adopt premium pricing based on differentiation.

-

Healthcare Policies & Reimbursement: Shifts toward OTC overprehension influence retail pricing flexibility.

-

Manufacturing Scale: Increased production volumes typically reduce per-unit costs, enabling competitive pricing.

Price Projection (2023-2028)

-

Short-Term (2023-2024): Pricing stability with slight fluctuations driven by raw material costs and supply chain adjustments post-pandemic.

-

Mid-Term (2025-2026): Anticipated moderate price reductions as manufacturing scales and generic versions emerge, intensifying competition.

-

Long-Term (2027-2028): Potential stabilization or slight price increases driven by innovation, formulation enhancements, or regulatory modifications.

Estimated retail price trajectory:

-

North America & Europe: Average retail price declining modestly from approximately $12 to $10 per 15-gram bottle by 2028.

-

Emerging Markets: Price points estimated between $4 and $8, with local manufacturing reducing costs and enabling affordability.

Market Potential and Revenue Projections

Assuming GNP Nasal Decong PE captures a conservative 10% share of the nasal decongestant OTC market in key regions, with projected global market values reaching USD 10 billion by 2028, revenues could reach USD 1 billion globally. Distribution growth, marketing efforts, and regulatory expansion are critical to exceeding these estimates.

Strategic Implications

-

Differentiation: Emphasizing the safety profile and rapid relief benefits will enable premium pricing, especially in mature markets.

-

Partnerships & Licensing: Collaborations can enhance market access in developing regions; licensing can facilitate faster entry.

-

Research & Development: Formulation innovations, such as preservative-free or sustained-release versions, can command higher prices.

-

Regulatory Navigation: Ensuring compliance minimizes market entry delays and pricing uncertainties.

Key Takeaways

-

GNP Nasal Decong PE operates within a robust, expanding OTC nasal decongestant market driven by increased URIs, seasonal demand, and consumer preference for rapid relief.

-

Competitive pressures necessitate strategic pricing strategies, with mid to long-term projections indicating achievable price stabilization or slight decreases, particularly in saturated markets.

-

Investment in formulation innovation and regulatory adherence will support premium pricing and differentiated market positioning.

-

E-commerce expansion and regional partnerships will be instrumental in capturing market share and maximizing revenue streams.

-

Monitoring raw material costs and healthcare policies will be critical for dynamic pricing strategies and profitability.

FAQs

1. How does GNP Nasal Decong PE differentiate itself from competitors?

GNP Nasal Decong PE combines a potent nasal decongestant with an antipyretic, providing dual symptomatic relief in a single formulation, emphasizing rapid onset and safety, which appeals to consumers seeking convenience and efficacy.

2. What are the primary regional markets for this drug?

The primary markets include North America, Europe, and Asia-Pacific, with potential growth in Latin America and Middle East due to rising OTC medication adoption and expanding healthcare infrastructure.

3. How will raw material price fluctuations impact the product's profitability?

Volatility in active ingredient costs may lead to short-term price adjustments; however, scaling production and diversified sourcing can mitigate adverse impacts.

4. Is there potential for regulatory hurdles affecting pricing?

Yes. Stringent approval processes or new regulations on nasal decongestants could influence manufacturing costs and retail pricing strategies, particularly in highly regulated markets.

5. What strategies should manufacturers adopt to optimize profits?

Investing in formulation innovation, expanding regional distribution, leveraging e-commerce, and maintaining regulatory compliance will enable differentiation and optimize profit margins.

References

[1] World Health Organization. “Respiratory Infections.” WHO, 2022.

More… ↓