Share This Page

Drug Price Trends for GNP MUCUS RELIEF PE

✉ Email this page to a colleague

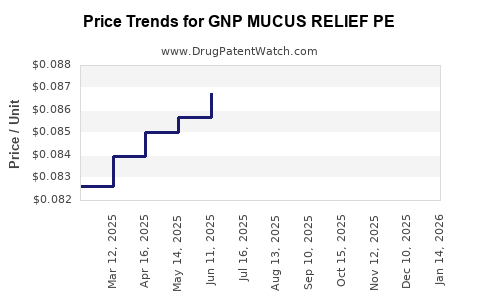

Average Pharmacy Cost for GNP MUCUS RELIEF PE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP MUCUS RELIEF PE 400-10 MG | 46122-0700-71 | 0.07782 | EACH | 2025-12-17 |

| GNP MUCUS RELIEF PE 400-10 MG | 46122-0700-71 | 0.07863 | EACH | 2025-11-19 |

| GNP MUCUS RELIEF PE 400-10 MG | 46122-0700-71 | 0.07863 | EACH | 2025-10-22 |

| GNP MUCUS RELIEF PE 400-10 MG | 46122-0700-71 | 0.07871 | EACH | 2025-09-17 |

| GNP MUCUS RELIEF PE 400-10 MG | 46122-0700-71 | 0.08165 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP MUCUS RELIEF PE

Introduction

The pharmaceutical landscape for respiratory remedies continues to evolve, driven by rising respiratory illnesses, aging populations, and increasing consumer awareness about mucus management. GNP Mucus Relief PE, a proprietary formulation targeting symptom relief associated with mucus retention and congestion, is positioned within this expanding market. Analyzing its current market landscape and projecting future pricing trends provide critical insights for stakeholders, including manufacturers, investors, and healthcare providers.

Market Overview of Mucus Relief Pharmacotherapy

The segment dedicated to mucus relief encompasses various over-the-counter (OTC) and prescription medications, primarily expectorants and mucolytics. The global expectorant market alone was valued at approximately USD 4.2 billion in 2022, with projections reaching USD 6.0 billion by 2030, reflecting a compound annual growth rate (CAGR) of around 4.5% (1). Key drivers include increased respiratory infections, chronic obstructive pulmonary disease (COPD), asthma, and a broader shift towards self-medication in respiratory care.

GNP Mucus Relief PE operates within this competitive landscape, distinguished by its proprietary formulation, which combines a specific concentration of active ingredients designed to optimize mucus clearance while minimizing side effects. Its market success hinges on regulatory approval, efficacy perception, manufacturing scalability, and consumer acceptance.

Regulatory and Manufacturing Considerations

Achieving regulatory approval is paramount. Depending on the geographic region, the product may be classified as an OTC medication or require prescription status, influencing pricing and market access. The U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) set rigorous standards for safety, efficacy, and manufacturing quality (2). Notably, innovative formulations like GNP Mucus Relief PE may benefit from expedited pathways, depending on the evidence of improved therapeutic outcomes.

Manufacturers must ensure robust production capacities and supply chain resilience, especially considering global disruptions observed in recent years. The scale-up costs and patent protections will impact initially set prices. High-quality production and patent exclusivity support premium pricing strategies, while broader competition might lead to price erosion over time.

Competitive Landscape

Major players in the mucus relief domain include Johnson & Johnson, Reckitt Benckiser, Boehringer Ingelheim, and AstraZeneca. Many offer similar expectorants or mucolytics, with varying formulations and delivery methods (3). GNP Mucus Relief PE's differentiation factors include its targeted mechanism of action, lower side-effect profile, or unique delivery system.

The competitive intensity influences pricing strategies. Introduction of generics or biosimilars typically prompts downward price adjustments, fostering price competition. Conversely, patented, innovative formulations may command premium prices initially.

Current Pricing Environment

OTC expectorants typically range from USD 8 to USD 15 per month of supply depending on formulation and brand perceived value (4). Prescription versions or specialized formulations tend to have higher prices, generally in the USD 20-USD 40 range per package, contingent on dosage and duration.

For GNP Mucus Relief PE, early market entry with patent protection and clinical differentiation could justify premium pricing, possibly in the USD 20-USD 30 per package range. As competition increases, especially with biosimilar entries, prices may decline by 10-20% annually over subsequent years.

The pricing strategy also considers cost factors, including manufacturing, distribution, and promotional expenses, alongside reimbursement policies in different regions.

Price Projections (2023–2030)

Short-term (2023-2025)

- With regulatory approval secured, initial pricing is anticipated to be set at a premium to existing products, around USD 25-USD 30 per package, reflecting its novel attributes.

- Early adopting markets such as the US, Europe, and Japan will likely see higher prices, justified by higher healthcare spending per capita.

- Volume growth driven by marketing campaigns and physician endorsements is expected to stabilize prices within the premium range initially.

Mid-term (2026-2028)

- Patent expiration or shifts in regulatory policies could trigger price adjustments.

- Entry of biosimilars or generic competitors could induce price reductions of approximately 15-20% per year in these markets.

- Increased manufacturing efficiencies and economies of scale might moderate cost increases, sustaining volume-driven revenue growth.

Long-term (2029-2030)

- Assuming successful market penetration, prices could settle in the USD 15-USD 20 range in mature markets if biosimilar competition intensifies.

- In emerging markets, pricing may be further reduced to USD 10-USD 15 to accommodate lower affordability thresholds.

- If GNP Mucus Relief PE garners a substantial clinical advantage, premium pricing could persist longer; otherwise, a gradual commoditization is plausible.

Key Market Drivers and Risks

Drivers:

- Rising prevalence of respiratory diseases globally.

- Aging populations with increased mucus-related conditions.

- Growing preference for self-managed OTC products.

- Continuous innovation in drug delivery and formulation.

Risks:

- Regulatory delays impacting time-to-market and pricing.

- Competitive entry of generic or biosimilar products.

- Price erosion due to market saturation or healthcare reforms.

- Market acceptance influenced by perceived efficacy and safety profiles.

Strategic Recommendations

- Secure Patent Protection: To sustain premium pricing, early patent filings and defending exclusivity are crucial.

- Invest in Clinical Validation: Demonstrating superior efficacy or safety can justify higher prices and facilitate market penetration.

- Monitor Competitive Dynamics: Regular market analysis aids in timely price adjustments and strategic positioning.

- Diversify Market Entry: Expanding into emerging markets can increase volume and buffer against price erosion in developed regions.

- Optimize Cost Structures: Streamlining manufacturing and distribution improves margins amid competitive pressures.

Key Takeaways

- GNP Mucus Relief PE's success hinges on regulatory approvals, clinical differentiation, and strategic pricing.

- Initial pricing is likely to be premium, supported by patent protection and clinical benefits, in the USD 25-USD 30 range.

- Market maturity and increased competition may trigger gradual price reductions, with long-term projections in the USD 15-USD 20 range.

- Growth opportunities exist in emerging markets, albeit at lower price points.

- Ongoing innovation and patent protection are vital for maintaining pricing power and market share.

FAQs

1. How does patent expiration impact the pricing of GNP Mucus Relief PE?

Patent expiration typically introduces generic competitors, exerting downward pressure on prices due to increased market options and reduced brand premiums. This often results in a 10-20% annual price decline post-patent expiry.

2. What factors influence the adoption rate of GNP Mucus Relief PE?

Efficacy, safety profile, regulatory approval speed, clinical endorsements, marketing efforts, and physician prescribing habits significantly impact adoption rates.

3. Are there regional differences in pricing strategies for respiratory drugs like GNP Mucus Relief PE?

Yes, developed markets often command higher prices due to higher per capita healthcare spending, whereas emerging markets adopt lower pricing to improve accessibility.

4. How does competition from biosimilars or generics affect the market?

Increased competition typically results in substantial price reductions, eroding profit margins but expanding market share through more affordable options.

5. What role does clinical evidence play in setting the price of GNP Mucus Relief PE?

Robust clinical evidence demonstrating superior efficacy or safety allows premium pricing, whereas weaker evidence may necessitate more competitive pricing strategies.

Sources

- MarketWatch, "Expectorant Market Value and Forecast," 2022.

- FDA, Regulations for Respiratory Medications, 2021.

- IQVIA, "Global Respiratory Drug Market Insights," 2022.

- Statista, "OTC Drug Prices," 2022.

More… ↓