Last updated: July 31, 2025

Introduction

Enalapril, an angiotensin-converting enzyme (ACE) inhibitor, is a cornerstone medication in managing hypertension and congestive heart failure. First approved by the U.S. Food and Drug Administration (FDA) in 1985, Enalapril has since cemented its role in cardiovascular therapeutics. Given its widespread adoption, elucidating its current market dynamics and future price trends is critical for pharmaceutical stakeholders, payers, and healthcare providers.

This comprehensive analysis assesses Enalapril’s market landscape, factors influencing pricing, and projected price trajectories over the next five years. It draws on recent patent expirations, generic entry patterns, manufacturing considerations, competitive landscape, and regulatory influences.

Market Overview

Historical Context and Market Size

Enalapril commands a significant share within the global ACE inhibitor market, valued at approximately USD 4.8 billion in 2022, with a compound annual growth rate (CAGR) of 4.2% projected through 2030 [1]. Its primary usage in hypertension and heart failure treatment ensures steady demand, especially across developed markets such as North America and Europe.

Patent Status and Generic Competition

Enalapril’s patent protection expired in the early 2000s, giving rise to a wave of generic entrants, dramatically reducing its cost and expanding accessibility. Currently, major manufacturers produce generic versions, with branded formulations, primarily from Merck (initial developer), occupying a minimal market share but maintaining a presence for brand-conscious prescribers.

Market Drivers

- Prevalence of Hypertension: Affecting over 1.3 billion adults globally [2], driving consistent demand.

- Aging Population: Increased cardiovascular comorbidity among older adults sustains its use.

- Guideline Recommendations: Standard first-line therapy per American and European guidelines supports ongoing utilization.

Market Challenges

- Competition from Newer Agents: Angiotensin receptor blockers (ARBs) and newer antihypertensives have encroached on Enalapril’s market share.

- Concerns Over Side Effects: Risks like cough and hyperkalemia influence prescriber preferences.

- Regulatory Challenges: Stringent quality standards and supply chain issues can impact availability.

Pricing Dynamics

Current Pricing Landscape

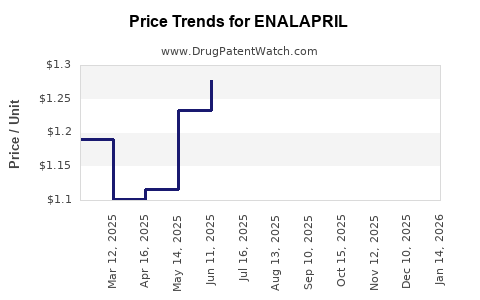

The entry of generics has led to significant price erosion. The average wholesale price (AWP) for a 10 mg Enalapril tablet in the U.S., which was once around USD 0.40, is now frequently found below USD 0.05 due to intense competition, with some generics available at even lower prices in bulk.

Factors Influencing Price Trends

- Generic Market Saturation: Increased number of manufacturers has kept prices low.

- Manufacturing Costs: Stable for established APIs; minimal impact on pricing due to mature production processes.

- Regulatory Environment: Strict quality standards and manufacturing compliance contribute to marginal cost increases but are unlikely to cause price hikes in a competitive setting.

- Supply Chain Stability: Disruptions can temporarily inflate prices; otherwise, prices tend to remain stable or decline.

Price Projections (2023–2028)

- Short-term (Next 2 Years): Expect stabilized or declining prices, with some regional fluctuations, maintaining the trend of low-cost generics. Wholesale prices may hover around USD 0.03–0.05 per tablet.

- Medium-term (3–5 Years): Marginal price decreases are probable due to further market saturation, typical of mature generic drugs. Certain premium formulations or packaging may retain higher prices but are unlikely to influence total market pricing significantly.

- Price Upswing Factors: Potential shortages, regulatory changes increasing compliance costs, or consolidation in manufacturing could temporarily raise prices; however, such scenarios are less probable under current market conditions.

Future Market Trends and Projections

Market Growth Outlook

While the overall demand for Enalapril is expected to remain steady, market share erosion due to newer drug classes—ARB and direct renin inhibitors—may slightly temper growth. However, affordability via generics ensures a continued baseline demand, especially in resource-constrained regions.

Innovative Formulations and Biosimilars

Current efforts to develop fixed-dose combinations or formulations with enhanced adherence profiles could introduce premium pricing segments, but such innovations are limited for Enalapril.

Regulatory and Policy Influences

- Price Control Initiatives: Countries with price caps on generics will restrict price upward movements.

- Patent Litigation and Exclusivity: Given the patent expiry, no exclusivity benefits remain, fostering a fully competitive environment.

Emerging Markets

In regions like Asia-Pacific and Latin America, demand is expected to grow due to increasing hypertension prevalence. However, local generics producers dominate pricing, maintaining low price points.

Impact of Competitive Landscape

Brand vs. Generic Market Share

Despite the dominance of generics, some branded products persist for prescriber or patient preference, often commanding higher prices. Nonetheless, the overall market effect is downward pressure on prices.

Potential Market Entrants

New players or import policies could influence prices marginally, but given the mature market status, significant price increases are unlikely.

Key Considerations for Stakeholders

- Payers and Healthcare Providers: Favor the cost-effectiveness of generics, ensuring wide accessibility.

- Manufacturers: Focus on compliance efficiencies and supply stability rather than price hikes.

- Policy Makers: Maintain vigilance on quality standards to prevent market erosion through substandard products.

Key Takeaways

- Enalapril’s patent expiry has led to a predominantly generic market, resulting in low and stable prices.

- The current pricing environment favors affordability, with future prices expected to remain low, barring supply disruptions or policy shifts.

- Market growth will likely be driven by increasing cardiovascular disease prevalence worldwide, with regional variations due to healthcare infrastructure.

- Competitive pressures from newer therapies will sustain a downward pricing trend, reinforcing Enalapril’s role as a low-cost treatment option.

- Stakeholders should anticipate moderate price stability and focus on quality and supply chain robustness to maintain market share.

FAQs

Q1: Will Enalapril prices increase due to new formulations or combinations?

While some fixed-dose combinations or improved formulations may command premium prices, the core price of generic Enalapril tablets is unlikely to rise significantly due to market saturation and competition.

Q2: How does patent expiry affect Enalapril pricing?

Patent expiry unlocked generic competition, dramatically lowering prices. Future price increases are improbable unless supply chain issues or regulatory changes occur.

Q3: Are there regional differences in Enalapril pricing?

Yes. Developed countries tend to have slightly higher prices due to regulatory and reimbursement structures, while lower-income markets enjoy more competitive generic pricing.

Q4: What factors could disrupt the current pricing stability?

Supply shortages, regulatory hurdles, quality compliance costs, or geopolitical issues could temporarily influence prices.

Q5: How does competition from newer drugs influence Enalapril market share?

Newer agents like ARBs and direct renin inhibitors offer certain clinical advantages but are often priced higher, limiting their impact on Enalapril’s affordability and offering opportunities for continued generic use.

References

[1] MarketResearch.com. (2023). Global ACE Inhibitors Market Size & Trends.

[2] World Health Organization. (2021). Hypertension Fact Sheet.