Share This Page

Drug Price Trends for FT PAIN RELIEVER PM

✉ Email this page to a colleague

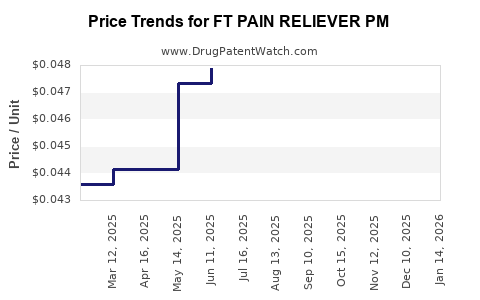

Average Pharmacy Cost for FT PAIN RELIEVER PM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT PAIN RELIEVER PM 500-25 MG GELTAB | 70677-1149-01 | 0.04666 | EACH | 2025-12-17 |

| FT PAIN RELIEVER PM 500-25 MG GELTAB | 70677-1149-01 | 0.04526 | EACH | 2025-11-19 |

| FT PAIN RELIEVER PM 500-25 MG GELTAB | 70677-1149-01 | 0.04637 | EACH | 2025-10-22 |

| FT PAIN RELIEVER PM 500-25 MG GELTAB | 70677-1149-01 | 0.04703 | EACH | 2025-09-17 |

| FT PAIN RELIEVER PM 500-25 MG GELTAB | 70677-1149-01 | 0.04712 | EACH | 2025-08-20 |

| FT PAIN RELIEVER PM 500-25 MG GELTAB | 70677-1149-01 | 0.04785 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Pain Reliever PM

Introduction

The pharmaceutical landscape for over-the-counter (OTC) products, notably sleep aids and pain relievers, remains highly competitive and dynamic. FT Pain Reliever PM, a combination product targeting pain management and insomnia, presents a strategic opportunity with its dual-action formulation. Given its distinct positioning, understanding market trends, competitive forces, and pricing dynamics is vital for stakeholders aiming to optimize market entry and profitability.

Product Overview

FT Pain Reliever PM combines analgesic and sedative ingredients tailored for consumers seeking relief from pain and associated sleep disturbances. Its formulation includes standard OTC analgesics like acetaminophen or NSAIDs, paired with sedative agents such as diphenhydramine or doxylamine, aligning with existing sleep aid products. The product’s unique proposition lies in its convenience and targeted health benefits, potentially attracting a broad demographic of adults aged 30-65.

Market Landscape

Market Size and Growth Potential

The global sleep aid market was valued at approximately USD 73.4 billion in 2021 and is projected to grow at a CAGR of 4.8% through 2028 [1]. Simultaneously, the pain management segment remains substantial, with OTC analgesics constituting a significant share. The convergence of these segments, exemplified by FT Pain Reliever PM, is driven by rising consumer awareness about sleep health, chronic pain prevalence, and convenience-driven demand.

In the U.S., OTC sleep aids account for over USD 400 million annually, with analgesics surpassing USD 1 billion [2]. The integration of these functionalities positions FT Pain Reliever PM favorably within a growing, multi-billion-dollar market.

Consumer Trends and Demographics

Data indicates increased consumer preference for multi-functional OTC products to reduce medication burden. Aging populations and lifestyle-related sleep and pain issues drive demand. Additionally, consumers seek ease of access, especially amid the COVID-19 pandemic's impact on healthcare access.

Regulatory Environment

The OTC status of FT Pain Reliever PM entails strict adherence to FDA guidelines on labeling, safety, and efficacy. The product’s formulation must avoid prohibited ingredients, ensuring compliance to avoid regulatory setbacks. Post-approval, monitoring for adverse events and consumer feedback will be critical for sustained success.

Competitive Analysis

Key Competitors

- Tylenol PM: Combines acetaminophen with diphenhydramine, widely marketed for pain and sleep.

- Midol Complete: Addresses menstrual pain with sleep support ingredients.

- ZzzQuil Sleep-Aid: Purely focused on sleep, often combined with analgesics separately.

Differentiating Factors

FT Pain Reliever PM's potential differentiators include formulation innovations (e.g., longer-lasting effects), better safety profiles, or targeted branding campaigns focusing on dual efficacy. Market incumbents primarily leverage established brand recognition; therefore, entering with a compelling unique selling proposition is essential.

Market Barriers

- Brand loyalty to established products.

- Regulatory hurdles concerning labeling and claims.

- Consumer skepticism about combined OTC formulations.

Pricing Strategy and Projections

Current Market Pricing

The retail price for existing OTC pain and sleep remedies ranges from USD 5 to USD 12 per package, with variations based on formulation, brand, and packaging. Tylenol PM retails approximately at USD 8-10, reflecting its market positioning.

Pricing Considerations for FT Pain Reliever PM

- Value proposition: Combining pain relief and sleep aid at a competitive price point can attract consumers seeking convenient solutions.

- Cost of goods (COGS): Estimated manufacturing costs should aim for a margin of at least 40%, considering active ingredients, packaging, and distribution.

- Market positioning: Premium branding may justify higher pricing; conversely, penetration pricing can foster rapid adoption.

Projected Price Range

Based on comparative analysis, initial retail pricing for FT Pain Reliever PM is projected at USD 9.99 to USD 11.99 per 20-count package. Tiered pricing strategies might employ promotional discounts and bundling to enhance market penetration.

Price Trajectory

- Year 1: USD 10.49 average retail, capturing early adopter segments.

- Year 2-3: Competitive adjustments to USD 9.99, promoting volume growth.

- Post-Launch: Incorporate consumer feedback and market data to refine pricing, possibly introducing value packs or larger formats at discounted per-unit costs.

Impact of Market Dynamics

Pricing will be sensitive to raw material costs (e.g., active ingredients), regulatory changes, and competitive responses. Should new entrants emerge or regulations tighten, the product may need to adapt pricing strategies accordingly.

Market Entry and Growth Strategies

- Brand Differentiation: Emphasize safety, efficacy, and convenience.

- Pricing Promotions: Launch discounts and loyalty programs.

- Distribution Channels: Maximize placements in pharmacies, supermarkets, online platforms.

- Consumer Education: Clarify product benefits and safe usage to mitigate skepticism.

Regulatory and Pharmacovigilance Considerations

Ongoing post-market surveillance of adverse events will influence pricing adjustments, especially if safety concerns arise. Regulatory compliance and transparent communication underpin successful market presence.

Conclusion

FT Pain Reliever PM is positioned within a robust and expanding market characterized by consumer demand for convenient, multi-functional OTC products. Competitive positioning, alongside strategic pricing and branding, will be pivotal. The projected retail price range of USD 9.99–USD 11.99 offers a competitive entry point, balancing margins and market attractiveness. Continuous monitoring of regulatory developments, consumer preferences, and competitive moves will be essential for sustained success.

Key Takeaways

- The combined OTC pain and sleep aid market is growing due to demographic shifts and consumer preferences for multi-functional products.

- Competitive differentiation hinges on formulation innovation, branding, and consumer education.

- Initial pricing of FT Pain Reliever PM is projected between USD 9.99 and USD 11.99, aligning with existing market leaders.

- Market entry strategies should focus on distribution expansion, promotional campaigns, and post-launch surveillance.

- Continuous market monitoring, regulatory compliance, and consumer feedback are critical for optimizing pricing and market positioning.

FAQs

1. What factors influence the pricing of OTC combination products like FT Pain Reliever PM?

Pricing is influenced by manufacturing costs, competitive landscape, consumer willingness to pay, perceived value, regulatory considerations, and distribution channel strategies.

2. How does the market competition affect FT Pain Reliever PM's pricing strategy?

High competition with established brands necessitates competitive pricing, promotional offers, and clear differentiation to capture market share and build consumer trust.

3. What regulatory hurdles could impact the pricing and marketing of FT Pain Reliever PM?

Regulations concerning ingredient safety, marketing claims, labeling, and post-market surveillance influence product formulation, branding, and ultimately, pricing.

4. How can market trends influence long-term price projections?

Rising consumer demand for multi-functional OTC products, demographic aging, and increased health awareness can justify gradual price increases or premium positioning over time.

5. What distribution channels are optimal for launching FT Pain Reliever PM?

Pharmacies, supermarkets, convenience stores, and e-commerce platforms are essential channels, with online sales offering targeted marketing and pricing flexibility.

Sources

[1] Grand View Research, "Sleep Aids Market Size & Trends," 2022.

[2] Nielsen, "Over-the-Counter Analgesics Sales Data," 2021.

More… ↓