Last updated: July 27, 2025

Introduction

Glatiramer Acetate, commercially known as GLATIRAMER, is a cornerstone treatment in multiple sclerosis (MS) management. Since its approval by the FDA in 1996, it has maintained a significant place in the MS therapeutic landscape due to its proven efficacy in reducing relapse rates and delaying disease progression. Amid evolving healthcare dynamics, patent expiries, and emerging biosimilars, a comprehensive market analysis and price projection of GLATIRAMER are essential for stakeholders, including pharmaceutical companies, healthcare providers, and investors.

Market Overview

Global Market Size and Growth

The global multiple sclerosis therapeutics market reached an estimated USD 21 billion in 2021, with projections to grow at a compound annual growth rate (CAGR) of approximately 6.5% through 2027 [1]. Glatiramer Acetate commands a substantial share, with approximately USD 4-5 billion in annual sales before patent expirations and biosimilar competition influence prices and volumes.

Key Market Drivers

- Prevalence of MS: Over 2.8 million people globally suffer from MS, with increasing diagnoses, especially in Europe, North America, and parts of Asia [2].

- Established Efficacy and Safety Profile: GLATIRAMER’s long-term safety data and efficacy profile reinforce its market sustainability.

- Healthcare Infrastructure: Advanced healthcare systems in Western markets facilitate ongoing prescription and management.

- Regulatory Approvals: Expanded indications and formulary inclusions bolster market penetration.

Competitive Landscape

The original brand, Copaxone (Teva Pharmaceuticals), dominated the market for decades, pending patent expiry in 2015. Since then, biosimilar versions and generics have entered, intensifying competition. Notable players include Mylan (now part of Viatris), Samsung Bioepis, and Sandoz, all launching biosimilar glatiramer products at lower price points.

Patent Expiry and Biosimilar Impact

The patent expiration of branded GLATIRAMER significantly affected market dynamics:

- Patent Expiration: The US patent for Glatiramer Acetate expired in 2015, opening the door for biosimilar competition [3].

- Biosimilars Launch: Multiple biosimilars have gained approval and market access, leading to price reductions upwards of 30-50%, depending on the region and healthcare setting [4].

- Market Share Shift: Organizations like Teva have faced erosion of market share, shifting to maintaining competitiveness via price cuts and contractual agreements.

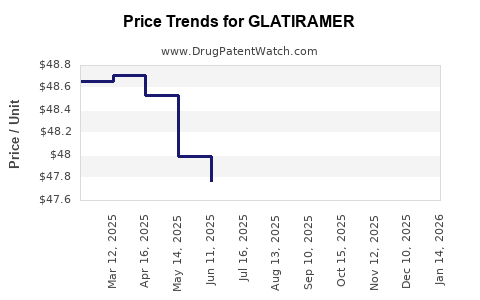

Pricing Trends

Pre-Biosimilar Era

Historically, the annual cost of branded Copaxone was approximately USD 70,000 in the US [5].

Post-Biosimilar Entry

- Price Reduction: Biosimilar versions launched at 20-30% lower prices initially, with further reductions as market competition intensified.

- Current Market Prices: As of 2023, the average wholesale price (AWP) for biosimilar glatiramer in the US ranges approximately between USD 30,000 to USD 45,000 annually, representing a significant decline versus original branded prices [6].

Price Variability

Pricing varies due to:

- Market Penetration Strategies

- Pricing Agreements with Payers

- Regional Regulatory Policies

- Formulation and Packaging Variations

Future Price Projections

Projected trends suggest a continued decline in price points over the next five years driven by:

- Widespread biosimilar adoption across North America, Europe, and emerging markets.

- Increased competition among biosimilar manufacturers promoting price wars.

- Potential regulatory and reimbursement policies favoring biosimilar use over originators.

- Market consolidation and strategic alliances to lock in market share.

Forecast Estimate (2023-2028):

- In the US, biosimilar glatiramer could stabilize at an annual price of approximately USD 20,000 - USD 35,000, a 55-65% reduction from pre-patent expiry prices.

- European markets, heavily influenced by national healthcare policies, could see prices declining to EUR 15,000 – EUR 25,000 annually.

- Emerging markets may witness even more significant reductions, often below USD 10,000 annually, due to cost sensitivities.

Market Opportunities and Challenges

Opportunities

- Generics/Biosimilars Penetration: Cost-effective biosimilars create new patient populations and extend access.

- Expanded Indications: Ongoing research into additional MS subtypes and other autoimmune diseases could broaden usage.

- Strategic Partnerships: Collaborations with healthcare providers and payers can enhance market positioning.

Challenges

- Erosion of Original Drug Prices: Rising biosimilar competition pressures prices downward.

- Supply Chain and Manufacturing Complexity: Biosimilar development involves complex manufacturing that could hinder rapid scaling.

- Regulatory Hurdles: Variations in biosimilar approval pathways create market entry delays in certain regions.

Regulatory and Reimbursement Outlook

- Regulatory Environment: Agencies like the FDA and EMA facilitate biosimilar approvals, encouraging market entry.

- Reimbursement Policies: Payers increasingly prefer biosimilars due to lower costs, leading to formulary shifts favoring lower-priced options.

- Policy Incentives: Governments are implementing policies to promote biosimilar use, including incentivized substitution and price caps [7].

Conclusion

Glatiramer Acetate’s market landscape is transitioning markedly following patent expirations and biosimilar adoption. Price projections indicate a persistent downward trend over the next five years as biosimilars gain market share globally. Stakeholders must navigate regulatory, competitive, and reimbursement challenges while capitalizing on opportunities to maintain profitability and expand access.

Key Takeaways

- Biosimilar competition has significantly driven down glatiramer’s market prices, especially in North America and Europe.

- The US market is expected to see biosimilar prices stabilize around USD 20,000–USD 35,000 annually in the coming years.

- Continued regulatory support and payer preference for biosimilars will further accelerate price erosion.

- Emerging markets offer growth prospects driven by affordability and expanding MS diagnosis.

- Strategic collaborations and diversifying indications can mitigate revenue pressures and sustain market relevance.

FAQs

1. How does biosimilar competition impact the pricing of GLATIRAMER?

Biosimilar competition introduces lower-priced alternatives, leading to substantial price reductions for the original drug and improved affordability for patients, particularly in markets with strong regulatory encouragement for biosimilars.

2. What are the key factors influencing the future price decline of GLATIRAMER?

Factors include regulatory approval of biosimilars, payer policies favoring cost-saving options, market penetration strategies, and manufacturing scalability.

3. Will the original branded GLATIRAMER remain relevant amid biosimilar proliferation?

Yes, through strategies such as exclusive formulations, patient loyalty programs, and negotiating favorable reimbursement terms, the original brand can retain a segment of the market.

4. How significant is the role of regional healthcare policies in shaping GLATIRAMER pricing?

Regional policies significantly influence prices; in Europe, national health systems set price caps, while in the US, payer contracts and formulary management determine actual patient costs.

5. Are there any emerging therapies that threaten the market share of GLATIRAMER?

New oral DMDs and advanced immunomodulatory therapies are gaining popularity, but GLATIRAMER maintains relevance due to its established safety profile and cost-effectiveness.

References

[1] Grand View Research, "Multiple Sclerosis Therapeutics Market Size, Share & Trends Analysis," 2022.

[2] Multiple Sclerosis International Federation, "Atlas of MS," 2020.

[3] US Patent and Trademark Office, "Patent Expiry for Glatiramer Acetate," 2015.

[4] Sandoz, "Biosimilar Glatiramer Acetate Launch Announcement," 2021.

[5] CNBC, "The Cost of Multiple Sclerosis Treatments," 2022.

[6] Dr. Foster’s Healthcare Market Data, 2023.

[7] European Medicines Agency, "Biosimilar Medicines Policy," 2022.