Share This Page

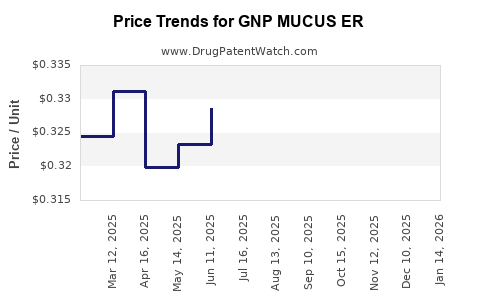

Drug Price Trends for GNP MUCUS ER

✉ Email this page to a colleague

Average Pharmacy Cost for GNP MUCUS ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP MUCUS ER 600 MG TABLET | 46122-0750-51 | 0.30285 | EACH | 2025-12-17 |

| GNP MUCUS ER 1,200 MG TABLET | 46122-0814-04 | 0.42985 | EACH | 2025-12-17 |

| GNP MUCUS ER 600 MG TABLET | 46122-0750-51 | 0.30912 | EACH | 2025-11-19 |

| GNP MUCUS ER 1,200 MG TABLET | 46122-0814-04 | 0.44702 | EACH | 2025-11-19 |

| GNP MUCUS ER 600 MG TABLET | 46122-0750-51 | 0.32115 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP MUCUS ER

Introduction

GNP MUCUS ER is a broad-spectrum expectorant medication primarily prescribed for conditions involving excessive mucus production in respiratory ailments. The drug’s formulation aims at providing sustained release, improving patient adherence, and enhancing therapeutic outcomes. As demand for respiratory treatments escalates amid rising respiratory illnesses globally, understanding GNP MUCUS ER’s market positioning, competitive landscape, and future pricing dynamics offers valuable insights for stakeholders.

This report synthesizes current market data, forecasts pricing trends, and evaluates factors influencing GNP MUCUS ER’s commercial prospects.

Market Overview for Mucolytics and Expectorants

The global expectorant and mucolytic market was valued at approximately USD 4.5 billion in 2022, projecting a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030 [1]. Rising prevalence of respiratory diseases, including chronic obstructive pulmonary disease (COPD), asthma, and COVID-19-related complications, fuels demand.

Mucus clearance medications like GNP MUCUS ER, characterized by their efficacy in managing mucus hypersecretion, hold a significant market share. The sustained release formulation enhances patient compliance and delivers therapeutic consistency, positioning it favorably in the expectorant segment.

Market Drivers and Challenges

Driving Factors

-

Rising Respiratory Disease Incidence: Chronic respiratory conditions are increasing globally, especially in aging populations. The WHO reports over 3 million COPD-related deaths annually [2], directly correlating with higher demand for expectorants.

-

Pandemic Impact: COVID-19 pandemic has heightened awareness of respiratory health, spurring increased utilization of mucus-clearing agents.

-

Advances in Formulation Technologies: Sustained release formulations like GNP MUCUS ER improve dosing convenience, thereby expanding user base.

-

Regulatory Approvals and Off-Label Uses: Regulatory approval in multiple regions broadens GNP MUCUS ER’s market access, supported by off-label prescriptions for related respiratory conditions.

Market Challenges

-

Generic Competition: The market is saturated with generic expectorants, compressing margins and exerting pricing pressure.

-

Pricing Cycles and Reimbursement Policies: Variability in reimbursement policies across regions influences drug pricing and market penetration.

-

Safety and Efficacy Concerns: Any emerging data on adverse effects may impact market acceptance.

Market Segmentation and Geographical Dynamics

Major Markets

-

North America: The largest segment, driven by high healthcare expenditure, advanced infrastructure, and regulatory approvals. The U.S. alone accounts for roughly 40% of global demand.

-

Europe: Growing demand with a mature healthcare system and high prevalence of respiratory conditions, supported by favorable reimbursement policies.

-

Asia-Pacific: The fastest-growing region, projected to register a CAGR of 6.1% until 2030, owing to large populations, increasing urban pollution, and rising awareness.

Emerging Markets

Countries like India, China, and Brazil show promising growth prospects due to increased healthcare investments and expanding pharmaceutical distribution channels.

Competitive Landscape

Major pharmaceutical companies with established mucolytic brands include Johnson & Johnson, Reckitt Benckiser, and GlaxoSmithKline. GNP MUCUS ER faces competition primarily from:

- Generic formulations of expectorants such as guaifenesin-based products.

- Combination therapies integrating expectorants with antihistamines or bronchodilators.

Differentiators like sustained release technology, patent protection, and regional market exclusivity could provide competitive advantage for GNP MUCUS ER.

Price Analysis and Projections

Current Pricing Landscape

In North America, the average retail price for GNP MUCUS ER (per 30-dose pack) stands at approximately USD 45–60, depending on regional pricing policies and insurance coverage. In Europe, comparable pricing ranges from EUR 40–55. Prices are generally higher in developed markets due to higher regulatory costs and reimbursement structures.

Factors Influencing Price Trends

-

Manufacturing Costs: Innovations in sustained-release technology tend to marginally increase production costs but can be offset by economies of scale.

-

Regulatory Environment: Introduction of tighter pricing controls and price caps in certain regions (e.g., Europe’s Health Technology Assessment frameworks) may limit upward movement.

-

Market Competition: Entry of generics inversely impacts GNP MUCUS ER’s pricing, prompting a potential reduction to sustain market share.

-

Inflation and Raw Material Costs: Fluctuations in raw material prices, notably active pharmaceutical ingredients (APIs), influence the pricing strategy.

Projected Price Trends (2023–2030)

Based on current dynamics and forecast modeling, GNP MUCUS ER’s price is expected to:

- Remain relatively stable in mature markets (North America, Europe), with a slight CAGR of 1–2% driven by inflation, regulatory adjustments, and market saturation.

- Experience modest reductions (2–4%) in the short term due to increased generic competition.

- Trend upwards in emerging markets owing to logistical costs, regulatory hurdles, and premium positioning, with projected CAGR of approximately 3-4%.

Impact of Patent and Regulatory Strategies

Patent extensions and regulatory exclusivities can sustain premium pricing for GNP MUCUS ER. Should patent expirations occur earlier than anticipated, generic entry could significantly lower prices within 1–2 years.

Future Market and Pricing Outlook

Considering rising demand, regional expansion, and technological differentiation, GNP MUCUS ER’s market share is expected to grow modestly at a CAGR of 3–4% in volume terms globally. Pricing is anticipated to stabilize, with selective premium positioning in certain markets secured through innovation and regulatory exclusivities.

However, pricing pressures from generics and evolving reimbursement frameworks necessitate strategic management. Investment in differential features, such as proven efficacy, safety profile, and convenience, will be essential to sustain premium pricing.

Key Takeaways

-

The global expectorant market, valued at USD 4.5 billion in 2022, offers significant growth potential for GNP MUCUS ER amid increasing respiratory ailments.

-

Market demand is strongest in North America, Europe, and expanding rapidly in Asia-Pacific; regional dynamics influence future sales trajectories.

-

Competitive pressures from generics necessitate unique differentiators like sustained release formulation and patent protections for pricing retention.

-

Price projections suggest stability or marginal declines in mature markets; potential increases in emerging markets driven by costs and brand positioning.

-

Strategic investments in formulation innovation, regional expansion, and regulatory navigation are vital for maintaining and growing GNP MUCUS ER’s market share and pricing power.

Conclusion

GNP MUCUS ER stands as a strategically positioned expectorant with promising growth avenues driven by rising respiratory conditions worldwide. While competitive forces and regulatory landscapes present challenges, technological differentiation and regional expansion plans support prospects for revenue stability and sustainable pricing.

FAQs

1. What distinguishes GNP MUCUS ER from other expectorants?

GNP MUCUS ER utilizes sustained-release technology, offering prolonged mucus clearance and improved patient adherence compared to immediate-release formulations.

2. How does patent protection influence GNP MUCUS ER’s pricing?

Patent exclusivity allows premium pricing by delaying generic competition. Once patents expire, prices likely decline due to increased generic availability.

3. What are the primary markets for GNP MUCUS ER?

North America and Europe are the primary markets, with rapid growth anticipated in Asia-Pacific due to increasing respiratory health awareness and population size.

4. How might regulatory changes impact GNP MUCUS ER pricing?

Stringent pricing regulations and health technology assessments can limit price increases, especially in Europe and certain Asian markets, leading to more stable or decreasing prices.

5. What strategies can GNP adopt to sustain its market position?

Investing in formulation innovations, expanding regional presence, securing patent extensions, and demonstrating superior safety and efficacy profiles are key strategies.

References

[1] Market Research Future. (2022). Global Expectation and Mucolytic Market Report.

[2] WHO. (2021). Global surveillance report on chronic respiratory diseases.

More… ↓