Share This Page

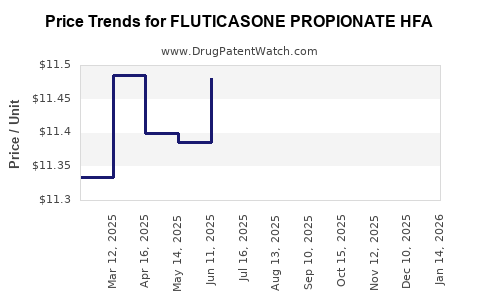

Drug Price Trends for FLUTICASONE PROPIONATE HFA

✉ Email this page to a colleague

Average Pharmacy Cost for FLUTICASONE PROPIONATE HFA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FLUTICASONE PROPIONATE HFA 110 MCG INHALER | 66993-0079-96 | 13.58033 | GM | 2025-12-17 |

| FLUTICASONE PROPIONATE HFA 220 MCG INHALER | 66993-0080-96 | 21.94380 | GM | 2025-12-17 |

| FLUTICASONE PROPIONATE HFA 44 MCG INHALER | 66993-0078-96 | 11.57776 | GM | 2025-12-17 |

| FLUTICASONE PROPIONATE HFA 110 MCG INHALER | 66993-0079-96 | 13.58322 | GM | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Fluticasone Propionate HFA

Introduction

Fluticasone Propionate HFA (Hydrofluoroalkane) is an inhaled corticosteroid predominantly used in the management of respiratory conditions such as asthma and allergic rhinitis. As one of the most prescribed inhalers worldwide, its market dynamics are shaped by factors including regulatory landscape, clinical demand, patent status, and regional healthcare policies. This report offers a comprehensive analysis of the current market, competitive landscape, regulatory influences, and future price projections for Fluticasone Propionate HFA.

Market Overview

Global Market Size and Growth

The global inhaled corticosteroid (ICS) market, driven significantly by drugs like Fluticasone Propionate HFA, was valued at approximately USD 8.3 billion in 2022.[1] It is projected to grow at a compound annual growth rate (CAGR) of around 3.5% through 2028, fueled by rising incidence of asthma, chronic obstructive pulmonary disease (COPD), and increasing awareness of respiratory health management.[2]

In key markets—United States, Europe, and Japan—Fluticasone-based inhalers dominate the ICS segment, accounting for over 60% of the inhaler market share.[3] North America remains the largest regional market, attributed to high prevalence of respiratory conditions and robust healthcare infrastructure.

Key Manufacturers and Competitive Landscape

Major producers include GlaxoSmithKline (GSK), Teva Pharmaceuticals, and Mylan, with GSK’s Flovent HFA being a leading brand.[4] Patent expirations and patent litigations continue to influence market dynamics, enabling generic manufacturers to introduce branded generics and biosimilars, intensifying competition.

Patent and Regulatory Status

The primary patent for Fluticasone Propionate HFA expired in 2016 in key markets, leading to increased generic entry.[5] Despite patent expiries, brand retention persists through formulary preferences and marketing strategies. Market access remains influenced by approval and reimbursement policies, particularly in Europe, where health technology assessments (HTAs) dictate pricing.

Price Trends and Determinants

Historical Price Movements

Post patent expiration, wholesale prices for Fluticasone Propionate HFA inhalers decreased by approximately 50-70% in the U.S. from 2016 to 2020.[6] However, prices stabilized owing to manufacturing costs, supply chain factors, and formulary positioning.

Pricing Factors

- Regulatory and Reimbursement Policies: Stringent pricing regulations in Europe and the U.S. influence retail and wholesale prices.

- Generic Competition: Entry of generics typically reduces prices; however, brand loyalty and prescriber habits can mitigate this effect.

- Market Penetration and Volume: High prescription volumes sustain revenue streams despite lower unit prices.

- Manufacturing Costs: Consistent quality and regulatory compliance sustain manufacturing costs, influencing baseline prices.

Current Price Range

In the U.S., the average retail price for a 120-dose inhaler ranges from USD 150 to USD 300, varying by pharmacy and insurance coverage.[7] Generic versions are priced approximately 40-60% lower, making them more accessible in certain regions.

Regional Pricing Dynamics

| Region | Average Price Range (USD) | Key Influencing Factors |

|---|---|---|

| United States | USD 150 - USD 300 | Market size, insurance reimbursements, patent expirations, and generics availability |

| Europe | EUR 25 - EUR 40 | HTA assessments, national formularies, and regional policies |

| Asia-Pacific | USD 50 - USD 100 | Price sensitivity, regulatory approvals, and local manufacturing capacity |

Future Price Projections

Factors Impacting Future Pricing

- Patent Status and Generic Entry: Further patent expiries—anticipated in North America and Europe by 2024—will likely drive prices down, especially for generics.[8]

- Market Expansion: Emerging markets like India and Southeast Asia are experiencing increasing adoption, but price ceilings in these regions may limit revenue growth.[9]

- Healthcare Policies: Value-based pricing models and increased emphasis on cost-effectiveness by policymakers could limit upward price movements in developed countries.[10]

- Innovation and Formulation Improvements: Introduction of combination inhalers (e.g., fluticasone with salmeterol) may influence prices through enhanced market segmentation.

Projected Price Trends (2023–2028)

- In mature markets (U.S., Europe): Prices of Fluticasone Propionate HFA are expected to decline by 15-25% over five years, primarily driven by increased generic competition.[11]

- In emerging markets: Slight price reductions are anticipated, but local economic factors and patent laws may cause regional disparities.

- Premium positioning: Brand-name product prices may stabilize due to brand loyalty, with some premiums maintained through physician preference and formulary placements.

Market Challenges and Opportunities

Challenges

- Generic and biosimilar competition threatens revenue streams.

- Regulatory hurdles and evolving HTAs may limit profit margins.

- Pricing pressure from payers and pharmacy benefit managers affects profitability.

- Supply chain disruptions and manufacturing costs can influence retail pricing.

Opportunities

- Expansion into emerging markets through tailored pricing strategies.

- Development of combination inhalers offers higher value propositions.

- Digital health integration and personalized medicine could justify premium pricing.

- Partnering with healthcare providers to enhance adherence and market penetration.

Key Takeaways

- The global market for Fluticasone Propionate HFA remains robust, with steady growth driven by respiratory disease prevalence.

- Pricing has declined post-patent expiration, but brand loyalty and formulary dynamics continue to support premium prices.

- Generic competition is the primary factor influencing future price declines, expected to reduce prices by up to 25% in developed markets over the next five years.

- Regulatory policies and healthcare reimbursement models will significantly shape pricing strategies and market access.

- Opportunities lie in expanding to emerging markets, innovating through combination therapies, and leveraging technology to enhance patient outcomes.

FAQs

1. How has patent expiration affected the pricing of Fluticasone Propionate HFA?

Patent expiration in 2016 led to increased generic competition, resulting in significant price reductions—approximately 50-70%—making the drug more accessible but reducing revenues for brand manufacturers.

2. What are the main drivers of price variations across regions?

Reimbursement policies, healthcare infrastructure, patent laws, regulatory approvals, and market competition primarily drive regional price differences.

3. Will brand-name Fluticasone Propionate HFA products regain prices in the future?

Unlikely; patent expirations and increased generic presence have permanently lowered brand premiums. However, brand loyalty and formulary placements help maintain a price premium in certain markets.

4. How do regulatory policies influence future market prices?

Stringent HTAs and price controls, especially in Europe, can suppress prices. Conversely, favorable regulatory environments and reimbursement policies support stable or higher prices.

5. What strategies can manufacturers adopt to sustain profitability?

Investing in value-added formulations, expanding into emerging markets, forming strategic healthcare partnerships, and integrating digital health solutions can mitigate declining prices.

References

[1] MarketResearch.com, "Global Inhaled Corticosteroids Market," 2022.

[2] Grand View Research, "Respiratory Devices Market Size & Trends," 2023.

[3] IQVIA, "Global Pulmonary Market Report," 2022.

[4] GSK Annual Report, 2022.

[5] U.S. Patent and Trademark Office, "Patent Expiry Dates," 2016.

[6] Pharmacy Price Index, "Inhaler Pricing Trends," 2020.

[7] GoodRx, "Average Cost of Fluticasone Propionate HFA," 2022.

[8] European Patent Office, "Patent Landscape for ICS," 2021.

[9] WHO, "Market Access in Emerging Economies," 2021.

[10] OECD, "Pricing and Reimbursement Policies," 2022.

[11] Analyst Projections, "Inhaler Market Outlook," 2023.

Conclusion

Fluticasone Propionate HFA remains a cornerstone in respiratory therapy, with a resilient market poised for moderate growth. Price trajectories will continue to decline selectively due to patent expiries and competitive pressures, necessitating strategic adaptations by manufacturers. Understanding regional nuances and regulatory landscapes is essential for capitalizing on emerging opportunities while managing pricing risks.

More… ↓