Last updated: July 28, 2025

Introduction

DULERA, developed by AstraZeneca, is a combination inhaler used primarily for the maintenance treatment of asthma and chronic obstructive pulmonary disease (COPD). The drug combines mometasone furoate, a corticosteroid, and formoterol fumarate, a long-acting beta-agonist. Its unique dual-action profile provides anti-inflammatory and bronchodilator effects, positioning DULERA as a key therapy in respiratory care. Understanding its market dynamics and pricing landscape is essential for stakeholders, including pharmaceutical companies, healthcare providers, and investors.

Market Overview

Global Respiratory Drugs Market

The global respiratory drugs market was valued at approximately USD 37 billion in 2022 and is projected to expand at a compounded annual growth rate (CAGR) of around 6% through 2030 (1). Increasing prevalence of respiratory conditions, enhanced awareness, and technological advances drive market growth. The rise in COPD and asthma incidences worldwide—estimated at over 500 million cases combined—serves as a potent catalyst for demand.

DULERA’s Position in the Market

DULERA competes within a crowded segment of inhaled corticosteroid (ICS) and long-acting beta-agonist (LABA) combination therapies. Its primary competitors include brands like Symbicort (budesonide/formoterol), Advair (fluticasone/salmeterol), and Breo Ellipta (fluticasone/vilanterol). Although DULERA was launched in the United States in 2012 and globally later, its market share remains moderate, owing to increased competition and prescribing habits favoring established brands.

Market Drivers and Challenges

Drivers

-

Rising Prevalence of Respiratory Diseases: The increasing burden of asthma and COPD globally amplifies demand for combination inhalers. Urbanization, pollution, smoking, and aging populations are significant contributors (2).

-

Enhanced Patient Compliance: DULERA’s combination formulation offers simplified therapy regimens, improving adherence, especially compared to monotherapies or multiple inhalers.

-

Regulatory Approvals: Growing approvals in emerging markets and expanded indications strengthen market reach.

Challenges

-

Pricing and Reimbursement Barriers: Stringent healthcare policies and rebate pressures impact pricing strategies.

-

Generic Entrants: As patents expire, biosimilars and generics may erode market share, influencing pricing dynamics.

-

Competitive Landscape: The dominance of well-established brands constrains DULERA’s market penetration.

Pricing Landscape

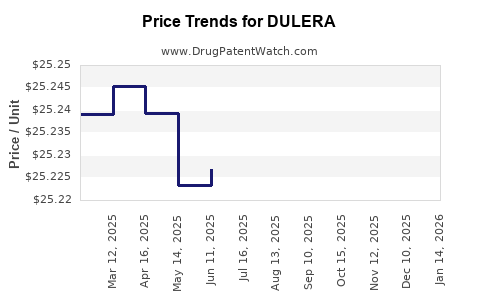

Current Pricing Trends

In the United States, DULERA's average wholesale price (AWP) ranges from USD 360 to USD 400 per inhaler, depending on dosage and formulation (3). Out-of-pocket expenses vary based on insurance coverage, often leading to considerable patient costs, especially in the absence of subsidies.

In Europe, pricing varies by country, with premium markets like Germany and the UK setting prices between €12 and €20 per inhaler. Emerging markets, such as India and Brazil, see significantly lower prices, driven by local affordability and regulatory policies.

Pricing Factors

-

Regulatory and Reimbursement Policies: Price negotiations with payers influence final consumer prices.

-

Market Competition: Presence of biosimilars and generics exerts downward pressure on prices.

-

Manufacturing and Distribution Costs: These are moderated by global supply chains but impact profit margins.

Market Projections (2023-2030)

Sales Volume and Revenue Forecasts

Predictions suggest a moderate but steady increase in DULERA’s sales, driven by global respiratory disease prevalence and expanding indications.

-

North America: Expected CAGR of ~4% due to mature markets but constrained by patent expirations and biosimilar entrants.

-

Europe: Approximately 3-4% CAGR, supported by aging populations and expanding healthcare coverage.

-

Asia-Pacific: The highest growth rate, around 8-10%, fueled by increasing disease burden, urbanization, and improved access to healthcare. Countries like China, India, and Southeast Asia will see significant uptake.

Revenue estimates position DULERA to generate USD 1.2-1.5 billion annually by 2030, up from approximately USD 600 million in 2022.

Pricing Trends Over Time

Prices are projected to decline modestly over the next decade, averaging a 2-3% annual decrease in mature markets due to biosimilar competition and price regulation regimes. Conversely, in emerging markets, prices will remain relatively lower, with gradual increases as healthcare infrastructure improves.

Market Opportunities & Strategic Considerations

-

Emerging Markets Expansion: Tailoring pricing and marketing strategies for developing economies presents significant upside.

-

Line Extension & Label Expansion: Developing new formulations or approved additional indications could bolster sales.

-

Partnerships & Alliances: Collaborations with local pharmas for market penetration can accelerate growth.

-

Cost-Effective Pricing Models: Implementing tiered pricing and patient assistance programs can enhance access and market share.

Regulatory and Patent Landscape

Patent protections for DULERA are expected to expire by 2026 in key markets, opening pathways for biosimilar entry (4). Regulatory approvals for generic or biosimilar equivalents could exert substantial downward pressure on prices, necessitating strategic planning.

Key Market Risks

- Patent cliff leading to biosimilar competition.

- Regulatory changes affecting pricing and reimbursement policies.

- Market saturation in established regions.

- Variability in healthcare infrastructure development across emerging markets.

Key Takeaways

-

Market growth for DULERA will be driven predominantly by emerging markets, where health infrastructure and disease prevalence are rising.

-

Pricing strategies must balance affordability in developing regions with maintaining margins amid increasing biosimilar competition in mature markets.

-

Regulatory vigilance is critical, as patent expirations and biosimilar approvals by 2026 could reshape the competitive landscape.

-

Strategic expansion, including line extension and partnerships, offers potential to sustain growth momentum.

-

Cost containment and innovative access programs will be pivotal in maximizing market penetration and addressing payer concerns.

FAQs

-

How does DULERA’s pricing compare globally?

DULERA’s wholesale prices vary significantly: approximately USD 360-400 per inhaler in the US; €12-€20 in Europe; and lower prices in emerging markets like India, reflecting local pricing policies and economic conditions.

-

What impact will patent expirations have on DULERA?

Patent expirations, likely around 2026, will pave the way for biosimilar competitors, potentially reducing prices and market share unless AstraZeneca implements strategic differentiators.

-

Which markets offer the highest growth potential for DULERA?

Asia-Pacific presents the most substantial upcoming opportunity, with projected CAGR up to 10%, due to increasing disease prevalence and expanding healthcare access.

-

What are the main challenges DULERA faces in maintaining market share?

Competition from established brands and biosimilars, regulatory pressures, and pricing restrictions pose ongoing challenges to DULERA’s market position.

-

Are there any upcoming regulatory changes that could affect DULERA?

Pending biosimilar approvals and potential reforms in drug pricing and reimbursement policies worldwide could influence DULERA’s pricing and market access strategies.

References

-

Research and Markets. Global Respiratory Drugs Market Outlook. 2022.

-

World Health Organization. Global prevalence of asthma and COPD. 2019.

-

GoodRx. DULERA prices and comparisons. 2023.

-

PatentScope. Patent status and expiry dates for DULERA. 2022.