Last updated: July 27, 2025

Introduction

FOCALIN XR (dexmethylphenidate extended-release) is a prescription medication primarily used for treating Attention Deficit Hyperactivity Disorder (ADHD) in children and adults. As one of the prominent stimulant drugs in the ADHD therapeutic landscape, understanding its market dynamics, competitive positioning, and future pricing trends is critical for pharmaceutical stakeholders, healthcare providers, and investors.

Market Overview

Global ADHD Treatment Market Dynamics

The global ADHD treatment market experienced significant growth over the past decade, driven by increasing diagnosis rates, expanding pediatric and adult patient populations, and the proliferation of both pharmacologic and non-pharmacologic interventions. The market was valued at approximately US$10 billion in 2021, with projections to reach over US$15 billion by 2030 (1). This growth is further fueled by increased awareness, improved diagnostic criteria, and the rising acceptance of stimulant therapies.

Key Players and Competitive Landscape

FOCALIN XR faces competition from several brands within the stimulant and non-stimulant classes, including:

- Adderall XR (amphetamine mixed salts)

- Ritalin LA (methylphenidate)

- Vyvanse (lisdexamfetamine)

- Concerta (methylphenidate extended-release)

- Strattera (atomoxetine, non-stimulant)

The drug's competitive positioning hinges on its efficacy profile, dosing convenience due to extended-release formulation, safety profile, and patient/treatment provider preferences.

Market Penetration and Prescribing Trends

Current Usage Patterns

FOCALIN XR commands a significant share within prescription stimulant-based ADHD therapies, particularly in pediatric settings, owing to its favorable once-daily dosing that improves adherence. Data indicates that in the United States, approximately 2.5 million children aged 6-17 are treated annually with stimulant medications, with FOCALIN XR accounting for roughly 15–20% of prescriptions among methylphenidate formulations (2).

Regional Market Trends

North America remains the dominant market, driven by high diagnosis rates and insured access. Europe's adoption rate is growing, influenced by increased awareness and stringent regulatory approvals. Emerging markets in Asia-Pacific show promising expansion potential but face challenges due to regulatory hurdles and pricing pressures.

Market Drivers and Barriers

Drivers

- Rising prevalence of ADHD globally

- Increased physician awareness

- Preference for once-daily formulations

- Favorable safety profile of dexmethylphenidate vs. other stimulants

- Competitive pricing strategies and formulary inclusion

Barriers

- Concerns over stimulant abuse and regulatory scrutiny

- Competition from generic formulations

- Pediatric safety concerns, particularly in long-term use

- Pricing pressures from insurers and government payers

Pricing Analysis of FOCALIN XR

Current Pricing Landscape

FOCALIN XR’s pricing varies across markets but typically follows a premium pricing model aligned with brand-name stimulant medications. In the U.S., the average wholesale price (AWP) per 20 mg capsule is approximately US$11–15, equating to roughly US$330–US$450 monthly for standard dosing (3). Generic methylphenidate extended-release options are priced at around 30–50% lower, influencing formulary decisions.

Reimbursement and Cost-Effectiveness

Third-party payers evaluate the cost-effectiveness of FOCALIN XR based on efficacy, safety, and adherence advantages. In some regions, formulary restrictions favor generic alternatives, constraining manufacturer pricing power. However, FOCALIN XR’s convenience and efficacy tend to justify premium pricing when supported by clinical outcomes.

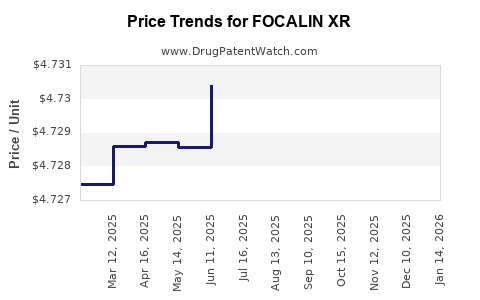

Price Projection Analysis

Factors Influencing Future Pricing

- Patent and Exclusivity Status: FOCALIN XR's patents are scheduled to expire in the early 2020s, paving the way for generic competition (4). Generic entries often reduce prices by 40–60%, pressuring brand pricing.

- Regulatory Approvals: Secure approvals for expanded indications (e.g., adult ADHD) can sustain or enhance demand, potentially moderating price erosion.

- Market Penetration: Increasing adoption in emerging markets may allow for tiered pricing strategies, moderately elevating prices where regulatory and economic conditions permit.

- Cost Containment Strategies: Payers’ push towards cost-effective generics will likely accelerate price declines over the next 3–5 years, especially post-patent expiry.

Projected Price Trends

- Short-term (1–2 years): Expect slight declines (~5–10%) in U.S. brand prices due to biosimilar and generic competition, alongside market saturation.

- Mid-term (3–5 years): Prices are projected to stabilize at 40–50% below current levels, with increased availability of generics and biosimilars.

- Long-term (beyond 5 years): Market dynamics may favor generics, with branded prices declining further, though niche premium pricing may persist due to clinical advantages or formulation improvements.

Implications for Stakeholders

Pharmaceutical companies planning to market or invest in dexmethylphenidate products should consider patent timelines, regulatory pathways for generics, and pricing strategies aligned with evolving payer preferences. Healthcare providers should balance efficacy, safety, and formulary considerations when prescribing, especially as price fluctuations influence accessibility.

Key Takeaways

- The ADHD treatment landscape is poised for continued growth, with stimulant drugs like FOCALIN XR at the forefront.

- Patent expiry in the early 2020s will likely accelerate generic competition, exerting downward pressure on prices.

- Current premium pricing aligns with brand value, but impending competition suggests near-term price reductions.

- Expansion into emerging markets could offer revenue diversification, albeit with price sensitivity considerations.

- Stakeholders must monitor regulatory changes, payer policies, and market entry timings to optimize investment and clinical decisions.

FAQs

1. How does FOCALIN XR differ from other methylphenidate formulations?

FOCALIN XR (dexmethylphenidate) contains the d-enantiomer of methylphenidate, which is pharmacologically active and may provide a more targeted action with potentially fewer side effects, compared to racemic methylphenidate formulations like Ritalin LA.

2. What is the patent situation for FOCALIN XR?

Patents protecting FOCALIN XR are set to expire in the early 2020s, opening the market for generic dexmethylphenidate extended-release formulations. This transition is expected to catalyze significant price reductions.

3. What are the future growth prospects for FOCALIN XR?

Growth prospects depend on patent expiry timing, regulatory approvals for broader indications, and activity in emerging markets. Despite increasing generic competition, niche clinical advantages and brand loyalty may sustain moderate demand.

4. How will generic entry impact the pricing of FOCALIN XR?

The entrance of generics typically reduces brand prices by 40–60%, depending on market competition and regulatory factors. This will likely lead to downward pressure on FOCALIN XR’s premium pricing.

5. Are there emerging alternatives that could replace FOCALIN XR?

Non-stimulant medications like atomoxetine (Strattera) and novel non-pharmacologic therapies are alternative options. However, stimulant medications like FOCALIN XR remain preferred due to their rapid onset and efficacy, unless specific safety concerns or contraindications emerge.

References

- Market Research Future. (2022). ADHD Treatment Market Analysis and Forecast.

- IQVIA. (2022). Top Prescriptions for ADHD Medications in the U.S.

- Medscape. (2022). Cost Data for ADHD Medications.

- U.S. Patent and Trademark Office. (2022). Patent Expirations for Focalin XR.