Last updated: July 27, 2025

rket Analysis and Price Projections for Etravirine

Introduction

Etravirine (brand name: Intelence) is a non-nucleoside reverse transcriptase inhibitor (NNRTI) developed by Janssen Pharmaceuticals. Approved by the U.S. Food and Drug Administration (FDA) in 2008, it is primarily indicated for the treatment of HIV-1 infections in adult patients with experienced virus. Over the last decade, the evolving landscape of HIV therapy, patent dynamics, and competitive options have significantly influenced the market performance and pricing strategies for etravirine. This analysis explores the current market landscape and project future price trends based on regulatory, commercial, and technological factors.

Market Overview and Key Drivers

- Market Penetration and Competitive Landscape

Etravirine occupies a niche within the broader HIV drug market, primarily targeting treatment-experienced patients exhibiting resistance to first-line NNRTIs such as efavirenz and rilpivirine. It competes with newer agents like doravirine and is often integrated into combination regimens. Despite its efficacy, etravirine's adoption has been tempered by the advent of fixed-dose combinations (FDCs) with simplified dosing regimens, which are now favored in treatment guidelines.

The competitive challenge is compounded by robust pipeline development, including novel agents with improved resistance profiles and fewer side effects. As a result, etravirine's market share has plateaued, particularly among newly diagnosed patients. However, it retains significance for salvage therapy in resistant cases, especially within healthcare systems where access to newer agents is limited.

-

Patent Landscape and Generic Entry

Patent protections for etravirine have historically governed pricing and market exclusivity. Janssen initially held patents until approximately 2026, with some patent extensions scrutinized by patent offices and generic manufacturers. The entry of generics is projected to depress prices significantly — with potential reductions of 50-70% within the next 2-3 years post-patent expiry, according to industry sources.

-

Regulatory Developments and Approvals

While etravirine remains FDA-approved for specific indications, regulatory bodies such as the European Medicines Agency (EMA) and other jurisdictions have not sanctioned substantial label expansions. This limits off-label uses and consequently constrains revenue growth. However, ongoing research into resistance management and novel combination strategies may influence future indications.

-

Market Demand and Geographic Dynamics

Global demand fluctuates primarily based on HIV prevalence among treatment-experienced populations. Developed markets (e.g., North America, Europe) show declining demand due to shifts toward integrase inhibitors and combination therapies, while emerging markets (e.g., Asia, Africa) maintain significant demand owing to treatment access programs and resource limitations.

The geopolitical landscape affects pricing, with organizations like the WHO advocating for affordable access, potentially pressuring prices downward in low-income regions. Conversely, high-income regions may sustain higher prices via negotiated reimbursement agreements.

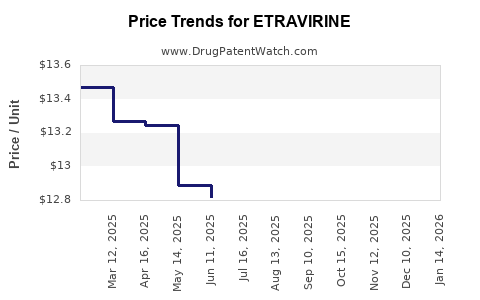

Price Projections and Trends

Current Pricing Landscape

As of 2023, patentee-maintained etravirine costs approximately $200–$300 per 30-day supply, depending on healthcare settings. Brand-name pricing tends to be higher in markets with limited generics and is driven by negotiated insurance rebates and procurement contracts.

Short to Medium-Term Projections (Next 3-5 Years)

- Patent Expiry and Generic Competition: Anticipated patent expiration around 2026 will trigger entry of generics, leading to a substantial price reduction. Industry consensus estimates a 60-70% drop within one year of patent expiry, aligning with historical trends observed in similar antiretroviral agents.

- Reimbursement and Pricing Policies: Governments and payers are expected to leverage generic availability to negotiate lower prices, especially in public healthcare systems. Private insurers may follow suit, further pressuring retail prices.

- Lifecycle Management: Janssen's potential strategies for extending exclusivity through delivery system innovations or licensing agreements may temporarily sustain higher prices, but these are unlikely to offset the broad impact of patent expiration.

Long-Term Outlook (Beyond 5 Years)

- Market Consolidation and Pricing Stability: Post-generic entry, the market will stabilize with low-cost alternatives dominating salvage therapy niches. Innovative combination therapies integrating newer agents will further diminish demand for standalone etravirine.

- Emerging Markets: In regions with limited access to new drugs, etravirine may retain a higher relative price point for longer periods, especially if supplied through patent pools or voluntary licensing agreements.

Overall, a progressive decline in etravirine's price is projected, reaching approximately $50–$100 for a 30-day supply within 2-3 years after patent expiry, contingent on regulatory approvals, market dynamics, and negotiation strategies.

Strategic Implications for Stakeholders

- Pharmaceutical Companies: Opportunities lie in lifecycle management, including combination formulations, patent extensions, or new indications to delay generic market entry.

- Healthcare Providers: Need to assess cost-effectiveness of etravirine versus emerging alternatives, especially in treatment-resistant cases where it remains relevant.

- Payers: Should prepare for significant price reductions post-patent expiry and evaluate formulary placement accordingly.

- Investors: Market timing for patent expiry presents investment risks and opportunities, particularly if companies pursue strategic patent prosecutions or licensing agreements.

Key Takeaways

- Etravirine's current market is niche, primarily serving treatment-experienced HIV patients with resistance issues.

- Patent expirations around 2026 will substantially drive prices downward, with estimates indicating a 60-70% reduction within the subsequent year.

- The advent of newer antiretroviral agents and fixed-dose combinations diminish etravirine's market share in developed countries but sustain its importance in resistant or resource-limited settings.

- Strategic lifecycle management and licensing can temporarily sustain higher prices but are unlikely to offset the long-term impact of generic competition.

- Stakeholders must adapt to evolving pricing, reimbursement policies, and treatment paradigms to optimize market positioning.

FAQs

1. When does the patent for etravirine expire, and what is the impact on pricing?

Patent protections are expected to expire around 2026, after which generic versions are anticipated to enter the market, leading to significant price reductions of approximately 60-70% within the first year.

2. How does the emergence of new HIV treatments influence etravirine's market share?

Newer agents, especially integrase inhibitors and fixed-dose combinations, have supplanted etravirine in first-line and many salvage regimens, diminishing its share among treatment-naïve populations but maintaining niche relevance for resistant cases.

3. What factors could delay or accelerate etravirine's price decline?

Factors include the pace of patent litigation, regulatory approvals for new indications, licensing agreements, and the development of superior therapies. Patent disputes or licensing strategies can delay generic entry, while rapid development of alternatives accelerates pricing declines.

4. Are there ongoing clinical developments that could extend etravirine’s market viability?

Future research may explore expanded indications or combination therapies involving etravirine; however, the competitive landscape favors newer agents, limiting clinical development's impact on overall market viability.

5. How should payers approach the inclusion of etravirine in formularies moving forward?

Payers should monitor patent status and anticipated generic entry, assess cost-effectiveness against emerging therapies, and consider patient-specific resistance profiles to optimize formulary decisions.

References

[1] U.S. Food and Drug Administration. (2008). FDA approves new drug to treat HIV.

[2] Janssen Pharmaceuticals. (2023). Intelence (etravirine) prescribing information.

[3] EvaluatePharma. (2022). World preview 2023: outlook for key drugs.

[4] WHO. (2021). Consolidated guidelines on HIV prevention, testing, treatment, service delivery and monitoring.

[5] MarketWatch. (2023). Antiretroviral Market Insights and Future Outlook.