Last updated: July 27, 2025

Introduction

Efavirenz is a non-nucleoside reverse transcriptase inhibitor (NNRTI) widely used in the management of Human Immunodeficiency Virus (HIV) infection. Approved by the U.S. Food and Drug Administration in 1998, it remains a cornerstone in combination antiretroviral therapy (cART). As the global HIV/AIDS epidemic persists, understanding the market dynamics, competitive landscape, regulatory trends, and pricing trajectories for efavirenz is crucial for stakeholders. This analysis provides a comprehensive view of the current market standings and forecasts future price trends, aiding strategic decisions for pharmaceutical companies, healthcare providers, and policymakers.

Market Overview

Global Demand and Epidemiology

According to UNAIDS, approximately 38 million people globally lived with HIV/AIDS in 2021, with sub-Saharan Africa bearing the highest burden (around 67%) [1]. Efavirenz remains a key component of first-line antiretroviral regimens, especially in low- and middle-income countries (LMICs). The World Health Organization (WHO) recommends efavirenz-based regimens as a preferred initial therapy due to its efficacy, tolerability, and cost-effectiveness.

Market Penetration and Key Regions

- Developing Countries: Efavirenz dominates initial treatment protocols in Africa, Southeast Asia, and parts of Latin America. Its affordability, when supplied through generics, underpins widespread use.

- Developed Markets: In the U.S. and Europe, efavirenz use has declined marginally due to the advent of integrase inhibitors like dolutegravir, which boast superior safety profiles [2]. Nonetheless, efavirenz remains part of some regimens, especially where newer agents are either unavailable or cost-prohibitive.

Key Players and Supply Chain

- Name-Brand: Pfizer (original manufacturer Viread), Johnson & Johnson.

- Generics: Multiple manufacturers in India, China, and other countries produce efavirenz generics, contributing significantly to price reductions.

- Distribution Channels: Government procurement agencies, nonprofit organizations (e.g., Medecins Sans Frontières), and private healthcare providers are primary purchasers, particularly in LMICs.

Competitive Landscape

Patent Status and Market Entry

The patent for efavirenz expired in 2012–2014 in major jurisdictions, facilitating generic competition [3]. This led to a sharp decline in prices globally but also increased market saturation.

Emergence of Newer Therapies

While efavirenz remains essential in many settings, newer options such as integrase inhibitors (dolutegravir, bictegravir) are replacing efavirenz in many developed markets due to benefits in tolerability and fewer side effects [4]. Nonetheless, cost and accessibility continue to sustain efavirenz use in resource-limited settings.

Pricing Trends and Projections

Historical Price Movements

- Brand-Name Efavirenz: Initially priced at approximately $1,200–$1,500 per patient annually in high-income markets.

- Generic Efavirenz: Post-patent expiry, prices plummeted, with annual costs dropping below $100 per patient in LMICs, often under $50 through bulk procurement [5].

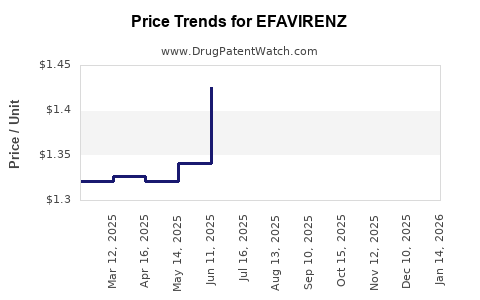

Current Pricing Landscape

- Developed Markets: Efavirenz typically costs $150–$250 annually for brand-name versions, with generics available at approximately $50–$100.

- Developing Markets: Prices vary widely, often between $20 and $50, influenced by procurement methods and negotiated discounts.

Future Price Trajectory

Based on current trends, efavirenz’s market is expected to experience:

- Stability or Slight Decline in LMICs: Due to robust generic competition and international donor subsidies, prices may remain stable or decrease marginally, possibly reaching single-digit dollar per patient annually.

- Potential Price Stabilization or Slight Increase in Developed Markets: As demand shifts towards newer therapies, demand for efavirenz may decline, leading to possible consolidation or price stabilization, likely remaining below $100 per year for generics.

Influencing Factors

- Patent and Regulatory Developments: Patent litigation or the introduction of next-generation formulations could influence prices.

- Supply Chain Dynamics: Manufacturing capacity expansions or disruptions could impact prices.

- Market Demand: Decreased use in regions adopting newer regimens may reduce demand, suppressing prices.

- International Funding Initiatives: Global efforts like PEPFAR and the Global Fund continue to subsidize efavirenz procurement, maintaining affordability in LMICs.

Regulatory and Policy Outlook

WHO’s inclusion of efavirenz in the Essential Medicines List sustains its importance, ensuring ongoing demand and regulatory support. Conversely, shifting policies favoring integrase inhibitors may diminish efavirenz’s footprint, especially in high-income settings, impacting its market stability and pricing strategy.

Risk Factors and Market Challenges

- Development of Resistance: Emerging resistance patterns could limit efavirenz’s long-term utility.

- Adoption of Alternatives: The trend toward integrase inhibitors poses a significant threat to future effavirenz demand.

- Pricing Pressures: Continued generic competition and procurement negotiations will likely keep prices low but could hamper profitability for manufacturers.

- Supply Chain Risks: Manufacturing disruptions, especially in countries like India and China, could cause supply shortages, affecting pricing and access.

Strategic Insights

- For Manufacturers: Focus on maintaining competitive costs, diversifying formulations, and exploring combination therapies to retain relevance.

- For Policymakers: Emphasize procurement strategies that leverage global discounts to ensure sustainable access.

- For Investors: Opportunities remain in generic segments, particularly within LMIC markets, though profitability is increasingly constrained.

Key Takeaways

- Efavirenz remains vital in global HIV management, especially within LMICs, due to affordability and existing infrastructure.

- Patent expiry catalyzed a significant reduction in prices, with generic versions dominating the market.

- The global shift toward newer antiretrovirals may diminish efavirenz’s demand in high-income markets but sustain its relevance in resource-limited settings.

- Price projections indicate stable or declining prices in developing countries, potentially approaching single-digit dollar levels per patient annually.

- Market uncertainties hinge on policy shifts, resistance patterns, and emerging treatment guidelines, necessitating continuous monitoring.

FAQs

1. Will efavirenz’s price rise again after patent expiration?

Unlikely. The patent expiry in key regions led to increased generic competition, sharply reducing prices. Future price increases are improbable unless supply disruptions occur or new formulations command premium pricing.

2. How does efavirenz compare price-wise to newer antiretrovirals?

Efavirenz, especially as a generic, remains significantly cheaper—often by an order of magnitude compared to newer integrase inhibitors like dolutegravir, which can cost several hundred dollars annually.

3. Are there supply risks associated with efavirenz?

While generally stable, supply chain disruptions due to manufacturing issues in key producing countries could impact availability and prices temporarily.

4. Is efavirenz still recommended by WHO?

Yes, efavirenz remains on the WHO’s Essential Medicines List for first-line HIV treatment, primarily in resource-limited settings.

5. What is the outlook for efavirenz in high-income countries?

Its use is declining in high-income countries owing to better-tolerated alternatives. Future demand may be minimal, leading to marginal pricing variations focused on existing inventory.

References

- UNAIDS. Global HIV & AIDS statistics — 2022 fact sheet.

- WHO. Consolidated guidelines on HIV prevention, testing, treatment, service delivery, and monitoring — 2021.

- U.S. Patent and Trademark Office. Patent expiry dates for efavirenz.

- NIH. Antiretroviral drugs: recent developments and clinical guidelines.

- Management Sciences for Health. International Drug Price Indicator Guide, 2022.

In summary, efavirenz remains a cost-effective mainstay in the global HIV treatment landscape. While the advent of newer therapies challenges its dominance in high-income markets, strong demand in LMICs sustains its relevance, with prices expected to remain low and stable in these regions. Continuous assessment of market and regulatory trends will be essential for stakeholders to optimize access and profitability.