Share This Page

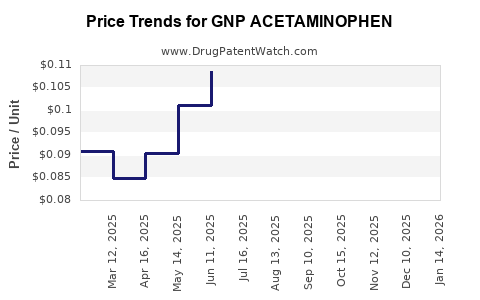

Drug Price Trends for GNP ACETAMINOPHEN

✉ Email this page to a colleague

Average Pharmacy Cost for GNP ACETAMINOPHEN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP ACETAMINOPHEN-IBUPROFEN 250-125 MG TABLET | 46122-0742-68 | 0.09255 | EACH | 2025-12-17 |

| GNP ACETAMINOPHEN-IBUPROFEN 250-125 MG TABLET | 46122-0742-68 | 0.09348 | EACH | 2025-11-19 |

| GNP ACETAMINOPHEN-IBUPROFEN 250-125 MG TABLET | 46122-0742-68 | 0.09647 | EACH | 2025-10-22 |

| GNP ACETAMINOPHEN-IBUPROFEN 250-125 MG TABLET | 46122-0742-68 | 0.08918 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP Acetaminophen

Introduction

GNP Acetaminophen, a leading formulation of the widely used analgesic and antipyretic medication, is positioned within the global over-the-counter (OTC) and prescription drug markets. Its ubiquitous use in managing mild to moderate pain and fever underscores its relevance in both developed and emerging markets. This analysis provides a comprehensive review of GNP Acetaminophen's current market landscape, competitive positioning, regulatory environment, and forecasts future pricing trends influenced by generics, supply chain dynamics, and patent expiry.

Market Overview

Global Market Size and Growth Dynamics

The global acetaminophen market was valued at approximately USD 6.5 billion in 2022, with a compound annual growth rate (CAGR) of around 4.2% projected through 2028 [1]. The primary drivers include escalating demand in pain management regimes, expanding OTC sales, and increased prevalence of chronic conditions necessitating affordable analgesics.

Application Segments

- OTC segment: Dominates the market due to widespread OTC accessibility.

- Prescription segment: Growing in regions with stricter regulatory controls, especially where combinations with opioids or other analgesics are marketed.

Geographic Distribution

North America holds the largest market share (~40%), driven by high healthcare expenditure and consumer awareness. Asia-Pacific is poised for rapid growth (~6-8% CAGR), fueled by rising healthcare access, urbanization, and population growth.

Competitive Landscape

Major Players and Market Share

Key players include Johnson & Johnson, Bristol-Myers Squibb, and local manufacturers in emerging markets. GNP Acetaminophen's competitive positioning depends on factors such as formulation, pricing strategies, and regulatory approvals. Notably, the US market observes intense competition from generic manufacturers post-patent expiry.

Formulation and Brand Differentiation

While GNP Acetaminophen is often sold as a generic or under store brands, differentiation hinges on formulation quality, packaging, and perceived safety. Innovations like sustained-release formulations exist but constitute a niche segment.

Regulatory Environment and Patent Landscape

Patent Expiry and Generic Entry

The original patent for acetaminophen expired in the early 2000s, catalyzing a surge in generic manufacturers. This patent landscape is crucial for pricing strategies; increased generic competition typically drives prices downward.

Regulatory Standards

Regulatory agencies (FDA in the US, EMA in Europe, TGA in Australia) enforce stringent quality standards. Compliance impacts manufacturing costs and, consequently, pricing.

Pricing Trends and Projections

Current Price Landscape

In the US, the average OTC price for a bottle of 100 tablets (500 mg) ranges from USD 4 to USD 8, contingent upon the brand and retailer. GNP Acetaminophen, available via various channels, typically follows this range but benefits from bulk and wholesale discounts.

Price Drivers

- Generic Competition: The entry of multiple generics post-patent expiration has historically led to price erosion—averaging 15-25% annually in the first three years after generic entry.

- Manufacturing Costs: Material prices (API procurement), labor, and regulatory compliance influence retail prices.

- Supply Chain Dynamics: Disruptions—such as raw material shortages or logistic issues—can temporarily inflate prices.

Future Price Projections (2023-2028)

- Baseline Scenario: Continuing generic competition is expected to stabilize prices at approximately USD 3 to USD 5 per 100 tablets by 2028.

- Upside Potential: Introduction of niche formulations (e.g., combination products, sustained-release variants) could command a premium, potentially up to USD 10 per 100 tablets.

- Downside Risks: Price wars amongst generic manufacturers or regulatory curtailments could push prices below current levels, especially in price-sensitive markets.

Market Influencers

- Emerging Markets: Lower pricing thresholds are common, with prices often 50-70% below Western benchmarks, driven by lower purchasing power.

- Intellectual Property Trends: While the original patent has expired, patents on specific formulations or combinations could intermittently restrict generic proliferation, influencing prices.

- Regulatory Price Controls: Some jurisdictions enforce price caps, limiting potential upside.

Strategic Implications for Stakeholders

- Manufacturers: Innovation in formulations or delivery mechanisms could sustain premium pricing.

- Investors: Entry of new generic competitors could pressure margins but also expand market size.

- Regulators: Monitoring for quality compliance ensures market stability and consumer safety, indirectly affecting pricing.

Key Market Drivers and Constraints

- Growth in OTC adoption sustains demand.

- Cost pressures may incentivize price reduction.

- Patent expiries catalyze generic entry influencing prices.

- Regulatory changes—from safety concerns (e.g., hepatotoxicity risks)—may impact formulations and pricing strategies.

Conclusion

The GNP Acetaminophen market is mature, characterized by intense generic competition and declining prices. While current retail prices are relatively stable, future trends predict a gradual stabilization at lower levels, moderated by product innovation and market expansion in emerging regions. Stakeholders capable of differentiating their offerings or navigating regulatory landscapes will better position themselves for sustained profitability.

Key Takeaways

- In the wake of patent expiration, GNP Acetaminophen faces aggressive generic competition, driving prices downward.

- Price projections suggest a stabilization around USD 3-5 per 100 tablets domestically and more competitive pricing in emerging markets.

- Formulation innovation and niche formulations offer opportunities for premium pricing.

- Supply chain stability and regulatory compliance remain critical determinants of pricing and market access.

- The expanding Asian market presents significant growth prospects but demands adaptation to regional price sensitivities.

FAQs

1. How has patent expiry influenced GNP Acetaminophen pricing?

Patent expiry unlocked the market for multiple generic entrants, precipitating substantial price reductions—often by 15-25% annually in the initial years—due to increased competition.

2. What factors could cause GNP Acetaminophen prices to rise despite generic competition?

Regulatory constraints, rising raw material costs, formulation innovations, or supply chain disruptions could elevate manufacturing costs, leading to higher retail prices.

3. Which regions are expected to see the fastest growth in GNP Acetaminophen consumption?

Asia-Pacific regions are projected to experience the highest CAGR (6-8%) due to increasing healthcare infrastructure, rising middle-class populations, and greater OTC penetration.

4. How might regulatory policies impact future GNP Acetaminophen pricing?

Price controls or safety-related regulations restricting certain formulations could limit supply or increase compliance costs, thus influencing prices.

5. Are branded formulations of GNP Acetaminophen still viable in competitive markets?

Yes, especially in segments emphasizing formulation quality, safety, or specific delivery mechanisms, which can command a price premium over standard generics.

Sources

[1] MarketWatch. "Acetaminophen Market Size, Share & Trends Analysis Report," 2022.

More… ↓