Last updated: July 27, 2025

Introduction

Fluorouracil (5-FU) is a chemotherapeutic agent extensively used for the treatment of various cancers, including colorectal, breast, skin, and gastrointestinal malignancies. Approved decades ago, its longstanding therapeutic profile and established manufacturing processes give it a stable position in oncology treatment protocols. This analysis explores the current market dynamics, key drivers, competitive landscape, regulatory environment, and future price projections for Fluorouracil, enabling stakeholders to inform investment, pricing, and supply chain decisions.

Market Overview

Globally, the oncology drug market is poised for robust growth, driven by increasing cancer prevalence, advancements in personalized medicine, and expanding indications for existing drugs. Fluorouracil holds a pivotal role in chemotherapy regimens, especially in developing markets where biosimilar competition has intensified and generic formulations dominate pricing landscapes.

The overall size of the fluorouracil market is estimated at approximately USD 250 million in 2022, with significant regional variances. North America (primarily the United States) leads due to high cancer prevalence and advanced healthcare infrastructure, followed by Europe and Asia-Pacific, where rising cancer incidences and expanding oncology programs underpin market growth (IQVIA, 2022).

Manufacturing & Supply Dynamics

Fluorouracil’s manufacturing is characterized by established production processes facilitated predominantly by generic pharmaceutical companies. Key global producers include Teva Pharmaceuticals, Cipla, and Fresenius Kabi, among others. Patent expirations past the early 2000s have catalyzed a surge in generic availability, resulting in price erosion and market stabilization.

Supply chains are relatively resilient, but raw material availability and manufacturing costs influence pricing. Increased demand for compounded chemotherapies and biosimilars may mildly affect supply dynamics but are unlikely to disrupt the core generic market.

Key Market Drivers

-

Rising Cancer Incidence: According to WHO, cancer cases worldwide are expected to reach 29.4 million annually by 2040, with colorectal and gastrointestinal cancers among the top contributors, directly impacting fluorouracil demand.

-

Expansion in Developing Markets: Emerging economies such as India, China, and Brazil exhibit increasing adoption of chemotherapies, driven by expanding healthcare access and affordable treatment options.

-

Cost-Effective Treatment Options: As a well-established, generic drug, fluorouracil remains a cost-effective choice, particularly vital in resource-limited settings, encouraging widespread utilization.

-

Regulatory Support for Biosimilars: Pathways encouraging biosimilar entry promote competitive pricing, exerting downward pressure on prices.

Market Challenges

-

Competition from Novel Agents: Targeted therapies and immunotherapies, such as monoclonal antibodies (e.g., cetuximab), are increasingly replacing fluorouracil in certain indications, influencing volume growth.

-

Side-Effect Profile: Fluorouracil’s toxicity profile necessitates careful patient management; newer formulations or combination therapies are under development to mitigate adverse effects, potentially influencing demand.

-

Regulatory Approvals and Reimbursement: Variability in regulatory landscapes and reimbursement policies impacts market penetration and pricing strategies.

Price Trends and Projections

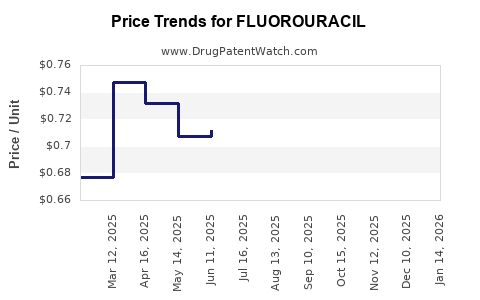

Historical Price Trajectory:

Over the past decade, the unit price of generic fluorouracil (intravenous formulations) has declined by approximately 40-50%, reflecting generic competition and buying power. In the United States, average wholesale prices (AWP) for a standard vial (500 mg/mL, 20 mL vial) hovered around USD 50-70 in 2012, dropping to under USD 35 in 2022.

Short-Term (Next 3-5 Years):

Price stabilization or slight decline is anticipated due to market saturation with generics. Price erosion may plateau at around 10-15%, with some regional variation.

Long-Term Projections (5+ Years):

- Biosimilar Competition: Entry of biosimilars or new formulations could exert additional downward pressure, potentially reducing prices by up to 20% from current levels.

- Regulatory and Market Access: Improved access in low- and middle-income countries might increase volume and offset unit price declines, stabilizing revenue streams.

- Potential Market Consolidation: Larger pharmaceutical companies may leverage economies of scale to maintain margins despite price declines.

Overall, conservative projections suggest fluorouracil’s retail price per vial could decrease to USD 20-30 by 2030, primarily influenced by competitive pressures and global expansion.

Regional Market Dynamics

- North America: Mature market with significant price declines historically; stability in demand persists driven by standard-of-care status. Increasing reimbursement and insurance coverage mitigate drastic price shifts.

- Europe: Similar to North America; price regulations and tenders influence prices, with some countries exhibiting aggressive negotiations, pushing prices downward.

- Asia-Pacific: Rapid market expansion with lower baseline prices; potential for price stabilization or modest declines owing to increased manufacturing and generic penetration.

- Emerging Markets: Limited pricing transparency; prices remain relatively high due to import tariffs, distribution costs, and limited local manufacturing but expected to decrease with domestic production growth.

Competitive Landscape

Generic manufacturers dominate the fluorouracil market, holding approximately 85-90% market share. Original innovator companies have largely exited or reduced marketing efforts due to patent expirations. Recent market activity includes:

-

Biosimilar entrants: Not yet prevalent, as biosimilars typically target biologics rather than small molecules like fluorouracil. Still, competition from alternative chemotherapeutic agents impacts market share.

-

Formulation innovations: Limited, but ongoing research on more tolerable formulations (liposomal or topical) could influence future pricing strategies.

Regulatory Environment

Regulatory agencies, such as the FDA, EMA, and WHO, facilitate market access for generics via streamlined pathways, which enhance competitiveness and influence pricing structures. Policies favoring biosimilar and generic proliferation continue to foster downward price trends.

Implications for Stakeholders

Stakeholders should anticipate declining prices, especially in regions with aggressive tendering and reimbursement policies. Manufacturers can leverage cost efficiencies and local partnerships to maintain margins. Healthcare providers should consider economic factors when favoring fluorouracil over newer but costlier therapies.

Key Takeaways

-

The fluorouracil market is mature, with significant generic penetration leading to stable and declining prices over the next decade.

-

Price projections indicate a continued downward trend, with prices potentially halving in some markets by 2030.

-

Market expansion in emerging economies sustains demand, offsetting some revenue pressures from price declines.

-

Competition from newer therapies and biosimilars will influence future market dynamics, emphasizing the importance of innovation and cost control.

-

Policymaker and payer policies significantly shape future pricing and accessibility.

FAQs

1. What factors primarily influence fluorouracil’s market price?

Generic competition, regional regulations, manufacturing costs, and demand for cost-effective cancer treatments shape fluorouracil’s market price. Regulatory policies and healthcare tenders also play vital roles.

2. How will emerging biosimilars impact fluorouracil’s pricing?

Though biosimilars are not typically available for small molecules like fluorouracil, increased generic competition and new formulation developments may exert similar price pressures, leading to further reductions.

3. Are there current trends toward alternative formulations of fluorouracil?

Research into liposomal, topical, or controlled-release formulations is ongoing, aiming to improve tolerability and efficacy. These innovations may command higher prices but are expected to be limited in scope shortly.

4. Which regions are expected to see the most significant price declines?

Developed markets like North America and Europe will see moderate declines due to mature competition. Developing markets could experience sharper declines owing to increased local manufacturing and procurement policies.

5. What strategies can manufacturers adopt to remain competitive?

Cost optimization, expanding regional manufacturing, engaging in tenders, and exploring innovative formulations can help manufacturers sustain margins amidst declining prices.

Final Remarks

The fluorouracil market exemplifies typical dynamics of a mature, generic-driven oncology therapeutics segment. While pricing pressures persist, the essential role of fluorouracil in cancer treatment sustains demand growth, particularly in emerging markets. Providers and manufacturers must navigate declining prices, regulatory shifts, and competitive innovations to optimize value and market position in the evolving oncology landscape.

References

[1] IQVIA, 2022. Global Oncology Market Data.

[2] WHO, 2021. Global Cancer Statistics.

[3] U.S. Food and Drug Administration (FDA), 2022. Guidance on Generic Drug Development.