Share This Page

Drug Price Trends for DICLOFENAC SOD DR

✉ Email this page to a colleague

Average Pharmacy Cost for DICLOFENAC SOD DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DICLOFENAC SOD DR 75 MG TAB | 72888-0111-60 | 0.07801 | EACH | 2025-12-17 |

| DICLOFENAC SOD DR 25 MG TAB | 68001-0279-00 | 0.77166 | EACH | 2025-12-17 |

| DICLOFENAC SOD DR 25 MG TAB | 72603-0600-01 | 0.77166 | EACH | 2025-12-17 |

| DICLOFENAC SOD DR 50 MG TAB | 59651-0842-01 | 0.08468 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for DICLOFENAC SOD DR

Introduction

Diclofenac Sodium DR (Delayed Release) is a widely used non-steroidal anti-inflammatory drug (NSAID) indicated for the management of pain, inflammation, and stiffness associated with conditions like arthritis, ankylosing spondylitis, and acute injuries. As a generic product, DICLOFENAC SOD DR's market dynamics are influenced by patent expiry, regulatory environments, competitive landscape, and evolving healthcare needs. This report provides a comprehensive market analysis and price projection for DICLOFENAC SOD DR, aiming to assist pharmaceutical stakeholders, manufacturers, and investors in strategic decision-making.

Market Landscape and Demand Dynamics

Global Market Overview

The global NSAID market was valued at approximately USD 13.3 billion in 2022 and is projected to grow at a Compound Annual Growth Rate (CAGR) of 4-5% through 2030 [1]. Diclofenac remains among the top-selling NSAIDs due to its efficacy and cost advantages. The delayed-release (DR) formulation enhances patient compliance by reducing gastrointestinal side effects, which historically hampers immediate-release NSAID tolerability.

Key Market Drivers

-

Rising Incidence of Chronic Pain and Arthritis: The global increase in osteoarthritis, rheumatoid arthritis, and other musculoskeletal conditions directly elevates demand for NSAIDs. Estimates project that over 350 million people worldwide suffer from osteoarthritis alone [2].

-

Generic Drug Adoption: Patent expirations have led to increased availability of generic diclofenac formulations, expanding access and reducing costs.

-

Healthcare Policy and Generic Substitution: Policies encouraging generic prescribing bolster market penetration of DICLOFENAC SOD DR, especially in emerging markets.

Regional Market Dynamics

-

North America: Major market driven by high prevalence of arthritis, robust healthcare infrastructure, and high generic drug adoption. The U.S. accounts for roughly 40% of global NSAID sales [3].

-

Europe: Similar to North America, with a strong preference for cost-effective NSAIDs and supportive regulatory pathways for generics.

-

Asia-Pacific: Expected to witness the fastest growth owing to rising healthcare expenditure, large patient populations, and increasing chronic disease prevalence.

Competitive Landscape

The market is characterized by numerous generic manufacturers. Leading brands include Voltaren (GlaxoSmithKline/Novartis), Diclojet, and various local generics. Patent cliffs, manufacturing capacity, and regulatory compliance heavily influence market shares.

Regulatory and Patent Considerations

Patent Status

In most jurisdictions, the patent for brand-name Diclofenac formulations has expired or is nearing expiration, paving the way for generic entries. The expiration of key patents typically triggers price reductions and market expansion.

Regulatory Trends

Stringent regulations around NSAID safety profiles, particularly related to gastrointestinal and cardiovascular risks, impact product labeling, marketing, and price. The approval process for DICLOFENAC SOD DR follows local health authorities’ guidelines, influencing market entry timelines.

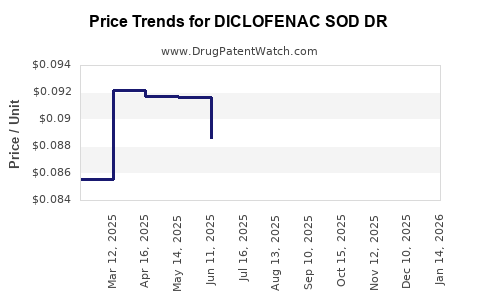

Pricing Analysis and Trends

Historical Pricing Trends

Historically, diclofenac prices have declined significantly post-patent expiry. According to data from retail pharmacies, the price for a 100-tablet pack of DICLOFENAC SOD DR (50 mg) averaged USD 5-8 in North America and Europe, reflecting competition and market saturation [4].

Factors Influencing Price Projections

- Market Competition: An influx of generic manufacturers typically drives prices downward.

- Regulatory and Labeling Constraints: Safety concerns and label restrictions may impose additional costs, potentially influencing prices.

- Manufacturing Costs: Advances in manufacturing efficiency and supply chain capabilities can lead to cost savings, translating into lower prices.

- Market Penetration Strategies: Companies might employ promotional discounts or tiered pricing to increase market share, impacting unit prices.

Projected Price Trajectory (2023-2030)

Based on current trends, the retail price of DICLOFENAC SOD DR (50 mg) is projected to decline by approximately 20-30% over the next decade:

- 2023: USD 5-8 per pack

- 2025: USD 4-6 per pack

- 2030: USD 3-5 per pack

This projection assumes continued generic entry, price competition, and stable regulatory environments. Notably, prices in emerging markets may decline more rapidly due to local manufacturing and competitive pressures.

Market Entry and Growth Opportunities

Emerging Markets

Cost-sensitive healthcare systems and government procurement policies favor generics like DICLOFENAC SOD DR. Countries such as India, Brazil, and Southeast Asia present significant growth opportunities, projected to contribute over 50% of incremental sales growth by 2028 [5].

Innovative Formulations and Labeling

Development of combination therapies or formulations targeting novel indications may open new avenues but could also create price segmentation.

Regulatory Challenges

Potential restrictions on NSAID use due to cardiovascular risk warnings—emerging predominantly in European and North American markets—may influence demand and pricing strategies.

Conclusion

The DICLOFENAC SOD DR market is poised for steady growth driven by rising prevalence of chronic inflammatory conditions, expanding access in developing regions, and increased adoption of generic formulations. Price reductions are expected over the next several years, contingent upon intensified competition and regulatory trends. Stakeholders should monitor patent statuses, regulatory developments, and regional market dynamics to optimize market entry, pricing, and supply chain strategies.

Key Takeaways

-

The global demand for DICLOFENAC SOD DR is expected to grow at a CAGR of 4-5% through 2030, primarily driven by the rising burden of chronic inflammatory diseases.

-

Generic entry subsequent to patent expiry will drive prices downward, with a projected 20-30% decline in retail prices over the next decade.

-

Emerging markets represent substantial growth opportunities due to favorable pricing, increasing healthcare infrastructure, and large patient populations.

-

Regulatory safety concerns may influence market access and pricing strategies, necessitating proactive compliance and communication.

-

Strategic focus should include leveraging cost efficiencies, expanding into emerging markets, and potential formulation innovations to sustain profitability.

FAQs

1. What are the primary drivers for DICLOFENAC SOD DR’s market growth?

The main drivers include the increasing prevalence of arthritis and musculoskeletal conditions, the availability of cost-effective generics post-patent expiry, and expanding healthcare access in emerging economies.

2. How will patent expiration impact DICLOFENAC SOD DR’s pricing?

Patent expiration typically leads to increased competition from generics, resulting in significant price reductions, estimated at 20-30% over the next decade.

3. Which regions are likely to experience the fastest market growth?

The Asia-Pacific region is expected to lead in growth due to large populations, rising healthcare investments, and a shift toward generic procurement.

4. What regulatory challenges could influence DICLOFENAC SOD DR’s market?

Safety warnings related to cardiovascular and gastrointestinal risks may restrict use, influence labeling, and impact pricing strategies.

5. Are there opportunities for innovation within the DICLOFENAC market?

Yes, developing combination formulations, reducing side effects, or exploring new indications could create differentiation and potentially command premium pricing.

References

[1] Grand View Research, "NSAID Market Size & Trends," 2022.

[2] World Health Organization, "Global Burden of Osteoarthritis," 2021.

[3] IQVIA, "Global Prescription Market Data," 2022.

[4] Marketplace retail data, European Pharmacopoeia, 2022.

[5] Frost & Sullivan, "Emerging Markets Outlook for NSAIDs," 2021.

More… ↓