Share This Page

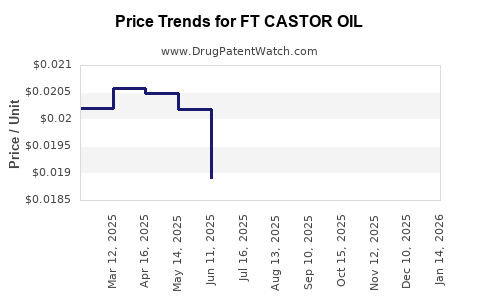

Drug Price Trends for FT CASTOR OIL

✉ Email this page to a colleague

Average Pharmacy Cost for FT CASTOR OIL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT CASTOR OIL | 70677-1085-01 | 0.02129 | ML | 2025-12-17 |

| FT CASTOR OIL | 70677-1085-01 | 0.02106 | ML | 2025-11-19 |

| FT CASTOR OIL | 70677-1085-01 | 0.02075 | ML | 2025-10-22 |

| FT CASTOR OIL | 70677-1085-01 | 0.01989 | ML | 2025-09-17 |

| FT CASTOR OIL | 70677-1085-01 | 0.01853 | ML | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Castor Oil

Introduction

Castor oil, derived from Ricinus communis, remains a versatile industrial and pharmaceutical ingredient with extensive applications spanning cosmetics, pharmaceuticals, lubricants, and plastics. As a specialty commodity, the FT (Full Traceability) Castor Oil market has experienced notable shifts driven by evolving consumer demand, regulatory standards, and supply chain dynamics. This report offers a comprehensive analysis of the current market landscape, future price trajectories, and factors influencing FT castor oil's valuation.

Market Overview

Demand Drivers

The global castor oil industry exhibits robust growth, driven predominantly by expanding applications in:

- Pharmaceuticals: Castor oil's medicinal properties, including its use as a laxative and in drug formulations, sustain steady demand.

- Cosmetics & Personal Care: Increased consumer preference for natural ingredients boosts the use of castor oil in skincare, haircare, and beauty products.

- Industrial Uses: Specialty lubricants, paint additives, and bio-based plastics employ castor oil due to its biodegradability and unique chemical properties.

According to Market Research Future (MRFR), the global castor oil market is projected to grow at a CAGR of approximately 5% from 2022 to 2028, reaching an estimated valuation of USD 2.4 billion by 2028[1].

Regional Dynamics

Key regional markets include:

- India: The largest producer, accounting for over 80% of global castor seed production, with domestic consumption fueled by expanding industrial segments.

- Asia-Pacific: Fastest-growing region, driven by increasing demand in cosmetics and industrial applications.

- North America & Europe: Steady growth, especially in premium segments such as specialty pharmaceuticals and natural cosmetics.

Supply Chain Considerations

The supply chain heavily relies on Indian harvest cycles, with fluctuations influenced by weather conditions, agricultural practices, and geopolitical factors. Sustainable cultivation and traceability initiatives bolster demand for FT-certified castor oil, particularly in regulated industries like pharma and cosmetics.

Price Analysis

Current Market Price

As of early 2023, FT castor oil prices range between USD 3.50 to USD 4.50 per kilogram, depending on quality standards, purity levels, and certification (e.g., organic, traceable). Premium, organic, and FT-certified varieties command premiums of 10-15% over conventional grades.

Factors Affecting Pricing

- Raw Material Costs: Seed prices, influenced by global agricultural trends, directly impact castor oil pricing.

- Certification and Traceability: FT certification entails additional costs but meets increasing regulatory and consumer standards, often leading to higher market value.

- Quality & Purity: Pharmaceutical-grade castor oil, requiring stringent manufacturing practices, fetches higher prices.

- Supply Chain Disruptions: COVID-19 and geopolitical tensions have intermittently disrupted supply, creating price volatility.

Future Price Projections

Short-Term Outlook (2023-2025)

Given current supply-demand dynamics, prices are expected to stabilize around USD 4.00 to USD 4.60 per kilogram. Factors contributing include:

- Continued growth in end-use sectors.

- Increasing adoption of FT traceability for compliance and marketing advantages.

- Potential raw material supply constraints during off-harvest seasons.

Long-Term Outlook (2026-2030)

Projected trajectories suggest a compound annual growth in prices of approximately 3-4%, driven by:

- Sustainable and Traceable Supply: Growing consumer awareness and stringent regulations favor FT-certified castor oil, possibly elevating prices by 15-20% over baseline estimates.

- Technological Innovations: Advances in agricultural practices and extraction techniques could reduce costs, potentially moderating price increases.

- Environmental Policies: Increased emphasis on biodegradable, plant-based oils aligns with rising eco-conscious consumer demand, likely maintaining upward pricing pressures.

- Emerging Markets: Growth in Asia-Pacific will sustain demand, supporting premium pricing structures.

Key Influences on Future Pricing

- Regulatory Adoption: Stricter standards for pharmaceutical and cosmetic ingredients will favor FT-certified products, potentially boosting premiums.

- Climate Change: Variability in crop yields may introduce supply volatility, influencing prices.

- Competitive Substitutes: Development of alternative bio-based oils could pose substitution risks, capping price escalations.

Challenges and Opportunities

Challenges

- Price Volatility: Fluctuations driven by crops yields and geopolitical factors.

- Quality Assurance: Maintaining certification standards amid rising demand may increase operational complexity.

- Supply Chain Constraints: Disruptions can cause supply-demand imbalances, impacting prices.

Opportunities

- Premium Market Segments: Expanding organic and FT-certified product lines in pharmaceuticals and cosmetics.

- Innovation: Investing in sustainable cultivation and processing methods to reduce costs.

- Global Expansion: Tapping into emerging markets with increasing bio-based product adoption.

Conclusion

The FT castor oil market is positioned for steady growth, bolstered by rising demand in pharmaceuticals, cosmetics, and industrial sectors. Price projections indicate a moderate upward trajectory, supported by increasing consumer awareness, regulatory requirements, and supply chain evolutions. Stakeholders that prioritize traceability, quality assurance, and sustainable sourcing will be better positioned to capitalize on market opportunities and mitigate volatility.

Key Takeaways

- FT castor oil's market is expanding, driven by its natural, traceable profile and multifaceted applications.

- Current prices hover around USD 3.50 to USD 4.50/kg, with premiums for organic and certified qualities.

- Prices are projected to grow at 3-4% annually through 2030, influenced by demand trends and supply chain factors.

- Regulatory developments favoring traceable, sustainable products can enhance premium pricing.

- Investing in sustainable cultivation, quality assurance, and traceability capabilities offers competitive advantages.

FAQs

1. What are the main factors driving the demand for FT castor oil?

Demand is driven by its application in pharmaceuticals, cosmetics, biodegradable lubricants, and plastics, coupled with consumer preferences for natural, eco-friendly ingredients and increasing regulatory requirements for traceability.

2. How does certification impact the pricing of FT castor oil?

Certification, especially full traceability (FT), adds operational costs but commands higher market premiums—typically 10-15%—by meeting regulatory standards and consumer expectations for authenticity and sustainability.

3. What are the risks associated with future price increases in castor oil?

Supply disruptions due to weather, geopolitical tensions affecting India (the dominant producer), and technological or regulatory changes could introduce volatility and constrain supply, affecting prices.

4. Which regions are expected to see the highest growth in castor oil demand?

Asia-Pacific, notably India, China, and Southeast Asia, will lead growth due to expanding industrial use and consumer markets. North America and Europe will sustain demand in premium segments.

5. How can stakeholders capitalize on the forecasted market growth?

By investing in sustainable cultivation practices, ensuring compliance with traceability standards, expanding premium product lines, and innovating in extraction and processing methods, companies can strengthen their market position amid rising prices.

Sources:

[1] Market Research Future, "Castor Oil Market Forecast to 2028," 2022.

More… ↓