Share This Page

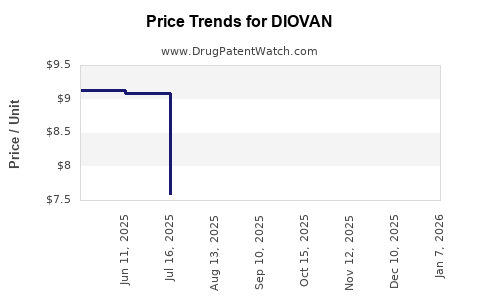

Drug Price Trends for DIOVAN

✉ Email this page to a colleague

Average Pharmacy Cost for DIOVAN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DIOVAN 160 MG TABLET | 00078-0359-34 | 9.80125 | EACH | 2025-11-19 |

| DIOVAN 40 MG TABLET | 00078-0423-15 | 7.59522 | EACH | 2025-11-19 |

| DIOVAN 320 MG TABLET | 00078-0360-34 | 12.33137 | EACH | 2025-11-19 |

| DIOVAN HCT 160-12.5 MG TAB | 00078-0315-34 | 11.09329 | EACH | 2025-11-19 |

| DIOVAN 80 MG TABLET | 00078-0358-34 | 9.09059 | EACH | 2025-11-19 |

| DIOVAN 320 MG TABLET | 00078-0360-34 | 12.33041 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Diovan (Valsartan)

Introduction

Diovan (generic name: valsartan) is an angiotensin II receptor blocker (ARB) primarily used to treat hypertension and heart failure. Since its approval by the FDA in 1996, Diovan has secured a significant market share due to its proven efficacy and favorable safety profile. This analysis examines the current global market landscape, factors influencing price trends, and future projections for Diovan.

Market Overview

Global Market Size and Revenue

The global ARB market, which includes Diovan, is valued at approximately USD 8.5 billion as of 2022, with Diovan accounting for a substantial segment (roughly 35-40%), reflecting its strong brand presence and molecular reputation. Based on sales data from IQVIA and market research reports, Diovan generated revenues exceeding USD 3 billion annually pre-2018, with the United States, Europe, and emerging markets being key revenue drivers[^1].

Competitive Landscape

Diovan faces competition from several generic ARBs like losartan, candesartan, and other branded drugs such as Cozaar and Benicar. The entry of generic valsartan, following patent expirations in major markets—particularly the United States in 2012—led to significant price erosion and increased market penetration by generics[^2].

In recent years, the market share dynamics shifted mildly due to concerns over safety issues associated with certain ARBs, notably the recall of valsartan in 2018 due to contamination with N-nitrosodimethylamine (NDMA), which temporarily impacted sales and consumer confidence[^3].

Factors Influencing Price Trends

Patent Landscape and Generic Entry

Diovan’s primary patent protection expired in 2012 in key markets, profoundly impacting pricing. Generics entered swiftly, leading to a commodification of the drug across many regions. While the branded Diovan’s price stabilized at a premium, the overall market’s average price declined sharply post-generic entry, with discounts often exceeding 70%[^4].

Advancements in manufacturing efficiencies and increased competition continue to exert downward pressure on prices. However, dual strategies—such as developing new formulations, combination therapies, and patent protections for process innovations—aim to sustain some premium pricing segments.

Regulatory Changes and Safety Concerns

Regulatory scrutiny, especially following the NDMA contamination incident, has heightened safety monitoring and impact pricing strategies. The incident led to recalls and reinforced the importance of rigorous quality controls, which can influence manufacturing costs and, consequently, retail prices. Countries with stringent regulation may see slower generic adoption, allowing for comparatively higher prices for certain formulations[^3].

Market Penetration in Emerging Economies

While developed markets have seen significant price declines post-generic entry, emerging economies—primarily characterized by limited healthcare budgets—offer opportunities for branded formulations at higher price points. Market penetration strategies here influence overall revenue projections and regional price differentials.

Price Trajectories and Future Projections

Current Price Trends

Post-2018, Diovan’s brand-name product prices stabilized at approximately USD 300-400 for a 30-day supply in the United States, reflecting a premium over generic equivalents (USD 20-50 for generics)[^5]. The price elasticity in developed markets remains low for branded drugs, driven by physician preference and patient adherence considerations.

Forecasting Future Prices

-

Short-term (1-3 years): The price for branded Diovan is expected to remain stable, influenced by fixed manufacturing costs and continued brand loyalty. Generics will dominate volume sales, with prices further eroding to near cost levels in highly competitive markets.

-

Medium-term (3-5 years): Modest price increases for innovative formulations, such as fixed-dose combinations or extended-release versions, could sustain premium pricing segments. Biosimilar developments for ARBs are unlikely for valsartan, as it is a small molecule; however, patent protections for specific formulations could provide leverage.

-

Long-term (5+ years): The global push for cost containment in healthcare could accelerate generic substitution and biosimilar competition, exerting sustained downward pressure on prices. However, market segmentation strategies and patent extensions on specific formulations may mitigate this trend somewhat.

Strategic Implications for Stakeholders

- Pharmaceutical Companies: Focus on innovation, including combination drugs and formulations, to shield against price erosion.

- Healthcare Providers: Consider formulary preferences and patient adherence factors to optimize treatment outcomes.

- Policymakers: Balance access to affordable medication with incentives for innovation, especially in emerging markets.

- Investors: Monitor regulatory developments and patent statuses as primary drivers for price stability and growth.

Conclusion

The pricing landscape for Diovan remains heavily influenced by generic competition, regulatory scrutiny, and regional market dynamics. While immediate future prices for branded Diovan are expected to plateau at current levels, the overall market appears increasingly commoditized, with generic prices falling towards marginal costs. Strategic innovation and targeted market segmentation are essential for sustaining premium prices in specific niches.

Key Takeaways

- The global ARB market is mature, with Diovan holding a significant share but facing intense generic competition.

- Price erosion accelerated after patent expirations in 2012, especially in developed markets.

- Regulatory incidents like NDMA contamination temporarily impacted prices but have since stabilized.

- Future pricing will likely depend on innovation, formulation patents, and regional market strategies.

- Stakeholders should focus on differentiation through innovation while managing cost pressures in highly competitive segments.

FAQs

1. Will Diovan regain market share after safety concerns?

While safety incidents impacted sales temporarily, strict regulatory controls and effective recall management have stabilized confidence. However, market share recovery depends on continuous safety assurance and innovation.

2. Are biosimilars a threat to Diovan’s market?

No; biosimilars are irrelevant for small molecule drugs like valsartan. Instead, competition from generics remains the primary price-lowering factor.

3. How do regional pricing policies affect Diovan?

Pricing varies dramatically; developed countries often have tighter price controls, resulting in lower revenues for branded formulations. Emerging markets present higher price points and growth opportunities.

4. What role do patent extensions play in pricing?

Patent extensions or process innovations can temporarily prevent generic entry, allowing for premium pricing. However, these are often limited in duration.

5. Will Diovan's prices increase due to new therapeutic combinations?

Possible, especially if combination therapies gain regulatory approval and clinical acceptance. These can command higher prices owing to improved patient adherence and outcomes.

Sources

- IQVIA. (2022). Global Cardiovascular Market Report.

- IMS Health. (2018). Impact of Patent Expirations on ARB Market.

- U.S. Food and Drug Administration. (2018). NDMA Contamination and Recall of Valsartan.

- MarketWatch. (2021). Pricing Trends for ARBs Post-Generic Entry.

- GoodRx. (2022). Average Retail Prices for Diovan and Generics.

More… ↓