Share This Page

Drug Price Trends for FLUVOXAMINE ER

✉ Email this page to a colleague

Average Pharmacy Cost for FLUVOXAMINE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FLUVOXAMINE ER 150 MG CAPSULE | 27241-0275-30 | 5.05271 | EACH | 2025-12-17 |

| FLUVOXAMINE ER 100 MG CAPSULE | 69452-0182-13 | 4.93143 | EACH | 2025-12-17 |

| FLUVOXAMINE ER 150 MG CAPSULE | 10370-0176-11 | 5.05271 | EACH | 2025-12-17 |

| FLUVOXAMINE ER 100 MG CAPSULE | 00228-2848-03 | 4.93143 | EACH | 2025-12-17 |

| FLUVOXAMINE ER 150 MG CAPSULE | 00228-2849-03 | 5.05271 | EACH | 2025-12-17 |

| FLUVOXAMINE ER 100 MG CAPSULE | 10370-0175-11 | 4.93143 | EACH | 2025-12-17 |

| FLUVOXAMINE ER 100 MG CAPSULE | 27241-0274-30 | 4.93143 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Fluvoxamine ER

Introduction

Fluvoxamine ER, a selective serotonin reuptake inhibitor (SSRI), primarily prescribed for the treatment of obsessive-compulsive disorder (OCD) and anxiety disorders, has garnered renewed attention during the COVID-19 pandemic due to emerging evidence of potential antiviral and anti-inflammatory properties. As an extended-release formulation, Fluvoxamine ER offers advantages in compliance and tolerability over immediate-release variants, further shaping its market dynamics. This report provides a detailed market analysis and price projection outlook, including key factors influencing supply, demand, pricing strategies, and regulatory trends.

Market Overview

Therapeutic Landscape

Fluvoxamine ER's primary indications remain OCD and anxiety disorders, representing a mature segment with established prescribing practices. Its off-label use for COVID-19-related treatment has, however, introduced volatility and fresh interest among stakeholders. The global antidepressant market exceeded USD 15 billion in 2022 [1], with SSRIs accounting for a significant share, driven by increasing prevalence of mental health conditions.

Key Players and Supply Chain

Major pharmaceutical companies such as Johnson & Johnson (marketed as Luvox), Solvay, and select generic manufacturers produce Fluvoxamine ER. The drug’s manufacturing involves complex synthesis and extended-release formulation technology, influencing production costs. Patent expirations and biosimilar entries also impact market competition and price competition.

Regulatory Context

FDA approval for fluvoxamine as an SSRI remains unchanged; however, recent emergency use authorizations or ongoing clinical trials for COVID-19 indication could reshape the regulatory landscape. Approval or endorsement for new indications typically bolsters market demand, influencing pricing.

Market Drivers and Barriers

Drivers

- Mental health trends: Rising prevalence of OCD and anxiety syndromes, compounded by COVID-related stress, sustains demand.

- Off-label COVID-19 use: Preliminary studies (e.g., the STOP COVID trial) suggest fluvoxamine may reduce severity in early COVID-19, increasing off-label prescribing; a factor that can temporarily inflate prices.

- Advanced formulation advantages: ER formulations improve adherence, allowing clinicians to prefer fluvoxamine ER over immediate release versions, greater market penetration.

- Increasing generic competition: Post-patent expiration, generic versions substantially lower costs, expanding access and utilization.

Barriers

- Regulatory restrictions: Pending confirmation of COVID-19 indications might restrict off-label expansion.

- Side effect profile: Gastrointestinal disturbances, sexual dysfunction, and drug interactions limit broader use.

- Market saturation: Established SSRIs and generic competitors curtail aggressive pricing.

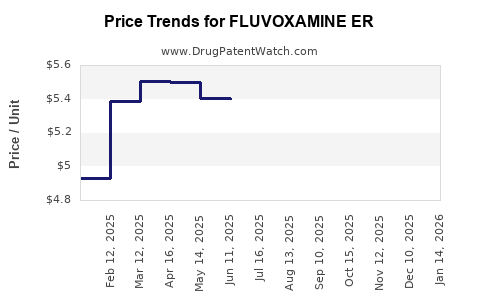

Pricing Dynamics and Trends

Current Pricing Landscape

As of early 2023, branded fluvoxamine ER (produced by J&J) retails at approximately USD 250–USD 350 for a 30-day supply (30 capsules of 100 mg), varying by country and healthcare system. Generic formulations, where available, price at an average of USD 100–USD 150 per month, indicating a typical 50%–60% reduction in cost post-patent expiry.

Factors Influencing Price Movements

- Regulatory approvals: The expansion into COVID-19 treatment indications could temporarily increase prices due to heightened demand and limited supply, especially if manufacturing bottlenecks occur.

- Market competition: Entry of generics steadily depresses prices, especially in mature markets like the US and Europe.

- Supply chain disruptions: Global semiconductor shortages and raw material constraints could elevate manufacturing costs temporarily.

- Reimbursement policies: Insurance coverage and formulary inclusions heavily influence retail prices; expanded coverage drives volume, potentially pressuring prices downward.

Future Price Projections

Based on current trends and historical data of similar SSRIs:

- Short-term (1–2 years): Prices for branded Fluvoxamine ER are anticipated to decline gradually by 10%–15%, driven by generic market entry and increased competition.

- Medium-term (3–5 years): With COVID-19 indications potentially gaining approval or backing, demand could stabilize or slightly increase prices, especially for formulations with patent protection or exclusive manufacturing rights. Prices could range from USD 200 to USD 300 per month.

- Long-term (5+ years): As biosimilars or alternative therapies emerge and demand stabilizes, prices are expected to further decline, possibly settling around USD 80–USD 120 for generics.

Market Outlook: Opportunities and Risks

Opportunities

- Expansion into additional indications: Positive trial outcomes for COVID-19 or other inflammatory conditions may create new revenue streams.

- Diversified formulations: Development of novel sustained-release forms or combination therapies can command premium pricing.

- Emerging markets: Growing mental health awareness and healthcare infrastructure expansion offer higher penetration potential in Asia-Pacific, Latin America, and Africa.

Risks

- Regulatory hurdles: Delays or rejections for new indications can dampen demand.

- Clinical outcome uncertainties: Variability in study results for COVID-19 efficacy impacts prescribing trends.

- Market saturation: Dominance by cheaper generics can erode profit margins for branded products.

Key Takeaways

- Fluvoxamine ER remains a relevant player within the SSRI class, with expanding off-label COVID-19 applications temporarily influencing its market dynamics.

- The mature segment is characterized by declining prices post-patent expiry, though upcoming regulatory actions and clinical evidence could shift demand trajectories.

- Branded prices are expected to fall steadily over the coming five years, with generics driving the majority of market share and price competition.

- Supply disruptions or manufacturing challenges could introduce short-term price volatility, while increased production capacity may stabilize costs.

- Healthcare policy changes, reimbursement landscapes, and clinician preferences will strongly influence pricing and market growth in various regions.

Conclusion

Fluvoxamine ER's market is at a pivotal junction, balancing established therapeutic roles with emerging off-label opportunities. While short-term price reductions are foreseeable owing to generic competition, localized demand surges tied to COVID-19 research may temporarily influence pricing structures. Strategic positioning—such as securing approvals for new indications or enhancing formulation benefits—remains crucial for manufacturers seeking sustainable revenue streams.

FAQs

Q1: How will the recent COVID-19 findings affect fluvoxamine ER’s market?

A: Positive clinical trial results supporting COVID-19 treatment could lead to regulatory approvals, increasing demand and potentially enabling premium pricing. However, the off-label status may limit reimbursement and practitioner acceptance until formal approval is granted.

Q2: What is the impact of generic competition on fluvoxamine ER prices?

A: Generic entry typically causes significant price erosion, often reducing costs by 50% or more, boosting accessibility but shrinking profit margins for branded manufacturers.

Q3: When could we expect a significant price decline for fluvoxamine ER?

A: Likely within 3–5 years post-patent expiry, as generics fully penetrate the market, with prices stabilizing around USD 80–USD 150 per month.

Q4: Are there regional variations in fluvoxamine ER pricing?

A: Yes. Pricing varies due to differences in healthcare policies, reimbursement systems, and market maturity. For example, prices tend to be higher in the US compared to emerging markets.

Q5: What factors could disrupt current market predictions?

A: Supply chain issues, regulatory delays, or adverse clinical trial outcomes could reduce demand or increase costs, leading to price volatility.

Sources

[1] Market Data Forecast, "Global Antidepressant Market Size & Share," 2022.

More… ↓