Last updated: July 28, 2025

Introduction

ENBREL (etanercept) remains a leading biologic therapy in immunology, targeting autoimmune conditions such as rheumatoid arthritis (RA), psoriatic arthritis, ankylosing spondylitis, and plaque psoriasis. As of 2023, its global market validates its therapeutic efficacy and widespread adoption. However, consistent patent expirations, emerging biosimilars, and evolving market dynamics necessitate an in-depth analysis of its current positioning and future price trajectories.

Market Overview

Current Market Size

The global biologics market, particularly for rheumatologic indications, approached approximately $125 billion in 2022, with ENBREL commanding a significant portion owing to its early market entry and extensive indication approvals. In 2022, ENBREL’s global sales exceeded $4.7 billion, reflecting its entrenched market presence [1].

Key Market Segments

-

Geographical Distribution:

North America (particularly the US) dominates with roughly 60% of sales, followed by Europe (25%) and emerging markets (rest). The US benefits from higher insurance coverage, frequent diagnosis, and strong physician familiarity.

-

Therapeutic Indications:

The primary markets include RA, psoriatic arthritis, and ankylosing spondylitis, with expanding application in pediatric psoriasis and off-label uses.

-

Market Share:

ENBREL held approximately 7-8% of the global biologics market in autoimmune indications (2022). Its main competitors are Humira (adalimumab), Remicade (infliximab), and newer biosimilars.

Patent Landscape and Biosimilar Competition

Patent Expiry Impact

ENBREL’s original patent expired in Europe in 2015 and in the US in 2029; however, various secondary patents delayed biosimilar entry in some regions [2]. Currently, biosimilars entered the US market in late 2023, with several approved and commercialized.

Biosimilars and Market Entry

-

US:

Multiple biosimilars launched post-2023, leading to anticipated price reductions of 20-30% relative to ENBREL’s list price.

-

Europe:

The biosimilar landscape is more mature, with discounts reaching 25-30%; adoptions are robust, driven by cost-effectiveness and payer preferences.

The increasing biosimilar penetration is a key driver influencing future ENBREL pricing strategies.

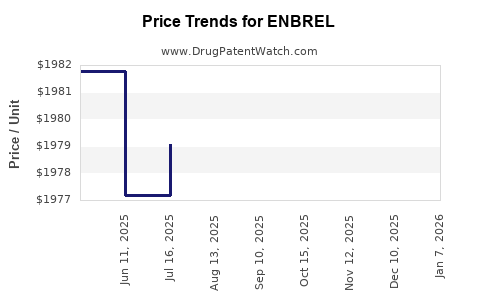

Pricing Trends and Projections

Historical Pricing Patterns

-

List Price (US):

ENBREL’s average annual cost per patient has hovered around $50,000–$55,000, with some variation based on indication and insurance negotiations.

-

Price Reduction Post-Biosimilars:

The entry of biosimilars typically precipitates a decline in list and negotiated prices. In markets with established biosimilar competition, reductions of 15-30% are observed within 2-3 years.

Price Projections (2023-2028)

-

United States:

Overshadowed by biosimilar competition, the list price for ENBREL may decline annually by 3-5%, with actual net prices possibly decreasing by 15-20% over five years due to improved payer negotiation leverage.

-

Europe and Emerging Markets:

More aggressive discounts are possible, with prices possibly falling by 20-30% in mature markets, driven by biosimilar uptake.

-

Impact of Payer Strategies:

Payers and pharmacy benefit managers increasingly favor biosimilar adoption, further putting downward pressure on branded biologic prices.

Market Dynamics Influencing Price Trends

-

Regulatory Environment:

Faster regulatory approvals for biosimilars and potential patent litigation settlement align with price declines.

-

Competitive Dynamics:

Introduction of next-generation biologics or personalized therapies could affect ENBREL’s market share, indirectly influencing pricing.

-

Healthcare Policy:

Cost containment measures, especially in the US and Europe, incentivize biosimilar utilization, leading to potential downward price adjustments for ENBREL.

Strategic Implications for Stakeholders

-

Pharmaceutical Companies:

Need to innovate or diversify portfolios to offset declining revenues from branded products like ENBREL.

-

Payers and Providers:

Can leverage biosimilar competition to negotiate better drug prices, promoting affordability and access.

-

Investors:

Should monitor biosimilar launches and patent litigation developments, which significantly influence future pricing.

Conclusion

ENBREL’s market prospects are strongly influenced by biosimilar entry, healthcare policy, and global pricing strategies. Over the next five years, an average annual price decline of around 10-15% can be expected in mature markets, with accelerated reductions in regions with rapid biosimilar adoption. Prices will stabilize at lower levels, but ENBREL’s established brand recognition and clinical efficacy continue to sustain its market relevance.

Key Takeaways

- ENBREL’s 2022 global sales surpassed $4.7 billion, cementing its status as a leading biologic.

- Biosimilar competition initiated in the US in 2023 will likely reduce prices by 15-25% over the next 3–5 years.

- US prices are expected to decline 3-5% annually, while European markets may see drops of 20-30%.

- Patent and regulatory factors remain crucial; further patent litigations could delay biosimilar price impacts.

- Stakeholders must adapt pricing, reimbursement, and R&D strategies to evolving market dynamics.

FAQs

1. How does biosimilar competition impact ENBREL’s pricing?

Biosimilar entry generally leads to a 15-30% reduction in list prices, with negotiated discounts and real-world savings potentially exceeding 25%. The increased competition pressures the original biologic to lower prices to maintain market share.

2. What is the outlook for ENBREL’s global sales in the next five years?

While sales will face pressure from biosimilars, ENBREL’s established therapeutic profile and expanding indications sustain demand, especially in regions with slower biosimilar adoption. Overall, expect moderate decline with potential stabilization influenced by medical advancements.

3. Which markets will see the steepest price reductions?

Europe and emerging markets, due to mature biosimilar markets and strong payer negotiations, will likely experience the most significant price cuts, up to 30% within five years.

4. What factors could delay biosimilar price impacts?

Legal patent litigations, regulatory delays, or limited biosimilar supply constraints can slow price reductions, maintaining higher prices longer than expected.

5. How should pharmaceutical companies prepare for declining ENBREL prices?

Investing in next-generation biologics, expanding therapeutic indications, or exploring novel delivery mechanisms can offset revenue declines and sustain growth trajectories.

Sources:

- IQVIA, 2022. "Biologic Market Reports."

- FDA, 2023. "Biosimilar Approvals and Patents."