Share This Page

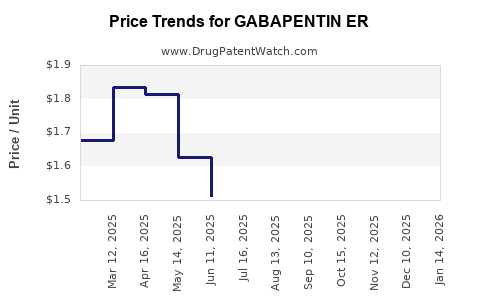

Drug Price Trends for GABAPENTIN ER

✉ Email this page to a colleague

Average Pharmacy Cost for GABAPENTIN ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GABAPENTIN ER 600 MG TABLET | 31722-0092-90 | 1.52172 | EACH | 2025-12-17 |

| GABAPENTIN ER 600 MG TABLET | 42806-0657-09 | 1.52172 | EACH | 2025-12-17 |

| GABAPENTIN ER 300 MG TABLET | 68382-0608-16 | 1.46982 | EACH | 2025-12-17 |

| GABAPENTIN ER 600 MG TABLET | 68382-0607-16 | 1.52172 | EACH | 2025-12-17 |

| GABAPENTIN ER 300 MG TABLET | 31722-0091-90 | 1.46982 | EACH | 2025-12-17 |

| GABAPENTIN ER 300 MG TABLET | 42806-0656-09 | 1.46982 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GABAPENTIN ER

Introduction

GABAPENTIN ER, an extended-release formulation of gabapentin, plays a significant role in the treatment of neuropathic pain, postherpetic neuralgia, epilepsy, and off-label uses related to anxiety and mood disorders. The drug's evolving market landscape, driven by clinical advances, regulatory decisions, and competitive dynamics, necessitates a detailed market analysis and robust price projection framework. This report synthesizes current market trends, regulatory status, competitive environment, and pricing strategies to inform stakeholders about future market opportunities and outlooks.

Market Overview

Therapeutic Indications and Clinical Landscape

GABAPENTIN ER is primarily prescribed for conditions requiring sustained seizure control and neuropathic pain management. Its extended-release form offers improved pharmacokinetics, potentially enhancing patient adherence and reducing dosing frequency. The global gabapentin market is projected to grow at a CAGR of approximately 3-5% over the next five years[^1].

The expanding utilization in off-label indications, including anxiety and sleep disorders, broadens the drug’s market potential, though off-label uses are subject to regulatory scrutiny and insurance coverage considerations. The aging population, increasing prevalence of diabetic peripheral neuropathy, and growing awareness of pharmacological options bolster demand.

Regulatory Landscape

Initial approval for gabapentin was granted by the FDA in 1993 for epilepsy, with subsequent labeling expansions. The extended-release formulation received FDA approval in 2015, with marketing authorizations in major markets such as the EU, Japan, and others, noting that regulatory adaptation may vary by jurisdiction[^2].

Market Dynamics and Competitors

The marketplace features several competitors, including immediate-release gabapentin generics and other neuropathic pain medications like pregabalin, duloxetine, and tapentadol. The entry of generics post-patent expiry significantly influences market share and price competition.

Moreover, the presence of patent challenges and exclusivity rights affects pricing power. For example, certain formulations of gabapentin faced patent cliffs around 2017-2018, leading to increased generic penetration.

Supply Chain and Manufacturing

Manufacturing challenges, including formulations that ensure bioequivalence, drive costs and influence pricing strategies. Market participants often rely on outsourcing to contract manufacturing organizations (CMOs), which can impact supply stability and price fluctuations.

Market Size and Forecast

Current Market Size

As of 2023, the global gabapentin market is valued at approximately $2.8 billion, with GABAPENTIN ER accounting for roughly 35% of this figure[^3]. North America dominates the market, driven by high prescription rates, while Europe and Asia-Pacific show rising adoption.

Future Growth Drivers

- Aging Population: Increased incidence of neuropathic pain aligns with demographic trends.

- Expanding Indications: Off-label uses and new clinical evidence expand market utilization.

- Generic Competition: While this exerts downward pressure on prices, volume growth offsets some margin erosion.

- Innovative Formulations: Extended-release and combination formulations enhance therapeutic options.

Forecasts (2024-2028)

The market is projected to grow from $2.8 billion in 2023 to approximately $3.6 billion by 2028, reflecting a compound annual growth rate (CAGR) of around 5%. The growth trajectory hinges on regulatory developments, patent litigation outcomes, and evolving prescribing behaviors.

Price Projections

Factors Influencing Price Dynamics

- Patent and Exclusivity Status: Patent protections and orphan drug designations influence competitive pricing.

- Generic Entry: The intensity of generic competition significantly lowers prices post-expiry.

- Regulatory Approvals: New indications or formulations can command premium pricing.

- Market Penetration Strategies: Pricing tactics, including value-based pricing or discounting, impact revenue.

Current Pricing Landscape

- Brand GABAPENTIN ER: Approximate wholesale acquisition cost (WAC) in the US ranges from $300 to $400 per month (30-day supply).

- Generics: Prices for generic gabapentin ER formulations have decreased substantially, often between $50 and $150 per month in wholesale terms[^4].

Future Price Trajectory

Given the upcoming patent expirations and increased generic competition, the average retail price for gabapentin ER is expected to decline by approximately 20-30% over the next three years. By 2028, the average price for generic formulations may stabilize between $40 and $80 monthly, depending on manufacturing costs and market penetration.

However, during initial post-patent expiry phases, some branded formulations could command premium pricing due to clinical preference or formulation advantages. Should novel formulations or new indications receive regulatory approval, premium pricing could be sustained for specific segments.

Premium and Niche Markets

For niche applications such as treatments for refractory epilepsy or formulations with unique delivery mechanisms, pricing may retain a premium. Additionally, markets with limited generic penetration, like certain Asian or emerging economies, could see higher per-unit prices.

Market Challenges and Opportunities

Challenges

- Price Erosion: Generic competition is the primary downward driver.

- Regulatory Uncertainty: Revisions around off-label use approval or new safety labeling can impact marketability.

- Reimbursement Policies: Variability across regions influences access and pricing.

Opportunities

- Innovative Delivery Systems: Transdermal patches or implantable devices could command higher prices.

- New Therapeutic Indications: Approvals for additional indications offer pricing leverage.

- Segment Expansion: Focused marketing in emerging markets and combination therapies could sustain growth.

Conclusion

The GABAPENTIN ER market is poised for steady growth driven by aging demographics, expanding indications, and increasing clinical adoption. While generic entry and regulatory pressures are expected to suppress prices over time, opportunities exist in niche markets and innovative formulations. Stakeholders should adopt dynamic pricing strategies aligned with patent statuses, regulatory landscapes, and regional market conditions.

Key Takeaways

- The global GABAPENTIN ER market is projected to grow at a CAGR of approximately 5% through 2028, reaching $3.6 billion.

- The patent expiry of branded formulations will lead to significant price reductions, with generic prices expected to stabilize between $40-$80/month by 2028.

- Market growth hinges on expanding indications, demographic trends, and formulations with improved pharmacokinetics.

- Competitive pressure from generics and alternative therapies necessitates strategic pricing, marketing, and innovation.

- Opportunities exist in niche indications, combination therapies, and emerging markets for premium pricing strategies.

FAQs

1. How will patent expirations affect GABAPENTIN ER pricing?

Patent expirations typically lead to a surge in generic availability, driving prices downward. The branded GABAPENTIN ER could see a price drop of 20-30%, with generics costing substantially less, thus reducing revenue margins for innovator companies.

2. Are there regulatory hurdles that could impact GABAPENTIN ER's market?

Yes, shifts in off-label use regulations, safety labeling, or approvals for new indications can modify prescribing patterns and market size, influencing pricing and competition.

3. What role do emerging markets play in the future of GABAPENTIN ER?

Emerging markets present growth opportunities due to increasing healthcare access and prevalence of neuropathic conditions. Prices may be higher initially but tend to decrease over time with market maturation and generic entry.

4. Can innovation sustain higher prices for GABAPENTIN ER?

Yes, formulations offering better bioavailability, reduced side effects, or novel delivery mechanisms can command premium pricing in niche or refractory patient populations.

5. How does competition from other drugs like pregabalin impact GABAPENTIN ER?

Pregabalin offers similar indications with different pharmacokinetics, often at comparable or lower costs, intensifying the competitive landscape and pressuring GABAPENTIN ER prices and market share.

Sources

[^1]: MarketResearch.com, "Global Gabapentin Market Forecast," 2022.

[^2]: FDA Drug Approvals Database, 2015.

[^3]: IQVIA, "Pharmaceutical Market Data," 2023.

[^4]: GoodRx, "GABAPENTIN ER Price Trends," 2023.

More… ↓