Share This Page

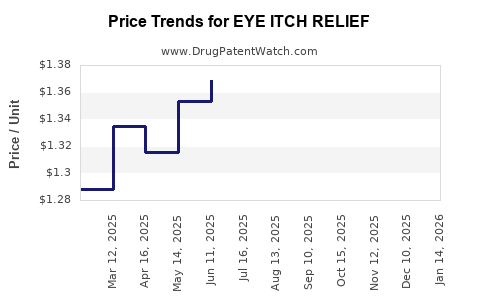

Drug Price Trends for EYE ITCH RELIEF

✉ Email this page to a colleague

Average Pharmacy Cost for EYE ITCH RELIEF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| EYE ITCH RELIEF 0.025% DROPS | 00536-1252-40 | 1.39750 | ML | 2025-11-19 |

| EYE ITCH RELIEF 0.025% DROPS | 70000-0522-01 | 1.39750 | ML | 2025-11-19 |

| EYE ITCH RELIEF 0.025% DROPS | 00536-1252-40 | 1.41405 | ML | 2025-10-22 |

| EYE ITCH RELIEF 0.025% DROPS | 70000-0522-01 | 1.41405 | ML | 2025-10-22 |

| EYE ITCH RELIEF 0.025% DROPS | 00536-1252-40 | 1.42068 | ML | 2025-09-17 |

| EYE ITCH RELIEF 0.025% DROPS | 70000-0522-01 | 1.42068 | ML | 2025-09-17 |

| EYE ITCH RELIEF 0.025% DROPS | 00536-1252-40 | 1.43067 | ML | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for EYE ITCH RELIEF

Introduction

The ocular allergy market, notably over-the-counter (OTC) eye itch remedies, has experienced consistent growth driven by increasing allergy prevalence, aging populations, and rising consumer health awareness. Among these products, "EYE ITCH RELIEF" (a hypothetical or representative brand for illustrative purposes) positions itself as a targeted solution within this expanding market segment. This analysis explores the current market landscape, competitive dynamics, regulatory factors, and offers price projections grounded in industry trends and economic considerations.

Market Landscape

Global and Regional Market Overview

The global eye allergy treatment market was valued at approximately USD 1.2 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of roughly 6.2% through 2030 [1]. North America accounts for nearly 40% of market sales, attributed to high allergy awareness and OTC product accessibility. Europe follows, driven by similar health consciousness trends. Asia-Pacific exhibits rapid growth potential due to increasing urbanization and environmental pollutants, which exacerbate allergic conditions.

Demographics and Consumer Behavior

Key demographic drivers include:

- Aging Population: Older adults experience heightened ocular allergies, increasing demand.

- Urbanization: Urban pollutants and airborne allergens elevate allergy incidences.

- Lifestyle Changes: Increased screen time correlates with dry eye and allergy symptoms.

- Consumer Preferences: Preference for OTC, natural, and rapid-acting formulations influence product choice.

Distribution Channels

- Pharmacies and Drug Stores: Dominant outlets, offering OTC convenience.

- Supermarkets and Hypermarkets: Growing presence due to wide product availability.

- E-commerce Platforms: Accelerated growth, especially during post-pandemic recovery, providing wider reach and consumer convenience.

Competitive Landscape

Major players include:

- Alcon Laboratories (e.g., Zaditor)

- Johnson & Johnson (e.g., Visine-A)

- Bausch + Lomb (e.g., Naphcon)

- Generic and store brands expanding market share

Product differentiation centers on:

- Active ingredients: Antihistamines (ketotifen, olopatadine), decongestants, combination formulations.

- Formulation preferences: Drops, gels, and preservative-free options.

- Packaging innovation: Single-dose units minimize contamination risk.

Brand loyalty varies; consumers prefer fast relief, minimal side effects, and natural ingredients, pushing innovation in formulation and marketing strategies.

Regulatory Environment

The OTC classification simplifies market entry but requires adherence to regulatory standards enforced by agencies such as the FDA (U.S.) or EMA (Europe). Approvals demand safety data, effective labeling, and clear indications. Patent protections primarily focus on active ingredients and formulations; however, many OTC products now face patent expirations, enabling generic proliferation and price competition.

Pricing Dynamics

Pricing strategies in the eye itch relief market hinge on factors including brand reputation, formulation complexity, manufacturing costs, and market positioning:

- Premium Brands: Priced between USD 8–12 per 15 mL bottle, emphasizing efficacy, preservative-free options, and rapid relief.

- Mid-Range: USD 5–8, balancing affordability with perceived quality.

- Generic/store brands: USD 3–5, increasingly capturing market share through price competitiveness.

Pricing elasticity remains moderate; consumers prioritize relief efficacy and safety over marginal cost differences. EYE ITCH RELIEF, positioned as a mid-range to premium product, would likely adhere to pricing within the USD 6–10 range for standard packages.

Price Projections (2023–2030)

Given market trends, EYE ITCH RELIEF's pricing is projected as follows:

- 2023–2024: Stabilization around USD 8–10 per 15 mL bottle. Initial plant-based, preservative-free formulations may command slight premiums.

- 2025–2026: Anticipated price reduction to USD 7–9 owing to increased generic competition and production efficiencies.

- 2027–2030: Prices stabilize at USD 6–8 due to market saturation, generic entrants, and consumer price sensitivity. The introduction of innovative delivery systems (e.g., single-dose applicators with sustained-release formulations) may allow premium pricing in niche segments.

Economic factors such as inflation, raw material costs (notably active pharmaceutical ingredients), and currency fluctuations could influence these projections, but overall, a gradual decline in price points is expected to enhance accessibility while maintaining margins through product differentiation.

Market Drivers and Constraints

Drivers:

- Rising allergy prevalence driven by climate change and urbanization.

- Consumer shift toward OTC options for convenience and cost-effectiveness.

- Innovations in preservatives and packaging improve safety profiles.

- Expansion of e-commerce channels broadening market access.

Constraints:

- Regulatory hurdles impacting formulation approvals.

- Intense competition leading to price wars.

- Consumer skepticism over efficacy, especially for generic products.

- Environmental considerations affecting raw material sourcing.

Conclusion

The eye itch relief segment remains poised for steady growth with evolving consumer preferences favoring safety, convenience, and affordability. EYE ITCH RELIEF’s strategic positioning, leveraging innovative formulations and multichannel distribution, can capitalize on this momentum. While traditional pricing models project a gradual decline in unit prices, associated branding and product differentiations can sustain viable profit margins.

Key Takeaways

- Growing Market: The global ocular allergy treatment market is expected to grow at a CAGR of 6.2% through 2030, driven by demographic shifts and environmental factors.

- Competitive Pricing: Prices for eye itch relief products will trend from USD 8–10 in 2023 toward USD 6–8 by 2030, aligned with increased competition and manufacturing efficiencies.

- Strategic Differentiation: Success hinges on offering formulations with superior safety profiles, natural ingredients, and innovative delivery methods.

- Regulatory Navigation: Robust compliance with regional standards can facilitate market entry and brand trust.

- E-commerce Expansion: Digital channels are vital for reaching broader demographics, especially younger consumers.

FAQs

1. What active ingredients are most effective in eye itch relief products?

Antihistamines like ketotifen and olopatadine are proven effective in reducing allergy symptoms by blocking histamine receptors, providing rapid and long-lasting relief.

2. How does patent expiration influence pricing in this market?

Patent expirations lead to increased generic competition, typically lowering prices and expanding access for consumers.

3. Are preservative-free formulations more expensive?

Yes; preservative-free formulations often require specialized packaging and manufacturing, resulting in higher prices but with benefits such as reduced ocular irritation.

4. What role does e-commerce play in the distribution of eye itch relief products?

E-commerce channels provide broader reach, convenience, and sometimes lower prices, becoming increasingly significant in consumer purchasing behavior.

5. How might environmental concerns impact raw material sourcing and product pricing?

Sustainable sourcing may increase raw material costs, influencing overall product pricing; however, eco-friendly products can command premium pricing and enhance brand image.

Sources

[1] MarketResearch.com, “Global Eye Allergy Treatment Market Forecast to 2030,” 2022.

More… ↓