Share This Page

Drug Price Trends for FT CHILD ACETAMINOPHEN

✉ Email this page to a colleague

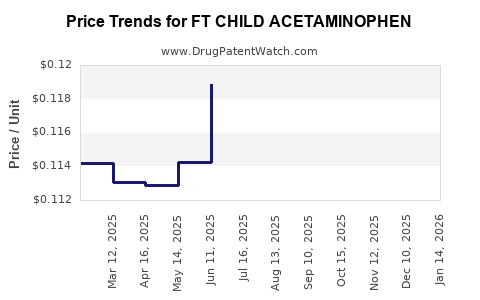

Average Pharmacy Cost for FT CHILD ACETAMINOPHEN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT CHILD ACETAMINOPHEN 160 MG | 70677-1127-01 | 0.11689 | EACH | 2025-12-17 |

| FT CHILD ACETAMINOPHEN 160 MG | 70677-1127-01 | 0.11463 | EACH | 2025-11-19 |

| FT CHILD ACETAMINOPHEN 160 MG | 70677-1127-01 | 0.11636 | EACH | 2025-10-22 |

| FT CHILD ACETAMINOPHEN 160 MG | 70677-1127-01 | 0.11734 | EACH | 2025-09-17 |

| FT CHILD ACETAMINOPHEN 160 MG | 70677-1127-01 | 0.12174 | EACH | 2025-08-20 |

| FT CHILD ACETAMINOPHEN 160 MG | 70677-1127-01 | 0.11743 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Child Acetaminophen

Introduction

Acetaminophen, commonly known as paracetamol, is a globally essential medicine for pain and fever management. The formulation marketed under the trade name FT Child Acetaminophen targets pediatric use, primarily in formulations suitable for children. The expanding pediatric healthcare market, regulatory environment, manufacturing dynamics, and competitive landscape significantly influence its market trajectory and pricing models. This report provides a detailed analysis of the current market landscape and projections for FT Child Acetaminophen over the coming years.

Market Overview

Global Demand for Pediatric Paracetamol

The pediatric analgesic and antipyretic segment, driven by rising childhood illnesses, vaccination programs, and increasing awareness of pediatric healthcare, underscores sustained demand for child-specific formulations of acetaminophen. The global pediatric pain management market is estimated to reach USD 4.8 billion by 2027, with acetaminophen formulations accounting for a substantial share [1].

Developed regions like North America and Europe dominate consumption due to high healthcare standards, regulatory stringency, and consumer awareness. Meanwhile, emerging markets such as Asia-Pacific exhibit rapid growth potential driven by expanding healthcare infrastructure and increasing affordability.

Distribution Channels

Key distribution avenues include pharmacies, hospitals, and online platforms. The COVID-19 pandemic accelerated online procurement, yet traditional channels retain dominance in pediatric drugs. Regulatory approvals and prescription guidelines significantly influence distribution.

Competitive Landscape

Major players in pediatric acetaminophen include Johnson & Johnson, McNeil Consumer Healthcare, and Perrigo Company. Several generics manufacturers operate in emerging countries, often offering lower-cost options. Patent status largely influences market competition, though many formulations are off-patent.

Key companies and their strategies:

- Johnson & Johnson emphasizes brand loyalty and pediatric safety profiles.

- Perrigo focuses on affordable, high-quality generics for mass markets.

- Emerging players target underserved regions with cost-effective manufacturing.

Intellectual property rights, especially regarding formulations and delivery systems, shape competitive dynamics. FT Child Acetaminophen's brand positioning, safety profile, and manufacturing scale influence its market share.

Regulatory Environment

Regulatory agencies such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and respective health authorities impose strict standards for pediatric formulations. Recent updates emphasize safety (e.g., labeling for dosing and contraindications), quality control, and manufacturing standards.

Post-2010, regulatory directives have scrutinized liquid formulations' safety, impacting formulation development and recall rates [2]. Market players must navigate complex approval pathways and ensure compliance to sustain competitiveness.

Pricing Dynamics and Trends

Pricing Factors

- Manufacturing costs: Scale efficiencies reduce per-unit costs; complex formulations may command higher prices.

- Regulatory compliance: Meeting safety standards adds to costs, influencing final pricing.

- Brand vs. generic: Established brands like Tylenol often command premium prices compared to generics.

- Market segment: In high-income markets, consumers and payers accept higher prices motivated by safety and quality assurances.

Historical Price Trends

Between 2010-2022, pediatric acetaminophen prices have remained relatively stable in developed markets, with occasional fluctuations due to supply chain disruptions or regulatory changes (e.g., formulations requiring additional testing). The average retail price for a 100 mL liquid bottle typically ranged from USD 3 to USD 7, depending on the brand and region.

Impact of Patent Expiry and Generics

The expiration of patents for branded formulations generally leads to price erosion, with generic versions pricing 20-50% lower than branded counterparts [3]. FT Child Acetaminophen, if off-patent, faces intensified price competition but benefits from established manufacturing and distribution networks.

Market and Price Projections (2023-2028)

Market Growth Projections

The pediatric acetaminophen market is expected to grow at a CAGR of 4.5% from 2023 to 2028, driven by population growth, urbanization, and increasing healthcare access in emerging nations. The Asia-Pacific region is projected to witness the highest growth rates (~6%), fueled by China and India’s expanding healthcare sectors.

Price Trend Forecast

-

Short-term (2023-2025): Prices are expected to remain relatively stable, with minor fluctuations owing to manufacturing cost adjustments and inflation. Supply chain stability will be a critical factor; disruptions could inflate prices temporarily.

-

Mid-term (2025-2028): Prices may gradually decline in saturated markets due to increased competition and generic proliferation. Conversely, in regions with strict regulatory or quality standards, premium pricing for high-quality formulations could sustain higher price points.

-

Potential for Premiumization: Introduction of value-added features, such as sugar-free, dye-free, or organic formulations, could enable manufacturers to command higher prices.

Influencing Factors

- Regulatory Changes: New safety or efficacy mandates could lead to reformulations, impacting costs and prices.

- Raw Material Costs: Fluctuations in APIs and excipients impact manufacturing expenses.

- Supply Chain Dynamics: Post-pandemic recovery will determine availability and pricing stability.

- Market Penetration Strategies: Entrants offering affordable, quality pediatric acetaminophen could pressure existing prices downward.

Conclusion

FT Child Acetaminophen operates within a highly competitive, regulated, and rapidly evolving market. Its future pricing hinges on manufacturing efficiencies, competitive dynamics, regulatory compliance, and regional demand trends. While mature markets might see stabilization, emerging markets present significant growth opportunities with potential price reductions driven by generics and increased production capacity.

Key Takeaways

- The pediatric acetaminophen market is poised for steady growth, especially in emerging regions.

- Price stability in developed markets persists amid competition; however, generics exert downward pressure.

- Regulatory developments emphasizing safety and quality influence formulation costs and pricing strategies.

- Innovations in formulation and branding can support premium pricing segments.

- Supply chain resilience and raw material cost management are vital for maintaining competitive pricing.

FAQs

Q1: How does patent expiration influence the pricing of FT Child Acetaminophen?

A1: Patent expiry typically leads to increased generic competition, driving prices downward by 20-50%. Manufacturers may also reduce prices to maintain market share against low-cost entrants.

Q2: What regional factors impact the pricing of pediatric acetaminophen formulations?

A2: Regulatory stringency, market maturity, purchasing power, and distribution infrastructure influence pricing. Developed regions tend to maintain higher prices due to safety standards and brand preferences, while emerging markets prioritize affordability.

Q3: Are there opportunities for premium pricing in the pediatric acetaminophen segment?

A3: Yes. Features such as organic ingredients, dye-free formulations, or flavor enhancements can justify premium prices in health-conscious or premium markets.

Q4: How might regulatory changes affect the future market for FT Child Acetaminophen?

A4: Stricter safety and efficacy requirements could increase formulation and testing costs, potentially raising prices temporarily. Conversely, supportive regulatory pathways could facilitate faster market entry and potentially lower prices through competition.

Q5: What trends could disrupt current market and pricing projections for pediatric acetaminophen?

A5: Supply chain disruptions, raw material shortages, new safety regulations, or disruptive innovations (e.g., transdermal delivery) could alter supply-demand dynamics and pricing strategies.

Sources

- MarketWatch. Pediatric Pain Management Market Size & Share. 2022.

- U.S. FDA. Pediatric Drug Safety & Labeling Developments. 2021.

- IQVIA. Impact of Patent Expiry on Generic Pricing. 2022.

More… ↓